Your company’s security begins at the hiring process

It’s an exciting time for a company when business is growing and there is a need add more employees and start a hiring process. One organisation t…

Read MoreHow does Human Rights Due Diligence Legislation in EU affect Asia

With the EU Due Diligence Legislation in play, the concept of mandatory human rights due diligence for companies is gaining momentum among governments and businesses in Europe. So how does this legislation matter? In terms of working conditions in India, for example, a government report found that:

- A sizeable number of workers in India earn less than half of the accepted minimum wage

- 71% do not have a written employment contract

- 54% do not get paid leave

- Nearly 80% of these in urban areas work well beyond the eight-hour workday (48-hour week).

The tragic collapse of the Rana Plaza factory in Bangladesh in 2013, which claimed the lives of over 1,000 people, confirmed for European lawmakers the need to establish a strict liability regime for corporate supply chains, says a report by Dr Daniel Sharma on dlapiper.com

The EU Due Diligence Legislation imposes liabilities on companies that procure their products through supply chains from India and South Asia and sell them in Europe. The aim is to establish sanctions under public law and establish complaint procedures for affected parties.

Navigating Human Rights Due Diligence Requirements

Let us take a look at how companies with supply chains to India and South Asia can safely navigate this new regulatory landscape at the EU level:

- A good start would be to conduct an independent risk analysis of the company’s value chains, looking at the risk of potential human rights or environmental violations. Needless to say, this risk analysis must be conducted by independent third parties with knowledge of systems in India and South Asia.

- Companies should create a compliance structure and screening mechanism taking into account the cultural diversity of India and South Asia and ensuring that suppliers comply with the due diligence obligations.

- Companies must conduct a risk analysis of their value chains annually to verify that the due diligence mechanisms installed concerning their value chains are working and conduct an effective analysis of their preventive grievance mechanisms.

- Preventive measures need to be adopted for factors identified within the company’s value chain during the required risk analysis. This should be done by preparing agreements in which the suppliers are also required to comply with due diligence requirements relating to human rights, labour and environmental standards.

- Issuance of a policy statement regarding respect for human rights and the use of transparent and public reporting processes will also make the system robust for both the company as well as their suppliers.

- Random checks of the aforementioned requirements at regular intervals should also be part of effective supplier management, and suppliers can be asked to ensure that compliance standards are also observed in the downstream value chains.

Implementing the above will allow companies to safely navigate European supply chain legislation without exposing themselves to sanctions or penalties.

We Can Help With Human Rights Due Diligence

The CRI Group™ has developed a highly specialised assessment solution for Corporate Due Diligence to assist organisations in accurately identifying, preventing, mitigating and addressing actual and potential adverse impacts of affiliating with global partners and complying with all EU mandates.

From enhanced due diligence to identify non-compliance with the regulatory framework and damaging environmental allegations to investigating company (or stakeholder) human rights violations related to labour laws, child labour or human trafficking, CRI Group™ experts help determine the legal compliance, financial viability, and integrity levels of outside partners and suppliers affiliated with your company’s value chain.

About CRI Group™

Based in London, CRI Group works with companies across the Americas, Europe, Africa, the Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research Solutions provider.

We have the largest proprietary network of background screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are, we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds BS 102000:2013 and BS 7858:2012 Certifications and is an HRO-certified provider and partners with Oracle.

In 2016, CRI Group launched the Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification.

ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. Contact ABAC™ for more on ISO Certification and training.

Explore Insights

- PBSA Annual Conference 2024

- CRI Group™ Accredited by PBSA®| Background Screening Credentialing Council

- SHRM GCC HR SUMMIT – DUBAI 2024

- Economic Crime Act 2024: Impact on Your Business

- Navigating the Changes: ISO 37001:2016/Amd 1:2024 Explained

- Executive Director Appointment at Corporate Research and Investigations Limited: A New Era Begins

Case Study: Lessons Learned from Employee Fraud

The most popular type of fraud is misappropriation of assets, including theft of cash and inventories. The motivation to commit fraud include a lack of understanding about fraud behaviour, opportunity to commit fraud and lifestyle and financial pressure.

