Your company’s security begins at the hiring process

It’s an exciting time for a company when business is growing and there is a need add more employees and start a hiring process. One organisation t…

Read MorePBSA Annual Conference 2023

Celebrating 20 Years of PBSA: A Spectacular Event in Grapevine, TX

The Professional Background Screening Association (PBSA) is gearing up to celebrate its momentous 20-year anniversary at the 2023 PBSA Annual Conference in Grapevine, TX. This event promises to be a memorable occasion, filled with networking opportunities, informative sessions, and, of course, plenty of celebration.

Let’s take a closer look at what attendees can expect during this milestone event.

An Unforgettable Celebration

PBSA’s 2023 Annual Conference will be more than just a typical industry gathering. With two decades of excellence to commemorate, the celebration kicks off on Sunday evening with the Network Reception, where attendees from diverse backgrounds and industries can come together to connect and build relationships. The camaraderie will continue with the grand Opening Ceremony, followed by the highly anticipated Exhibit Hall Opening Showcase, featuring cutting-edge products and services from top industry players.

The 20 Year Opening Gala

One of the highlights of the event will be the 20 Year Opening Gala on Sunday evening. This elegant affair will take place at 8 p.m. and promises to be a night to remember. The gala will feature a dueling piano performance, setting the perfect tone for an evening of festivity and celebration. Attendees are encouraged to dress in black and gold formal attire to add a touch of elegance to the occasion. However, the organizers are welcoming all attendees, whether in tuxedos and long gowns or semi-formal attire, to be a part of this grand celebration.

Conference Days – Informative Sessions

Monday and Tuesday will be filled with a series of informative sessions led by industry experts and thought leaders. Attendees can expect engaging discussions, educational workshops, and insights into the latest trends and advancements in the background screening industry. These conference days will offer an excellent opportunity for attendees to expand their knowledge, gain valuable insights, and contribute to the professional growth of the background screening community.

CRI Group™ at the 2023 PBSA Annual Conference:

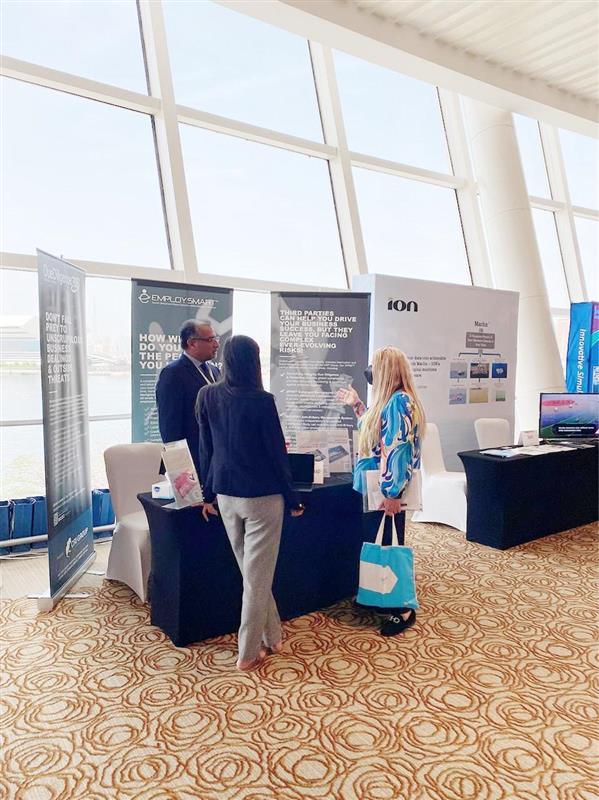

CRI Group™ is thrilled to be an integral part of the 20-year celebration and excited to showcase our latest offerings at the conference. Our team of experts will be available at booths 610 & 612 to provide personalized demonstrations of EmploySmart™ and DueDiligence360™, two groundbreaking solutions that have set new industry standards.

-

EmploySmart™ – ENSURING A SAFE WORK ENVIRONMENT FOR ALL

EmploySmart™ is our state-of-the-art background screening platform that leverages advanced technology and artificial intelligence to streamline the screening process. EmploySmart™ is more than just a screening platform; it’s a powerful tool that ensures a seamless experience for candidates and empowers employers to make confident and informed hiring decisions. With EmploySmart™, you can expect faster turnaround times without compromising on accuracy.

Our platform leverages cutting-edge technology to perform various essential checks, including address verification, identity verification, previous employment verification, and education & credential verification.

EMPOWERING GLOBAL SYNERGY:

YOUR TRUSTED SCREENING PARTNER IN THE USA, MIDDLE EAST, EUROPE & ASIA

Going beyond domestic boundaries, EmploySmart™ offers international criminal record checks, enabling you to make informed decisions about candidates with international backgrounds. For organizations seeking to delve deeper into a candidate’s integrity and reputation, our integrity due diligence service provides invaluable information.

-

DueDiligence360™

DueDiligence360™ is a comprehensive due diligence solution that provides a deep and thorough analysis of potential business partners, vendors, and other stakeholders. With our meticulously curated reports and risk assessments, businesses can make critical decisions with a heightened level of confidence and transparency.

Basic DueDiligence360™ Package:

Our Basic DueDiligence360™ investigation covers a wide range of critical checks, including international business verification, personal profiles on individuals, and company profiles on corporate entities. We conduct historical ownership analysis, identify subsidiaries, and uncover connected parties to give you a complete understanding of a subject’s business interests. Our global/national criminality & regulatory records checks, Politically Exposed Person database searches, and global terrorism checks provide essential information on potential risks and associations.

We also conduct thorough digital media research and company background analysis to ensure you have a comprehensive view of a subject’s online presence and reputation. Additionally, our investigation includes industry reputational assessment, FCPA and UK Anti-Bribery & Corruption risk database checks, and money laundering risk database checks, ensuring that you are aware of any potential compliance or regulatory concerns.

Furthermore, we provide financial reports and asset tracing, giving you valuable insights into a subject’s financial history and stability. Our country-specific databases include litigation checks, law enforcement agencies, and capital market regulators, providing you with comprehensive information about a subject’s legal and regulatory standing.

Level I Essential Integrity Due Diligence Package:

Building upon the DueDiligence360™ Package, our Level I Essential Integrity Due Diligence goes deeper into a subject’s corporate structure and affiliations. We verify addresses, telephone numbers, and corporate records, including shareholdings and directorships. Our investigation includes verification of corporate and business affiliations, as well as personal information on key principals associated with the subject entity.

We conduct research on government affiliations, political positions, and relationships with public officials to assess potential reputational issues. Additionally, we research criminal history records, civil litigation, liens, judgments, and bankruptcies to identify any red flags that could impact your association with the subject.

Level II Enhanced Integrity Due Diligence Package:

Our Level II Enhanced Integrity Due Diligence is the most comprehensive investigation, providing an in-depth understanding of a subject’s activities and history. In addition to all the checks included in Level I, we conduct onsite visits to verify addresses and localities, ensuring greater accuracy in our findings. We verify previous employments, projects completed, business and personal references, academic and professional qualifications, and current activities.

Our investigation delves into the background and track record of key principals and shareholders, with a focus on regulatory or reputational issues of concern. We thoroughly examine property records and asset ownership to provide a complete financial picture.

Furthermore, we conduct comprehensive screenings of local and international sanction lists, PEP databases checks, global compliance database searches, OFAC, and other international sanctions and law enforcement institutions. Our research includes profiling the positioning and connections of the subject and its key principals and shareholders, including business relationships, political affiliations, and exposure to international anti-bribery and anti-corruption legislation. We also undertake source interviews to gather local and industry expert insights, ensuring a well-rounded investigation.