The motivation for employee to commit fraud stems from three conditions:

- Need

- Opportunity &

- Rationalisation

Let us look at this case from 2019 which resulted in the conviction of a UK solicitor for fraud.

UK Solicitor, Andrew Davies Jailed for Defrauding His Firm of £2.3m

A former senior partner, the UK solicitor, has been jailed for four years after defrauding his firm out of a total of £2.3m. Andrew Davies, 59, paid personal invoices to himself from the business and under-declared £1.1m in stamp duty land tax to HM Revenue and Customs (HMRC) for over nine years.

Davies pleaded guilty to one count of fraud by false representation at Reading Crown Court in 2019 and was sentenced to four years imprisonment in January this year. As a senior partner at the firm, Andrew Davies managed to defraud it out of the money by paying personal invoices to himself from the business account.

The 59-year-old also under-declared £1.1m in Stamp Duty Land Tax to HMRC over nine years, over-declaring tax to clients and then taking money from the solicitor’s firms account for himself, both defrauding the company he worked for and HMRC at the same time.

Davies also raised invoices to pay over £1.6 million to his friend Stephen Allan, who worked as a property developer and was a firm client. The 62-year-old from Bishop’s Stortford was convicted at Reading Crown Court on one count of money laundering and jailed for three years.

In a statement, police mentioned the convictions and sentencing of a solicitor’s firm in Berkshire defrauded out of £2.3m between 2010 and 2017.

Allan then made smaller payments into Davies’ account and also pocketed around £400,000 himself. The solicitor extracted funds from the firm’s client account, paying it to Allan in transactions described as ‘fees’, but there was no known work for this.

Davies of The Street, West Clandon, Guildford, and Allan of Thornberry Road, Bishops Stortford, Hertfordshire, was charged by police officers in August 2019.

The statement did not name the firm, but a Solicitors Regulation Authority notice has previously stated that Davies worked for Reading firm Pitmans LLP, which has since become part of another practice. Davies has already been struck by the Solicitors’ Disciplinary Tribunal and ordered to pay £17,000 in costs.

Investigating officer Detective Constable Katie Taylor of Thames Valley Police’s Economic Crime Unit said: ‘In this case, a solicitor trusted to safeguard client funds abused this position and systematically defrauded his firm of large sums of money for his benefit.

‘He then used a corrupt relationship to launder the proceeds of his crime through a property developer. These professional enablers of organised crime represent a significant risk, and we hope that the conviction and sentence, in this case, will act as a deterrent to others.’

Source: Financial Crime News & The Law Society Gazette

Protecting Your Company From Employee Fraud

Employee background check and employment history check is vital to avoid horror stories and taboo tales within HR, your business, or your brand. Simply investing in sufficient employment screening services can save you time, money and heartbreak.

Get exclusive insights curated for subscriber-only when you join our mailing list.

About CRI Group™

Based in London, CRI Group™ works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are, we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, the CRI Group launched the Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence – an independent certification body established for ISO 37001 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000 Risk Management, providing training and certification. ABAC™ operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations.

What’s Your Plan of Action for Mandatory Due Diligence?

There is growing momentum among governments all over the world that calls for Mandatory Due Diligence. This requires companies to undertake human rights and environmental due diligence. We now have the French Duty of Vigilance Law and the adoption in 2021 of new laws in Germany and Norway to the publication of a proposal for an EU-wide law in 2022, all moving in this direction. Major investors and companies are also speaking out in favour of such legislation, according to business-humanrights.org

Corporates will not be allowed anymore to focus on short-term benefits at the expense of long-term sustainable value creation. Environmental and social interests will also need to be fully woven into business strategies of the corporates.

Improving Commitment to Mandatory Due Diligence

Corporates are bound to get in line with human rights due diligence guidelines, as prescribed by the UN Guiding Principles on Business and Human Rights. Yet very few actually comply with the standards and nearly half of the biggest companies in the world analysed in the latest Corporate Human Rights Benchmark could not produce any proof of mitigating human rights issues in their supply chains.

The KnowTheChain benchmarks showed companies scoring a poor 29% for their human rights due diligence efforts — something that mandatory human rights and environmental due diligence laws seek to address.

For these laws should to be effective, a few important factors need to be factored in, such as a due diligence obligation for businesses across their global value chains; an effective and safe stakeholder engagement; mandatory requirements that go beyond routine check and audits, a thorough look at irresponsible business models and purchasing practices, and strong civil liability enforcement.

We can help with Mandatory Due Diligence

The CRI Group™ has developed a highly specialised assessment solution for Corporate Due Diligence and Third-Party Risk Management to assist organisations in accurately identifying, preventing, mitigating and addressing actual and potential adverse impacts of affiliating with global partners and complies with all EU mandates.

From enhanced due diligence to identify non-compliance of the regulatory framework and damaging environmental allegations to investigating company (or stakeholder) human rights violations related to labour laws, child labour or human trafficking, CRI Group experts help determine the legal compliance, financial viability, and integrity levels of outside partners and suppliers affiliated with your company’s value chain.

The Benefits of Compliance

Recent studies have demonstrated a positive correlation between the extent to which companies implement environmental, social and good governance policies, and their overall economic performance, all while contributing to a more stable global marketplace. Such responsible business conduct will:

- Enhance protection for workers

- Improve access to justice for victims

- Safeguard the environment

- Ensure fair products for consumers

Further, apart from general compliance with EU mandates, such organisations will benefit from:

- Reduced overall liability risks

- Improved stakeholder protection

- Lower costs resulting from conflicts

- Improved company transparency

- More profound knowledge of the value chain

- Enhanced reputation in the market &

- Improved social standards for workers

CRI Group’s corporate due diligence and accountability solutions can help your organisation comply with a growing list of global regulations and mandates related to human rights and the environment while acting as an integral part of your business decision-making and risk management systems.

Contact the CRI Group to learn more about our Corporate Due Diligence and Accountability solutions and stay one step ahead of the pending EU mandates. We look forward to assisting you.

About CRI Group™

Based in London, CRI Group™ works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider.

We have the largest proprietary network of background screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are, we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI Group launched the Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification.

ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. Contact ABAC™ for more on ISO Certification and training.

EU: Can IP Infringements Cost You Your Life?

The Intellectual Property Commission estimates that IP infringements in the form of counterfeit goods, trade secret theft, and pirated software costs the US economy $225 billion to $600 billion.

Following the outbreak of the COVID-19 pandemic in late 2019 and its subsequent spread around the world, counterfeiters have turned their attention to producing fake testing kits, counterfeit personal protection equipment and, even before the authorities have approved treatments, fake medicines purporting to cure the disease, according to the 2020 status report by the European Union Intellectual Property Office (EUIPO) and the Organisation for Economic Co-operation and Development (OECD).

The joint report on counterfeit medicines showed that not only ‘lifestyle’ medicines but also medicines to treat serious diseases, including antibiotics, cancer therapies or heart disease medications, are subject to being counterfeited, with potentially deadly consequences for the patients who consume those medicines.

This report underlines the importance of IP rights to the EU economy and, therefore, to any recovery from the Covid-19 crisis, which has dominated the first half of 2020 and threatens to have long-lasting effects. It brings together the findings of the research carried out in recent years by the EUIPO, through the European Observatory on the infringement of Intellectual Property Rights, on the extent, scope and economic consequences of Intellectual Property Right (IPR) infringement in the EU.

The Status Report also contains research on the volume of counterfeit and pirated goods in international trade and the economic contribution of intellectual property-rights intensive industries to economic growth and jobs.

IP Rights and your employees

Depending on the type of business you are involved in, it is likely that your employees will create certain types of intellectual property in the course of their employment with you. This is especially true if they are involved in compiling databases, creating marketing material and training brochures. Since the IP rights here belong to the company they work for, an employee contract will serve to protect you here.