Join CRI Group™ at the PBSA Annual Conference and discover how EmploySmart™ and DueDiligence360™ can transform your background screening procedures. Take this opportunity to meet our team of experts, discuss your unique screening requirements, and learn how CRI™ can be your trusted partner in ensuring accurate and compliant background screenings.

Book your meetings at our booths 610 & 612 to secure a personalized session tailored to your needs.

The Rise in Insurance Fraud by Individuals

Insurance fraud is a growing concern worldwide, with individuals resorting to elaborate schemes to deceive insurers and cash in on substantial payouts. Among the many alarming cases that have come to light, one particular incident from 2015 stands as a stark example of the devastating consequences of such deceit. California resident Ali Elmezayen orchestrated a tragic car accident that claimed the lives of his two autistic children and almost drowned his wife.

Unbeknownst to the authorities, this horrifying event was staged as part of an elaborate insurance fraud plot, leading to a $260,000 payout. In a heart-wrenching twist, the ill-gotten funds were used to purchase real estate in Elmezayen’s native Egypt and a boat, leaving behind a trail of deceit and sorrow. This gripping case highlights the urgency in addressing the rise in insurance fraud by individuals and the need for vigilance in safeguarding the integrity of insurance systems.

What Is An Insurance Fraud?

Insurance fraud refers to the intentional deceit carried out against an insurance company or by an insurance agent, with the aim of gaining financial benefits. These illicit acts can be committed by policyholders, applicants, third-party claimants, and even insurance brokers and providers. Some common instances of insurance fraud involve “padding” or exaggerating claims, providing false information on insurance applications, making claims for injuries or damages that never happened, and staging accidents.

Estimates from the Federal Bureau of Investigation (FBI) indicate that insurance fraud costs the United States over $40 billion annually. This staggering figure underscores the severity of the issue and highlights the urgent need to address and combat fraudulent activities within the insurance industry.

Health insurance companies have faced numerous instances of insurance fraud by individuals. Some individuals have submitted false or exaggerated medical claims, forged medical records, or intentionally misrepresented their medical conditions to obtain insurance benefits fraudulently. Such fraudulent activities have cost health insurance companies millions of dollars annually.

Consequences of Insurance Fraud by Individuals for Companies in the USA

Insurance fraud by individuals can have far-reaching consequences for insurance companies in the USA. For example:

Financial Losses

Insurance fraud places a significant financial burden on companies as they end up paying for fraudulent claims that were deceitfully submitted. These losses can add up quickly, impacting the company’s bottom line and overall profitability. The funds that could have been invested in growth or development initiatives now must be diverted to cover fraudulent claims, hampering the company’s financial stability and growth prospects.

Reputational Damage

Insurance fraud cases can severely tarnish a company’s reputation, eroding the trust and confidence of customers, potential investors, and business partners. The negative publicity and association with fraudulent activities can lead to a loss of loyal customers and a damaged brand image. Rebuilding trust after reputational damage can be a challenging and time-consuming process, impacting the company’s ability to attract new customers and retain existing ones.

Legal Consequences

Companies found to be involved in insurance fraud may face serious legal repercussions. They may be subject to hefty fines imposed by regulatory authorities, endure costly legal battles, and even face criminal charges against the individuals responsible. These legal consequences can result in significant financial losses and damage to the company’s reputation.

Increased Insurance Costs

Insurance companies often pass on the costs of insurance fraud to their customers through increased insurance premiums. The rise in premiums affects honest policyholders who must bear the burden of fraudulent activities committed by a few individuals. Higher insurance costs can lead to decreased customer satisfaction and potential customer attrition.

Lower Employee Morale

Insurance fraud cases can create an atmosphere of distrust and suspicion within the company, negatively impacting employee morale. Employees may feel demotivated when they witness fraudulent activities going undetected or not adequately addressed. Lower employee morale can result in reduced productivity, decreased job satisfaction, and an increased likelihood of employee turnover.

Business Shutdown

For smaller or financially vulnerable companies, the cumulative impact of widespread insurance fraud can be devastating. The financial losses and reputational damage may become insurmountable, leading to business closure. Insurance fraud-induced business shutdowns can have severe implications for employees, customers, and other stakeholders.

Regulatory Scrutiny

Companies involved in insurance fraud may face heightened regulatory scrutiny. Regulatory authorities may closely monitor their operations, leading to additional compliance requirements and the diversion of resources toward addressing regulatory concerns. The increased scrutiny can further strain the company’s finances and impede its day-to-day operations.

Decreased Shareholder Value

Insurance fraud can negatively affect a company’s stock value and shareholder confidence. Shareholders may lose faith in the company’s management and decision-making processes, leading to a decrease in the value of their investments. The decline in shareholder value can have a cascading effect on the company’s ability to raise capital and attract new investors.

Opportunity Costs

Dealing with the impact of insurance fraud can divert the company’s attention and resources from other strategic opportunities and initiatives. The focus on investigating fraudulent activities and implementing measures to prevent future fraud may result in missed business opportunities or delayed projects.

Difficulty in Attracting Talent

Companies tainted by insurance fraud may struggle to attract and retain top talent. Potential employees may be hesitant to join an organization with a damaged reputation, fearing the impact on their own professional standing. Difficulty in recruiting skilled and qualified employees can hinder the company’s growth and competitiveness in the market.

CRI Group™: Mitigating Insurance Fraud Risks for Businesses

Insurance fraud by individuals poses significant challenges for businesses, leading to financial losses, reputational damage, and legal repercussions. To combat this pervasive issue, CRI Group™ offers a comprehensive suite of services designed to help businesses avoid insurance fraud and protect their interests.

Fraud Risk Assessment & Fraud Risk Management

CRI Group™ provides businesses with expert Fraud Risk Assessment and Fraud Risk Management services. By conducting thorough assessments, CRI Group™ identifies potential vulnerabilities in a company’s operations and systems that could be exploited by fraudulent individuals. Through this proactive approach, businesses can implement tailored risk management strategies to prevent insurance fraud before it occurs.

CRI™ Corporate Accountability Services

CRI™ Corporate Accountability services help businesses establish robust compliance and accountability mechanisms. By ensuring meticulous records of due diligence actions, risk assessments, and corrective measures, CRI Group™ empowers businesses to demonstrate their commitment to ethical practices and adherence to regulatory requirements. This transparency serves as a strong deterrent to potential fraudsters who may seek to exploit loopholes in a company’s processes.

Insurance Fraud Investigations Services

CRI Group™ offers specialized Insurance Fraud Investigations services to help businesses detect and address suspected fraudulent activities promptly. Highly skilled investigators with extensive experience in insurance fraud matters work diligently to uncover evidence, gather information, and identify potential fraud schemes. Timely and thorough investigations enable businesses to take appropriate actions to prevent further losses and protect their reputation.

Why Choose CRI Group™ for Insurance Fraud Investigations

CRI Group™’s service offerings are designed to empower your organization to combat insurance fraud by individuals effectively. With our comprehensive solutions, you can proactively detect and prevent fraudulent activities, safeguarding your financial health, reputation, and business integrity.

Fraud Risk Assessment & Fraud Risk Management

Our certified fraud examiners conduct a thorough review and assessment of your current fraud risk management program. We objectively evaluate your policies, procedures, controls, reporting functions, responsibilities assignment, and investigative requirements to identify vulnerabilities and susceptibility to fraud within your organization.