It is also vital here to run background checks on employees before you hire them.

Employee Background Checks

Simply investing in sufficient employment screening services can save you time, money and heartbreak. The CRI Group is a leading worldwide provider, specialising in local and international employee background check, including pre employment background check.

Our employee background checks services, also known as EmploySmart™, is a robust new pre employment screening service certified for BS7858 to avoid negligent hiring liabilities and prevent horror stories and taboo tales within HR, your business, or your brand.

How the CRI Group™ can help you tackle IP infringement

CRI Group’s Intellectual Property Investigations team helps companies identify threats to IP and confidential information internally and throughout their supply chain, develop the appropriate mitigation strategies and investigate suspected infringements.

For further information on IPR infringement or to book a meeting with our experts, click here.

The mandatory Corporate Sustainability Due Diligence: How to comply?

The European Commission on 23 February 2022 adopted a long-awaited proposal for a Directive on mandatory corporate sustainability due diligence for widely-defined specified “companies”. The proposals cover obligations throughout the value chain and also attach to non-EU companies which meet specific criteria.

Companies need to prepare now both across their own business operations and their value chain to comply with the proposed Directive. While 2024 is the earliest the Directive will come into effect, the lead time will be needed to put compliant measures in place, or to face civil liabilities and significant fines based on turnover.

How does the mandatory corporate sustainability due diligence directive work?

The proposed Directive establishes a corporate sustainability due diligence duty requiring specific companies to identify and, where necessary, prevent, end or mitigate the potential or actual adverse impacts of their activities on human rights and the environment. Companies will have to publicly communicate their findings in an annual report and there are express directors’ duties. A European Network of Supervisory Authorities will be created to ensure coordination and alignment between Member States, as per a report on cms-lawnow.com

The proposal recognises the important role that directors will play in this process, such that new directors’ duties are proposed to set up and oversee the implementation and integration of sustainable due diligence into the corporate strategy, and a remunerative incentivisation used to ensure climate change is incorporated within the scope of the corporate plan. A director’s duty to act in the best interest of a company will now include expressly taking into account the human rights, climate change and environmental consequences of their decisions in the near, medium and long term.

Accompanying Measures

Although SMEs are not directly in scope of the proposal, the Commission proposes accompanying measures to support all companies that may be indirectly affected by the broad application of the draft Directive.

Member States are required to ensure that natural and legal persons are entitled to submit substantiated concerns to any supervisory authority when they have reasons to believe, on the basis of objective circumstances, that a company is failing to comply with the national provisions adopted pursuant to the Directive. They are also obliged to establish civil liability regimes where companies are liable for damages if they fail to comply with the due diligence rules and as a result of this failure an adverse impact that should have been identified, prevented, mitigated, brought to an end or its extent minimised through appropriate measures occurs and leads to damage.

Implications of the corporate sustainability due diligence directive

Once the final version of the Directive is transposed, procedures and training will be required to ensure that companies have the requisite systems in place to be able to comply with the obligations and provide such reports. This will involve dialogue throughout the value chain and changes to existing contractual arrangements. Those not directly in scope should also consider their position and potential new requests for information to assist in the due diligence process by others. Once legislation is implemented, non-compliance can result in fines or orders issued requiring the company to comply with the due diligence obligation. Victims could also obtain compensation for damage due to non-compliance with this legislation, says cms-lawnow.com

The way forward

The proposal will be presented to the European Parliament and the Council for debate. Once a text is agreed, approved, and then adopted, Member States will have two years to transpose it into national law. This initiative is part of a wider corporate sustainability package intended to advance the European Green Deal which also announced an agreed Council position on the Commission’s proposal for a Corporate Sustainability Reporting Directive.

The German Supply Chain Due Diligence Act

In January 2023 a new German law, known as the Supply Chain Due Diligence Act, becomes effective and applies to companies operating or trading in Germany. The law introduces a legal requirement for businesses to manage social and environmental issues in their supply chains, through more responsible business practices.