Tailored Fraud Prevention Measures

Based on the assessment findings, we work closely with your team to develop and implement customized fraud prevention and investigation measures. Our anti-fraud controls are designed to strengthen your organization’s defenses against potential fraudulent activities, reducing the risk of financial losses and reputational damage.

Effective Detection Methods

CRI Group™ defines detection methods that encompass a comprehensive range of approaches. From internal audits and suspicious transaction reporting to whistle-blower strategies and program enforcement, our solutions empower you to detect and address potential fraud incidents proactively.

Due Diligence and Corporate Accountability

Our due diligence services extend beyond standard commercial or financial analyses. CRI® Group™ specializes in Integrity Due Diligence, which provides reliable and pertinent, but raw, information. We ensure complete independence in our research, relying as little as possible on information provided by the researched subject, thereby reducing risks associated with FCPA and UK Bribery Act compliance.

Informed Business Decisions

CRI Group™ supports your informed decision-making process by offering in-depth research and analysis. Our due diligence services allow you to make confident choices when pursuing takeovers, mergers, or business relations. With a focus on objectivity, our assessments provide valuable insights to minimize risks.

Diverse Range of Investigations

CRI Group™ handles a comprehensive range of investigations related to insurance fraud. Our expert investigators conduct factual claims investigations, background checks, and asset searches. We specialize in medical fraud investigations, workers’ compensation, injury, liability, and property claims.

Thorough and Professional Approach

With a commitment to professionalism and attention to detail, our investigators gather evidence, conduct interviews, and verify claims to uncover the truth behind suspicious activities. Our thorough investigations help you take prompt and effective actions against fraudulent individuals.

Trusted Global Partners

CRI Group™ serves as a trusted partner to businesses and institutions worldwide. Our dedicated team works with energy, insight, and care, ensuring a positive experience for all parties involved, including clients, reference providers, and candidates.

Proven Methodologies and Expertise:

Effective Solutions Based on Experience:

With a focus on integrity, CRI Group™ employs proven methodologies in our investigative and due diligence services. Our experienced team delivers reliable information while maintaining complete independence, ensuring you receive accurate insights to make well-informed decisions.

Mitigating Fraud Risks

We help you implement anti-fraud controls, making it challenging for potential fraudsters to exploit weaknesses within your organization. Our detection methods, such as internal audits, suspicious transaction reporting, and whistle-blower strategies, provide early warnings to prevent fraudulent activities.

Unbiased Fraud Risk Evaluation

Our certified fraud examiners bring objective and independent expertise to auditing your fraud prevention program. Through our unbiased assessments, we provide valuable insights to strengthen your organization’s defenses against fraud.

CRI Group™ stands out as a leading provider of fraud investigations and due diligence services, offering objective expertise, comprehensive assessments, advanced detection methods, and a commitment to integrity. As your trusted partner, we help your organization fortify its fraud prevention program and make informed decisions, reducing risks and ensuring compliance with legal requirements. With our experienced team and proven methodologies, CRI Group™ empowers your business to navigate the complex landscape of fraud risk management successfully.

Employee Background Screening is Taking the Middle East Region by Storm!

The success of any organization lies in its people—the driving force behind innovation, productivity, and growth. Hiring the right individuals who not only possess the required skills but also align with the organization’s values and culture is crucial for long-term success. Moreover, in an era where data privacy and security take center stage, the need for trustworthy and reliable employees has become paramount. That’s why businesses in the Middle East are embracing a powerful trend that is sweeping the region: employee background screening.

In the United Arab Emirates (UAE), background checks have gained significant attention and recognition, backed by the guidelines outlined in the UAE Labour Law. Employers are now held accountable for any negligence in the employee background verification (BGV) process. With the UAE’s diverse workforce consisting of expatriates from various countries and professional backgrounds, the complexity of employee screening is heightened, making it a critical step for businesses operating in the region.

This blog will unravel the explosive trend of employee background screening in the Middle East. Discover how organizations in the region are recognizing the significance of thorough screening processes and leveraging them to build high-performing teams. Learn about the legal framework surrounding background checks in the UAE and the implications of negligence in this crucial aspect of the hiring process.

Why Background Checks in the Middle East Are Needed?

Background checks have become an essential element of the hiring process in the Middle East. The region has witnessed a growing need for comprehensive background screenings, driven by the rise in terrorism, financial fraud, and other criminal activities. As a result, employers in the Middle East are recognizing the importance of thorough vetting to ensure the safety and success of their organizations.

A Diverse Workforce with Unique Challenges

Saudi Arabia, in particular, stands out as a hub for both native and non-native families, attracting a significant number of foreign nationals. According saudi census 2022, foreign nationals accounted for more than 40 percent of Saudi Arabia’s total population of 32.2 million. This diverse workforce presents unique challenges for employers, necessitating meticulous background checks as part of the work visa application process.

Increased Security Concerns

With the rise in terrorism and other crimes in the Middle East, background checks have become a crucial tool for businesses to ensure the safety and security of their employees and operations. By conducting thorough background checks, companies can identify potential risks and mitigate the chances of hiring individuals with questionable backgrounds.

Protection Against Fraud and Misrepresentation

Background checks help businesses verify the authenticity of a candidate’s qualifications, work history, and other relevant information provided in their resumes or job applications. This helps prevent instances of fraud and misrepresentation, ensuring that candidates possess the necessary skills and experience for the job.

Compliance with Legal Requirements

Background checks in the Middle East are not only a best practice but are also mandated by labor laws. Employers are responsible for ensuring the integrity of their workforce and can be held liable for any negligence in the hiring process. Conducting background checks helps businesses fulfill their legal obligations and demonstrate their commitment to hiring qualified and trustworthy employees.

Safeguarding Reputation and Brand Image

Hiring individuals with a history of misconduct or criminal behavior can have severe repercussions on a company’s reputation and brand image. By conducting thorough background checks, businesses can minimize the risk of hiring individuals who may engage in unethical or illegal activities that could tarnish their reputation.

Mitigating Financial and Legal Risks

Hiring the wrong person can result in significant financial and legal consequences for businesses. Employee misconduct, fraud, or other illegal activities can lead to financial losses, litigation, and damage to business relationships. Background checks help mitigate these risks by providing insights into an individual’s background, reducing the likelihood of making costly hiring mistakes.

Who Can Benefit from Background Screening in the Middle East?

Let’s explore the key beneficiaries of background checks in the Middle East:

Employers in All Industries:

Background checks are essential for employers across various industries in the Middle East. Regardless of the sector, employers need to maintain a safe and secure workplace environment, safeguard their assets, and protect their brand reputation. Background checks help employers ensure that potential employees have the necessary qualifications, skills, and experience to perform their roles effectively and meet the organization’s standards.

Companies Hiring Expatriate Workforce:

The Middle East attracts a significant number of expatriate workers from different countries. For employers hiring expatriates, background checks play a crucial role in assessing the credibility and trustworthiness of individuals coming from various regions. Conducting thorough background checks can help identify any potential risks associated with hiring foreign candidates, such as criminal records, financial irregularities, or fraudulent activities.

Government Organizations and Public Sector:

Government entities and public sector organizations in the Middle East have a responsibility to ensure transparency, accountability, and public trust. Background checks are particularly important for positions involving sensitive information, public safety, or handling public funds. By conducting rigorous background screenings, government organizations can mitigate the risk of hiring individuals with a history of misconduct or unethical behavior.

Financial Institutions and Banks:

The financial industry is highly regulated, and compliance with stringent regulations is paramount. Background checks are critical for financial institutions and banks to verify the integrity and reliability of individuals being considered for roles involving financial transactions, access to sensitive customer information, or positions of authority. Screening for financial integrity, including credit checks and verification of previous employment, helps mitigate the risk of fraudulent activities or potential breaches of confidentiality.

Educational Institutions:

Background checks are equally important for educational institutions in the Middle East, as they strive to provide a safe and secure learning environment for students. Conducting thorough background checks on teachers, administrators, and support staff helps ensure that individuals interacting with students have the necessary qualifications, certifications, and ethical standards. It also helps protect against potential risks such as previous criminal offenses or misconduct.

Healthcare and Pharmaceutical Organizations:

In the healthcare and pharmaceutical sectors, where patient safety and well-being are of utmost importance, background checks are critical. Employers in these industries need to ensure that healthcare professionals, including doctors, nurses, and pharmacists, possess the necessary qualifications, licenses, and credentials. Background checks help identify any discrepancies in educational qualifications, regulatory compliance issues, or previous malpractice allegations.

Security and Defense Agencies:

Security and defense agencies play a vital role in safeguarding national interests and public safety. Background checks are essential in recruiting personnel for security and defense agencies to ensure individuals have a clean record, loyalty to the country, and the necessary skills and qualifications. Thorough screenings can help identify potential risks, including links to criminal organizations, terrorist activities, or conflicts of interest.

Why Middle East Businesses Choose CRI™ for Employee Background Checking Services

At CRI™, we understand the critical importance of comprehensive employee background checks in the Middle East. With our certified pre-employment screening service, EmploySmart™, we provide comprehensive background verification solutions tailored to meet the specific requirements of Middle East businesses. Here’s why Middle East businesses choose us for their employee background checking needs:

Extensive Scope of Services:

We provide a comprehensive range of background screening services, covering various aspects of an individual’s background. Our services include address verification, identity verification, previous employment verification, education and credential verification, local language media checks, credit verification, compliance and regulatory checks, civil litigation record checks, bankruptcy record checks, international criminal record checks, integrity due diligence, and more. Our extensive scope ensures that businesses receive a thorough and detailed analysis of a candidate’s background.

Background Vetting Expertise (BS 7858):

Our team has specialized expertise in background vetting, including compliance with BS 7858 standards. We adhere to the highest industry standards to ensure accurate and reliable results. With our experience and knowledge, we can efficiently handle background checks for candidates and employees at all levels, from senior executives to shop-floor employees.

Direct Access to Senior Staff:

As a valued partner, CRI™ ensures that our clients have direct access to senior members of our staff throughout the background checking process. This direct communication allows for seamless collaboration, efficient information exchange, and timely resolution of any queries or concerns that may arise during the screening process. We prioritize client satisfaction and ensure a personalized and responsive approach to meeting their needs.

Trusted Partner with Global Reach:

CRI™ has established itself as a trusted partner to HR and recruiting managers across the world. Our integrity due diligence teams are highly experienced and well-trained, equipped to handle domestic and international screenings. We have a flat organizational structure, ensuring direct access to senior staff members throughout the background checking process. Our multi-lingual teams operate in over 80 countries, enabling us to provide global coverage and insights. Middle East businesses value our expertise, global network, and commitment to maintaining the highest standards.

Customizable Solutions and Quick Turnaround:

We understand that each business has unique concerns and risk areas. Our solutions are easily customizable and flexible to address specific requirements. Whether it’s tailoring the scope of the background check or accommodating specific timelines, we work closely with businesses to deliver personalized solutions. With our efficient processes and dedicated team, we provide quick turnaround times without compromising on the quality and accuracy of the screenings.

Extensive Global Network and Local Knowledge:

CRI™ has a team of over 50 full-time analysts spread across Europe, the Middle East, Asia, North and South America. Our analysts possess in-depth local knowledge and expertise, enabling us to serve the diverse needs of Middle East businesses with a global perspective. We leverage our extensive network and resources to provide reliable and up-to-date information for informed decision-making.

Conclusion:

When it comes to employee background checking services in the Middle East, businesses choose CRI™ for our comprehensive scope of services, industry expertise, global reach, and commitment to quality. Our solutions are tailored to address the specific needs and risk areas of businesses, enabling them to make informed hiring decisions, mitigate risks, and protect their interests. By partnering with CRI™, Middle East businesses can benefit from reliable and accurate background checks that ensure the integrity and safety of their workforce.

Secure Your Workforce with EmploySmart™ Employee Background Checks! Ensure Peace of Mind with BS7858 Certified Pre-Employment Screening Services Tailored to Your Company’s Needs. Don’t Gamble on Hiring, Trust CRI™ for Thorough Employee Background Checks. Contact Us Today for a Safer and More Reliable Hiring Process!

The DOJ’s Updated Compliance Guidelines: What Every Business Must Know or Face Serious Consequences!

Compliance is the lifeblood of your business, and the U.S. Department of Justice (DOJ) has just released game-changing guidelines that can make or break your success. Ignorance is no longer an excuse! In this blog post, we will delve into the DOJ’s updated compliance guidelines and shed light on what every business must know to ensure adherence.

We will explore the importance of compliance, highlight key elements of an effective compliance program, and emphasize the potential consequences of non-compliance. By understanding the guidelines and implementing robust compliance measures, businesses can protect themselves, mitigate risks, and demonstrate a commitment to ethical and responsible conduct.

Understanding the DOJ’s Updated Compliance Guidelines

Let’s explore the main themes of the DOJ’s updated compliance guidelines and shed light on crucial areas that businesses need to understand to ensure compliance excellence.

Element 1: Incentivizing Effective Compliance Programs

The DOJ’s guidelines place significant importance on companies maintaining effective compliance programs capable of identifying and mitigating misconduct. Notably, the “Compensation Structures and Consequence Management” section underwent significant changes. The guidelines introduce incentives for compliance and disincentives for compliance failures. Prosecutors will now monitor the effectiveness of compliance programs through tracking data on disciplinary actions and transparent communication. Additionally, a three-year Pilot Program on Compensation Initiatives and Clawbacks was introduced to further incentivize compliance.

Element 2: Resource Commitments and Information Sharing

The DOJ has made commitments to enhance corporate criminal enforcement by allocating additional resources. This includes the addition of 25 new prosecutors and substantial investments in the Bank Integrity Unit and Money Laundering and Asset Recovery Section. Furthermore, joint advisories with the Commerce and Treasury Departments will inform the private sector about enforcement trends and security-related compliance expectations. These efforts reflect the DOJ’s dedication to combating corporate crime and promoting compliance.

Element 3: Dynamic Risk Assessment and Continuous Learning

The DOJ emphasizes the significance of periodic risk assessments and the integration of lessons learned into compliance programs. The guidelines stress the need for continuous review and updating of risk assessments, policies, procedures, and controls. Evaluating the current nature of risk assessments and their responsiveness to new circumstances is a critical aspect of compliance. This ensures that compliance weaknesses and misconduct are effectively addressed and managed.

Element 4: Robust Policies, Procedures, and Employee Access

Strong compliance programs rely on robust codes of conduct, policies, and procedures. The DOJ highlights the importance of evaluating the accessibility of these policies and procedures for employees and relevant third parties. Companies should consider publishing policies in a searchable format to facilitate easy reference. Tracking access to policies allows companies to gauge their effectiveness and identify areas that require additional attention. This promotes widespread understanding and adherence to compliance guidelines.