The Act requires businesses to undergo significant efforts in order to achieve compliance. In this eBook, we will provide a first outline of the Act’s material contents and an in-depth analysis of the applicability of the Act to various corporate structures.

This eBook is the collection of a series of articles in which we will take a closer look at key issues, especially addressing the question of what you can do to adequately prepare yourself at this early stage. We would be happy to provide you with individual advice, as well. Please do not hesitate to contact us. If you cannot find what you are looking for, please feel free to get in touch with the team! Let’s talk

Newsletter

Join over 2000+ HR, Risk and Compliance communities around the world. Subscribe now to our monthly newsletter, and receive more articles like this!

Employee Background Screening: Fake CV Lands a Top NHS Job… Are Your Employees Telling the Truth?

Is Employee Background Screening as critical as they make it out to be?

A former builder who faked his CV to land a series of top NHS jobs has finally been forced to pay the full price for his ‘staggering lies’, says a shocking report on timesnewsuk.com/

Jon Andrewes, 69, spent a decade working as chairman of two NHS trusts and chief executive of a hospice after pretending to have a PhD, an MBA and a history of senior management roles. Mr Andrewes had been appointed chairman of the Royal Cornwall Hospitals NHS Trust (RCHT) ahead of 117 other candidates.

After Andrewes was exposed he was convicted of fraud, jailed for two years and ordered to hand over all his remaining assets of £96,737. But the confiscation order was overturned by the Court of Appeal two years ago when judges ruled he had given ‘full value’ for his salary in the jobs he did. Now, more than five years after pleading guilty to fraud charges, Andrewes has had the financial penalty reinstated by the Supreme Court and must pay back nearly £100,000.

Under his fake persona, Andrewes insisted on staff calling him ‘Dr’ and claimed to have degrees from three universities. But his only genuine higher education qualification was a certificate in social work. After starting as a builder he spent much of his career as a probation officer, customs officer or youth worker before inventing a new life for himself as an NHS manager.

His senior health jobs, which included a £75,000-a-year role as chief executive of a hospice in Taunton, earned him £643,602. He was appointed in 2004. He then led the Torbay NHS Trust in Devon for nearly a decade, before becoming chairman of the Royal Cornwall NHS Hospital Trust in 2015.

However, an investigation at the hospice uncovered discrepancies in his CV and led to police being called in. ‘He came across as very knowledgeable and competent,’ recalled David Shepperd, former head of legal services at Plymouth City Council, who liaised closely with Andrewes on a council-funded green project. ‘He was an affable, nice guy to deal with.’

‘It beggars belief that no due diligence was carried out when he was appointed to these roles in the NHS,’ says an NHS source, quoted in the timesnewsuk.com report.

The UK Screening Module covers:

- Identity Check: An independent check to authenticate an individual’s identity using various sources of stated data.

- Regulated Employment History & References: Regulated employment references to confirm previous employment details.

- Academic Qualifications: Confirmation of highest academic qualification, including details of institution and dates attended.

- Professional Qualifications: Confirmation of latest or most relevant Professional or Trade Memberships.

- FSA Register Search against the UK Financial Services Authority Individual Register and Prohibited Persons Register

- UK Credit Check Check to determine the general credit worthiness of the candidate.

- Directorship Search: Search for UK Directorships and any disqualifications.

- Negative Media Search: Search of press and other media focusing on derogatory information only.

- Compliance Database Check: Search for inclusion in governmental sanctions, enforcements, watchlists, blacklists and criminality.

- Criminal Record Checks — Standard Disclosure: A check of all convictions held on the PNC.

More details on the UK Screening Module can be had here.

A business must understand its exposure when hiring and type of insurance coverage and limits – does your policy cover a negligent hiring lawsuit? The checks are critical to any company’s success – hiring qualified, honest, and hard-working employees is an integral part of thriving in the business community.

IP infringement: The Intellectual Property and Youth Scoreboard 2022 is ut!