Element 5: Tailored Training and Effective Communication

Tailored training and targeted communication are vital components of effective compliance programs. The DOJ expects companies to provide training sessions that are shorter and more focused, enabling employees to timely identify and raise compliance-related issues. The guidelines emphasize the importance of creating a process for employees to ask questions arising from the training. Addressing employees who may struggle with compliance knowledge is also crucial. The impact of training on employee behavior and operations should be measured to ensure its effectiveness.

Element 6: Whistleblowing System and Reporting Mechanisms

The DOJ recognizes the importance of a robust internal whistleblowing system and anonymous reporting mechanisms. Companies should ensure the existence of an anonymous reporting mechanism and publicize it to employees and third parties. The guidelines explore the measures taken to test employees’ awareness of the reporting mechanism and their comfort level in using it. Offering specialized reporting channels and user-friendly access fosters transparency and encourages reporting of potential compliance violations.

Element 7: Thorough Investigation and Testing

Thorough investigation of allegations and suspicions of misconduct is paramount. The DOJ expects companies to have well-resourced case management systems and processes that ensure comprehensive investigations. Evaluating the effectiveness of investigation processes, such as data collection, analysis, and the testing of compliance mechanisms, is crucial. Tracking investigation findings for patterns of misconduct and compliance weaknesses is essential for remedial actions and future risk mitigation.

The Implications of Non-Compliance: Legal and Financial Consequences

Understanding and adhering to the updated compliance guidelines issued by the US Department of Justice (DOJ) is crucial for businesses to avoid potential legal and financial ramifications. Failure to comply with these guidelines can lead to severe consequences. Let’s delve into the potential repercussions of non-compliance and examine real-world examples where businesses faced serious consequences due to their failure to comply with DOJ guidelines.

Legal Consequences:

-

Criminal Prosecution:

Non-compliant businesses may face criminal charges and prosecution by the DOJ. This can result in significant fines, penalties, and even imprisonment for individuals involved in the misconduct.

-

Damaged Reputation:

Non-compliance can tarnish a company’s reputation, leading to a loss of customer trust and loyalty. Negative publicity surrounding legal proceedings can have long-lasting effects on a company’s brand image and market position.

-

Regulatory Enforcement Actions:

Regulatory authorities may take enforcement actions against non-compliant businesses, including imposing fines, sanctions, or revoking licenses or permits. These actions can severely impact a company’s operations and profitability.

-

Civil Litigation:

Non-compliance can expose businesses to civil lawsuits from affected parties, such as customers, shareholders, or employees. Lawsuits can result in substantial financial settlements, damage awards, and legal expenses.

Financial Consequences:

-

Monetary Penalties:

Non-compliant businesses may be subject to hefty monetary penalties imposed by regulatory bodies or as a result of legal proceedings. These penalties can amount to millions or even billions of dollars, significantly impacting the financial stability of the organization.

-

Loss of Business Opportunities:

Non-compliance can lead to the loss of lucrative business contracts, partnerships, and opportunities. Other companies may be hesitant to engage with non-compliant entities due to the associated risks and potential damage to their own reputation.

-

Increased Compliance Costs:

Remediation efforts to address non-compliance issues can be financially burdensome. Businesses may need to invest in additional resources, technology, and personnel to strengthen their compliance programs and meet regulatory requirements.

Real-World Examples:

-

Volkswagen (VW) Emissions Scandal:

VW faced severe consequences after it was revealed that they manipulated emissions tests in their vehicles. The company faced billions of dollars in fines, legal settlements, and reputational damage, along with criminal charges against some executives.

-

Wells Fargo Unauthorized Accounts Scandal:

Wells Fargo faced significant legal and financial repercussions for opening millions of unauthorized customer accounts. The company paid substantial fines, faced lawsuits from affected customers, and experienced a decline in its stock value and customer base.

-

Theranos Fraud Case:

Theranos, a healthcare technology company, faced legal action after it was discovered that the company misrepresented its capabilities and the accuracy of its blood testing technology. The founder, Elizabeth Holmes, faced criminal charges, and the company ultimately dissolved, facing financial ruin.

How Businesses Can Avoid Consequences Of Non-Compliance?

When it comes to compliance with the US Department of Justice (DoJ) guidelines, businesses need a trusted partner to help them navigate the complex regulatory landscape and avoid the severe repercussions of non-compliance. CRI Group™ is that partner, offering a comprehensive suite of compliance solutions tailored to address the critical areas identified by the DoJ. Let’s explore how our services can assist businesses in mitigating the consequences of non-compliance:

Due Diligence Services:

We understand the importance of conducting thorough due diligence on potential business partners, vendors, and other third parties. Our due diligence services provide businesses with detailed insights and comprehensive background checks, helping them assess the integrity, reputation, and compliance track record of their counterparts. By identifying potential risks and red flags early on, businesses can make informed decisions and avoid partnerships that may lead to non-compliance issues.

Third-Party Risk Management:

The DoJ has consistently emphasized the importance of robust third-party risk management programs. In high-profile cases, businesses faced severe consequences when their partners engaged in illegal activities. CRI Group’s third-party risk management solutions help businesses evaluate, monitor, and mitigate risks throughout the entire partnership lifecycle. By implementing risk-based due diligence, ongoing monitoring, and clear contractual obligations, businesses can proactively manage compliance risks, detect potential misconduct, and take corrective actions before it’s too late.

Compliance Program Development:

A well-designed compliance program is essential for preventing and detecting non-compliance. The DoJ has highlighted the significance of having effective policies, procedures, and controls in place. CRI Group™ collaborates with businesses to develop and enhance their compliance programs, aligning them with the DoJ guidelines and best practices. Our experienced compliance professionals assess the company’s risk profile, design tailored frameworks, and implement robust compliance management systems. By building a culture of compliance and implementing comprehensive program elements, businesses can minimize the risk of non-compliance and demonstrate a proactive commitment to meeting regulatory expectations.

Compliance Training and Education:

Businesses that neglect to provide adequate compliance training to their employees often face severe consequences for their actions. CRI Group™ offers customized training programs that educate employees, management teams, and third parties on compliance requirements, ethical conduct, and regulatory obligations. Through interactive and engaging training sessions, businesses can foster a compliance-conscious workforce that understands the potential risks, knows how to navigate complex compliance situations, and promptly reports any concerns.

Compliance Auditing and Monitoring:

Regular auditing and monitoring of compliance activities are essential to ensure ongoing adherence to DoJ guidelines. CRI Group™ assists businesses in conducting independent compliance audits to evaluate the effectiveness of their programs, identify gaps or weaknesses, and implement corrective measures. Our monitoring services help businesses stay proactive by continuously assessing compliance performance and providing recommendations for improvement.

Continuous Regulatory Intelligence:

Staying updated on evolving regulatory requirements is crucial to maintain compliance. CRI Group™ provides continuous regulatory intelligence services, keeping businesses informed about changes in laws, regulations, and enforcement trends. By leveraging our expertise and timely insights, businesses can adapt their compliance programs and practices to remain in alignment with the DoJ guidelines and other relevant regulations.

Ending Note

In conclusion, the recent updates and clarifications provided by the US Department of Justice (DoJ) in their compliance program evaluation guidelines highlight the importance of a tailored and evolving approach to compliance. It is crucial for companies to understand and adapt to these policy changes to avoid the severe consequences of non-compliance. By implementing effective compliance programs that align with the key requirements outlined in the guide, businesses can proactively address misconduct and mitigate risks.

To mitigate the potential legal, financial, and reputational repercussions of non-compliance with the DoJ guidelines, we invite you to contact CRI Group™ today. Our experienced team will work closely with you to understand your unique circumstances, develop customized compliance solutions, and ensure that your business remains on the path of compliance excellence. Take the necessary steps to protect your company’s reputation and avoid non-compliance consequences by partnering with CRI Group™. Contact us now for a consultation and let us help you navigate the ever-changing compliance landscape.

Case Study: Lessons Learned from Employee Fraud

The most popular type of fraud is misappropriation of assets, including theft of cash and inventories. The motivation to commit fraud include a lack of understanding about fraud behaviour, opportunity to commit fraud and lifestyle and financial pressure.

The motivation for employee to commit fraud stems from three conditions:

- Need

- Opportunity &

- Rationalisation

Let us look at this case from 2019 which resulted in the conviction of a UK solicitor for fraud.

UK Solicitor, Andrew Davies Jailed for Defrauding His Firm of £2.3m

A former senior partner, the UK solicitor, has been jailed for four years after defrauding his firm out of a total of £2.3m. Andrew Davies, 59, paid personal invoices to himself from the business and under-declared £1.1m in stamp duty land tax to HM Revenue and Customs (HMRC) for over nine years.

Davies pleaded guilty to one count of fraud by false representation at Reading Crown Court in 2019 and was sentenced to four years imprisonment in January this year. As a senior partner at the firm, Andrew Davies managed to defraud it out of the money by paying personal invoices to himself from the business account.

The 59-year-old also under-declared £1.1m in Stamp Duty Land Tax to HMRC over nine years, over-declaring tax to clients and then taking money from the solicitor’s firms account for himself, both defrauding the company he worked for and HMRC at the same time.

Davies also raised invoices to pay over £1.6 million to his friend Stephen Allan, who worked as a property developer and was a firm client. The 62-year-old from Bishop’s Stortford was convicted at Reading Crown Court on one count of money laundering and jailed for three years.

In a statement, police mentioned the convictions and sentencing of a solicitor’s firm in Berkshire defrauded out of £2.3m between 2010 and 2017.

Allan then made smaller payments into Davies’ account and also pocketed around £400,000 himself. The solicitor extracted funds from the firm’s client account, paying it to Allan in transactions described as ‘fees’, but there was no known work for this.

Davies of The Street, West Clandon, Guildford, and Allan of Thornberry Road, Bishops Stortford, Hertfordshire, was charged by police officers in August 2019.

The statement did not name the firm, but a Solicitors Regulation Authority notice has previously stated that Davies worked for Reading firm Pitmans LLP, which has since become part of another practice. Davies has already been struck by the Solicitors’ Disciplinary Tribunal and ordered to pay £17,000 in costs.

Investigating officer Detective Constable Katie Taylor of Thames Valley Police’s Economic Crime Unit said: ‘In this case, a solicitor trusted to safeguard client funds abused this position and systematically defrauded his firm of large sums of money for his benefit.

‘He then used a corrupt relationship to launder the proceeds of his crime through a property developer. These professional enablers of organised crime represent a significant risk, and we hope that the conviction and sentence, in this case, will act as a deterrent to others.’

Source: Financial Crime News & The Law Society Gazette

Protecting Your Company From Employee Fraud

Employee background check and employment history check is vital to avoid horror stories and taboo tales within HR, your business, or your brand. Simply investing in sufficient employment screening services can save you time, money and heartbreak.

Get exclusive insights curated for subscriber-only when you join our mailing list.

About CRI Group™

Based in London, CRI Group™ works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are, we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, the CRI Group launched the Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence – an independent certification body established for ISO 37001 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000 Risk Management, providing training and certification. ABAC™ operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations.

CRI Group™ Celebrates 32 Years

May 17th of 2022 marks the 32nd anniversary of the establishment of Corporate Research and Investigations (CRI Group™). Yay, for us! From the very beginning, the CRI Group™ has been dedicated to safeguarding organisations and helping businesses by establishing the legal compliance, financial viability and integrity levels of outside partners, suppliers and customers seeking affiliation. And we would like to thank all of you who have supported us over the last 32 years.

We were then, and continue to be, passionate about helping businesses fight bribery and corruption while promoting transparent business relations. CRI Group™ always stands ready to assist clients on every level and has achieved many significant accomplishments within the past year alone. From engaging in new partnerships, adding new clients to a new AML advisory service, and even opening two new offices, CRI Group™ has been busy expanding our reach to help more organisations prevent fraud, bribery, corruption, and other business risks.

Expanding the Global Reach With New Office Locations

In November 2021, CRI™ proudly announced the opening of its office in Turkey and, in February 2022, the opening of its Estonia office. Zafar Anjum, Group CEO at CRI™, said: “The ability to effectively pre-empt fraud and corruption by mitigating internal and external risks to prevent these issues can save corporations from immense potential losses and reputation damage. Our services such as DueDiligence360™, 3PRM™ and EmploySmart™ can significantly help organisations deal with bribery and corruption, third-party risk management, noncompliance with the regional and international regulatory framework and malpractice. CRI Group™’s expertise will enhance Turkey’s diverse pool of business support services.”

“Today’s business climate dictates an increasing demand of international business organisations for proactive measures designed to reduce bribery and corruption, particularly in the financial, government and multi-national business sectors,” Anjum further said. “CRI Group™’s worldwide network of multi-disciplined subject specialists and analysts, which now include Estonia, helps organisations prevent and deter bribery and corruption, third-party malfeasance, threats and corruption risks while ensuring our clients conform to the local and international regulatory framework. The establishment of our offices in Turkey gives us the platform to expand further and enhance the level of support we offer to the international business community.”

Dynamic New Industry Events, including our own ABAC Summit

In March, CRI Group™ was delighted to take its place at the Trade Winds, the largest annual U.S. government trade mission organised by the U.S. Commercial Service. Trade Winds was a great opportunity to have meaningful conversations with many of you. Our 3PRMTM solution address various specific areas, including conversations on how to protect your organisation from liability, business interruption and brand damage by partnering with the CRI Group™.

- Third-Party Integrity Due Diligence and Screening: ensures global compliance, provides adequate monitoring and protection against potential litigation;

- 3PRM Enhanced Background Checks: uncovers derogatory information within the public and private record resources through risk-based background checks, including investigative research into suppliers and individuals, ultimate-beneficial owners;

- ISO 37001 Anti-Bribery Management System: CRI Group™’s independent and accredited Certification Body can examine your Anti-Bribery and Anti-Corruption procedures and issue an accredited Certification; and

- ISO 37301 Compliance Management System: CRI Group™’s independent certification body helps companies worldwide to increase and measure their efforts against regulatory compliance risks.

This weekend, we attended FutureFest, Pakistan’s largest tech conference & Expo. CRI Group™ was able to talk with many of you about your goals and challenges in staying better protected from fraud and corruption. If you missed the event, don’t despair, CRI Group™ invites you to schedule a quick appointment with us to discuss how conducting due diligence and compliance can help you and your organisation. The role or size of the third party is not as important as the nature of the relationship they have with your business. Think of your third-party access to your sensitive data or your property!

After two years of having to put our ABAC summit on hold because of the pandemic, we are very excited to finally announce our “2022 Anti-bribery, anti-corruption (ABAC™) Summit.” In association with the Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence, our Summit embraces the theme of “Managing your Organisation Governance, Anti-bribery, Whistleblowing, Compliance & Risks Effectively.” This must-attend event for anyone working in anti-bribery and anti-corruption, due diligence, risk management, and anti-fraud such as CEOs, CFOs, Chief Legal Officers, Chief Compliance Officers, In-house Counsels, Compliance Managers, Lawyers and Auditors, Heads of Procurement and Other officers responsible for Compliance and Anti-Corruption. You can check out the full schedule here.

The ABAC Summit will bring together some of the greatest minds in the fight against corruption, with a lineup of expert speakers that share their experiences, knowledge and best practices with an attentive audience, including members from MACC, the Prime Minister of Malaysia Office and the U.S. Embassy in Malaysia. Intending to redefine the anti-bribery culture within organisations in the country, the conference and workshops bring together Foreign Consulates, high-profile enforcement authorities, faculty speakers, delegates from top 500 Forbes and public limited companies, and media in a single forum to discuss effective internal controls, ethics, compliance measures and best practices for preventing and detecting bribery within organisations. The event aims to provide guidance and training that enables business sectors to fight malpractices.

Finally, we are delighted to unveil our place at the 2022 ACC (Association of Corporate Counsel) annual conference as a sponsor and exhibitor. The ACC Annual Meeting at Las Vegas on October 23-26 is convened each year, emphasising law, legislature, training, and compliance associated topics in correlation to Third-Party Risk Management and ISO certification (ISO 37001 Anti-Bribery Management System and ISO 37301 Compliance Management System).

The ACC Annual Meeting is the world’s largest gathering of corporate counsel and will include more than 30 sessions led by industry-leading specialists and counsel. It is standard for the Exhibition Hall to be packed with industry affiliates and experts showcasing their goods and services and is an excellent prospect for you to educate yourself about the most recent industry manufactured goods and services that can be used to enrich your organisation’s stance on conducting due diligence and compliance. Every attendee is guaranteed to leave this conference equipped with significant data and resources to advance their corporate objectives.

If you are attending 2022 ACC, please come by and visit with us. CRI Group™ would love to talk about your goals and challenges in helping your company stay better protected from fraud and corruption.

New Webinars that Help Spread Knowledge About Bribery and Corruption Risks

With businesses continuing to turn to online learning opportunities, CRI™ hosted several webinars, including the upcoming “Compliance and Adequate Due Diligence for Third-Party Risk Managements” with the speaker, Samia El Kadiri, a renowned Consultant, Author and Trainer (6σGB | IRCA- QMS Lead Auditor | TOT | Auditor | Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence). A webinar on building a Culture of Compliance and Trust Through ISO 37301:2021 CMS: Compliance adequate Due Diligence for Third-Party Risk Management – corporate compliance program.

In February, our CEO was invited to speak at The Fraud Outlook 2022 Webinar hosted by the Fraud Advisory Panel. A webinar took a forward look at some of the current and emerging global fraud threats and what they mean for practitioners. It will provide a timely update on the current fraud landscape in Europe, the U.S., the Middle East and Asia, key insights into anticipated fraud trends over the next 12 to 18 months and the implications for counter fraud professionals and businesses.

New Anti-Money Laundering (AML) services

We launched new Anti-money laundering (AML) advisory services that help analyse systems and develop effective solutions that reduce your company’s risk of falling prey to employee, supplier or outside corporate and financial crimes. An effective AML framework is a testament to your organisation’s position against crime. Our unmatched investigative capabilities, worldwide presence and a long-standing reputation for independence and integrity make us uniquely qualified to resolve regulatory concerns.

Our vast Anti-Corruption and Compliance network provides the protection you need when making critical bottom-line decisions crucial to your organisation’s success. Leave it to experts. Ensure you have the 360-degrees analysis of your challenges – get in touch with the experienced CRI Group™’s AML team for a bespoke quote.

As a global business entity with a range of subsidiary partner operations that cross several distinct business sectors (including but not limited to telecommunication, financial services, petrochemicals, energy production/distribution, chemicals, fertilisers and food), your organisation needs to recognise that it is targeted by hostile entities seeking to take advantage of your market presence.

One of the critical challenges is corporate finance’s control and movement and ensuring that effective Anti-Money Laundering (AML Framework) procedures and practices are in place. Refusal to accept the risks and your organisation is openly exposed to:

- Corporate Fraud;

- Corruption;

- Exploitation from the theft of money & other assets.

You need to comply with national, regional, and international legislative frameworks such as:

- Section 453 of the 2017 Companies Act (Pakistan); and

- U.K.’s Proceeds of Crime Act (POCA) 2000).

More fundamentally, money that is unknowingly, unwittingly or (in the case of fraud and corruption) even consciously ‘laundered’ through the organisation could ultimately support, finance and promote international terrorism and the drugs trade.

A money-laundering prevention program is an essential element among institutions’ measures to protect their operations and promote trust among their clients and partners. CRI Group™ works with clients to design, implement, and refine comprehensive AML policies and procedures and establish an overarching compliance strategy and culture, including firm-wide training on AML compliance that reflects the latest regulatory and enforcement trends and industry best practices.

As global corporate citizens aware of their responsibilities, any international organisation must comprehensively address these concerns and implement policies, procedures, and associated risk assessment mechanisms.

CRI Group™: A Brief History

Reflecting on the beginning of our company’s story, our CEO, Zafar I. Anjum, said: “While working on one insurance fraud case, I realised that whereas the justice system deals with most types of crime, fraud itself mandates investigation by an external specialist agency in fraud detection however such organisations were sorely lacking. In addition to a distinct lack of counter fraud education in the general population, which aided those committing fraud greatly. Even where individuals were aware that they were being defrauded, they lacked the knowledge of how to resolve disputes between themselves and the defrauder effectively”.

Mr Zafar Anjum raised the firm to a new level in 2006 when he incorporated the U.K. company in 2006, and Corporate Research and Investigations LLC DIFC was incorporated in 2008 in UAE. Today, CRI Group™ is a leader in employee background screening services, investigative due diligence, third-party risk management services and Anti-bribery Management Systems.

Today, the company is a global firm with experts and resources located in key regional marketplaces across the Asia Pacific, South Asia, the Middle East, North Africa, North America and Europe. The company’s success and growth continue; CRI Group™ always stands ready to assist organisations and has achieved many significant accomplishments within the past year alone. From expanding service capabilities to launching podcasts and webinars every month, CRI Group™ has been busy helping businesses overcome risk management challenges. We collated a few of our achievements below.

Looking forward

Thank you for your past support, and we look forward to continuing to work with you. Check out our eBook of Why Partner with CRI Group™. CRI Group™ invites you to schedule a quick appointment with us to discuss how our risk management solutions can help you and your organisation.

CxO Global Forum Network welcomes Nilofar A.Gardezi

Corporate Research and Investigations Limited (CRI Group™) is happy to invite you to watch this exclusive talk with CXO Rendezvous. Our HRBP & Associate Director, Nilofar, sat with CxO Global Forum at the Rendezvous show to talk about her professional journey and discuss insights into the HR domain in Pakistan.

CXO Rendezvous is a monthly series that is intended to connect the professional community, and listen to inspiring talks from industry leaders, experienced entrepreneurs, visionaries, and innovators. And in this particular episode, Nilofar discusses how HR departments continue to evolve to meet the demands of a fast-paced, digitally-driven environment, forcing employers to be met with a new and distinct set of challenges. Nilofar also discusses how important is it to engage the workforce; attract and retain talent; manage relationships; train and development, embrace inevitable change, employee health and well-being, and more…

|

Ms. Nilofar A. Gardezi is a Senior Certified HR professional with more than nine (9) years of experience in HR. She has expertise in strategic human-centric based HR practices. She holds membership in PSHRM, SODEIT-UN and Rotaract Club Pakistan. Ms. Gardezi has done MPhil-PhD with a specialization in HRM. She has an MBA in Management and is an accredited SHRM professional from EPCA. Ms. Gardezi is also a gold-certified Trainer from DWE. She holds a certification in Psychology and serves as a Certified Professional Counsellor. She has worked with renowned organizations like Attock Group, British Council and Standard Chartered Bank. |

Nilofar A Gardezi

|

About CxO Global Forum

The CxO Global Forum Network is an invitation-only membership exclusively for Chief investment/information officers and technology officers, financial and marketing, executive officers and country heads from the world’s largest and most influential companies. Top Journal editors get together with global analysts and key thought leaders with the mission to identify key challenges in technology and new opportunities for innovation that will unlock value for their organisations.

We live in a social world. Connecting with others broadens our collective thinking while adding texture and dimension to the issues and challenges we all face, regardless of our professional roles. In today’s hyper-connected world, collaborating with a self-made network has become necessary. The forum is about global exposure, especially in digital transformation and innovation around the globe.

Who is CRI Group™?

Based in London, CRI Group™ works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence and other professional Investigative Research solutions provider. We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group™ also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI Group™ launched Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence – an independent certification body that provides education and certification services for individuals and organisations on a wide range of disciplines and ISO standards, including ISO 31000:2018 Risk Management- Guidelines; ISO 37000:2021 Governance of Organisations; ISO 37002:2021 Whistleblowing Management System; ISO 37301:2021 (formerly ISO 19600) Compliance Management system (CMS); Anti-Money Laundering (AML); and ISO 37001:2016 Anti-Bribery Management Systems ABMS. ABAC™ offers a complete suite of solutions designed to help organisations mitigate the internal and external risks associated with operating in multi-jurisdiction and multi-cultural environments while assisting in developing frameworks for strategic compliance programs. Contact ABAC™ for more on ISO Certification and training.

CRI Group™ invites you to schedule a quick appointment with us to discuss in more detail how our risk management solutions can help you and your organisation.

CRI Group™ is Attending 2022 ACC Annual Conference

Corporate Research and Investigations Limited (CRI Group™) is delighted to unveil our place at the 2022 ACC (Association of Corporate Counsel) annual conference as a sponsor and exhibitor.

The ACC Annual Meeting at Las Vegas on October 23-26 is convened each year with a large emphasis on law, legislature, training, and compliance associated topics in correlation to Third-Party Risk Management and ISO certification (ISO 37001 Anti-Bribery Management System and ISO 37301 Compliance Management System).

The ACC Annual Meeting is the world’s largest gathering of corporate counsel and will include more than 30 sessions led by industry-leading specialists and counsel. It is standard for the Exhibition Hall to be packed with industry affiliates and experts showcasing their goods and services and is an excellent prospect for you to educate yourself about the most recent industry manufactured goods and services that can be used to enrich your organisation’s stance on conducting due diligence and compliance. Every attendee is guaranteed to leave this conference equipped with significant data and resources to advance their corporate objectives.

If you are attending 2022 ACC, please come by and visit with us. CRI® Group would love to talk about your goals and challenges in helping your company stay better protected from fraud and corruption.

CRI® Group invites you to schedule a quick appointment with us to discuss in more detail how conducting due diligence and compliance can help you and your organisation.

The role or size of the third party is not as important as the nature of the relationship they have with your business. Think of your third-party level of access to your sensitive data or your property! A cleaning company with access to your filing cabinet represents a different but still significant risk. And remember, you are accountable for the inappropriate actions of any of your third parties. Do you have answers to the following:

- Have a lack of visibility or understanding danger of the risks posed by your relationships with many types of third parties?

- Want greater visibility into third-party performance and risks?

- Need to improve operational costs, process, efficiencies, and organisational agility associated with your third-party relationships?

- Need to gain greater control over the related risks?

- Want to be confident that third parties are compliant with your business’ policies, as well as their own—based on government regulations and industry requirements?

If your organisation seeks answers to any of the above questions, you must consider a third-party risk management solution. CRI® Group invites you to schedule a quick appointment with us to discuss in more detail how 3PRM™ can help you and your organisation.

Why attend?

Here are seven great reasons why you should be there…

- Your future success. In these uncertain times, you need to invest in your future and elevate your practice and law department to a new standard of excellence.

- The right subject matter. This year’s bold, new conference is packed with practical, interactive, and engaging adult learning formats — sessions, workshops, and roundtables that will help you and your colleagues from around the world dig deep into critical subject matters.

- Expert presenters. Hear directly from an impressive group of legal industry thought leaders.

- Unparalleled networking. Exchange ideas and share experiences with thousands of your colleagues from around the globe with 30+ hours of networking events.

- Solutions. Get up-to-the-minute information from 100+ law firms and legal service providers.

- CLE/CPD credit. Get the professional development you need and earn up to a year’s worth of CLE/CPD credits.

- The Phoenix Experience. Jaw-dropping sunsets paint the desert sky nightly. Bask in near-perpetual sunshine. And the Phoenix Convention Center sits in the middle of a walkable downtown filled with independent restaurants, craft brewpubs, and live-music venues.

Source: Event Website

If your organisation requires any of the below within your compliance checklist, you must consider a third-party risk management solution. CRI Group™ invites you to schedule a quick appointment with us to discuss in more detail how 3PRM™ can help you and your organisation.

Third-Party Risk Management solution (TPRM), also known as 3PRM™.

The solution includes establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers, customers, and other sources worldwide seeking potential affiliations with your organisation.

Our 3PRM™ solution streamlines the third-party risk management process through scalability and efficiencies – from third-party risk identification to assessment. What sets us apart is that our 3PRM™ solution includes:

- Due Diligence

- Screeningand background checks

- Business intelligence: information management

- Investigations: i.e. IP, fraud, conflict of interest, etc

- Regulatory compliance

- Anti-bribery and anti-corruption (ABAC) compliance

- Employee auditing training and education

- Monitoring and reporting

With a network of trained professionals positioned across five continents, CRI Group’s 3PRM™ services utilise one of the largest multi-national fraud investigation teams the industry has to offer. Our solution is flexible and responsive to the various risk domains that are most important to your business, from cybersecurity to anti-bribery. CRI Group™ invites you to schedule a quick appointment with us to discuss in more detail how 3PRM™ can help you and your organisation.

It is an honour for us to be a part of a conference that extends to and facilitates so many organisations across the globe; more information on the event will be released soon, so keep your eye out for our updates! We hope to see you there. Are you ready to 3PRM™? Find out more about the significance of conducting due diligence or download the free brochure. We look forward to seeing you in Las Vegas!

FIND OUT MORE or DOWNLOAD THE BROCHURE

About ACC

The Association of Corporate Counsel (ACC) is a global bar association that promotes in-house counsel’s common professional and business interests through information, education, networking opportunities, and advocacy initiatives. ACC is a global legal association that promotes the common professional and business interests of in-house counsel who work for corporations, associations, and other organisations through information, education, networking, and advocacy. ACC has more than 60 chapters and networks across the globe.

Founded as the American Corporate Counsel Association in 1981, our roots began in the United States. Since our founding, we’ve grown from a small organisation of in-house counsel to a worldwide network of legal professionals. Read the story of how ACC grew as an organisation of just 2,000 members to become today’s global organisation.

Who is CRI Group™?

Based in London, CRI Group™ works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence and other professional Investigative Research solutions provider. We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group™ also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.