IP infringement by way of buying counterfeit goods online and accessing digital content from illegal sources, intentionally or by accident, remain a common practise among youth, says the 2022 edition of the Intellectual Property and Youth Scoreboard.

Released by the European Union Intellectual Property Office (EUIPO), the study provides an update on the behaviours of youth towards purchasing fake products and intellectual property infringement. It is based on a survey of young people between the ages of 15 and 24 in all 27 member states of the European Union (EU) and highlights the factors driving young people to purchase counterfeit goods or access digital content from illegal sources.

Key drivers behind purchasing fakes and accessing pirated content are mostly the price and availability. Peer and social influence such as the behaviour of family or friends also affect the decisions of European youth, says a report of the study on IP Helpdesk.

The Increasing Dangers of IP Infringement

Counterfeit goods pose a significant threat to consumers’ health and safety and is detrimental to the environment. Pirated wares also have a wide range of negative consequences for global economies, the report finds.

Fact: Young Europeans buy more fake products and continue to access pirated content

- 37% of young people bought one or several fake products intentionally in the last 12 months

- 21% of 15 to 24 year olds say they intentionally use illegal sources of digital content in the last 12 months

- 60% of young Europeans said they prefer to access digital content from legal sources, compared to 50% in 2019

- Price and availability remain the main factors for buying counterfeits and for digital piracy

The EUIPO is based in Spain and among one of the most innovative intellectual property offices globally. The European Observatory on Infringements of Intellectual Property Rights is a network of experts and specialist stakeholders. It was established in 2009, with a mission to fight the increasing danger of IP Infringement in Europe and to protect the rights of online property.

Employee Background Screening FAQs – PART III: Conflict of Interest Checks & FACIS Searches

This three-part series of articles looks at employee background screening FAQs.

How do you know the candidate you just offered a role to is the ideal candidate? Are you 100% sure that everything they’re telling you is the truth? Or are you 90% certain? They showed you a diploma: How do you know it’s not photoshopped? Did you follow the correct procedures during your background checks process?

Simply investing in sufficient screening systems can save you time, money and heartbreak, as the employee background screening FAQs ebook will show you.

Part One of the series, “What, Why and Who?” provides an introduction to employee background checks and the necessary screenings that are vital to avoid horror stories and taboo tales that occur within your business. Part Two, “Pre-Employment Checks,” are essentially an investigation into a person’s character – inside and outside their professional lives. Part Three, “Conflict of interest check & FACIS Searches,” checks for any conflict of interests and sanctions, exclusions, debarments and disciplinary actions. To receive the next series subscribe to our monthly newsletter subscribe now!

Taken as a whole, this employee background screening FAQs ebook developed by the CRI® Group is the perfect primer for HR professionals and companies wanting guidance on background screening, pre-employment screening and post-employment background checks.

WE’VE COMPILED A LIST OF OUR MOST FREQUENTLY ASKED QUESTIONS IN THIS EMPLOYEE BACKGROUND SCREENING FAQs. IF YOU CANNOT FIND WHAT YOU ARE LOOKING FOR BELOW, PLEASE FEEL FREE TO GET IN TOUCH WITH THE TEAM!

At CRI® Group, we specialise in employment screening, working as trusted partners to HR and recruiting managers of corporations and institutions worldwide. Our people work with energy, insight and care to ensure we provide a positive experience to everyone involved – clients, reference providers and candidates.

Is it Possible to Identify Conflict of Interest During Checks?

Conflict of interest occurs when an individual or company have interests that might influence or be perceived as being capable of influencing their judgment even unconsciously. What your client wants you to do is to check whether the subject has any additional business or interests that are in conflict with what they were retained to do.

Example:

You head the public relations department of the UAE’s largest bank. The department is responsible for putting together a quality service recognition programme. Your bank’s public relations agency is designing the advertising speciality components for the programme targeting the bank’s 10,000 employees. Your wife owns XYZ Promotions, the largest advertising speciality firm in the state.

The company offers the best prices for large orders. XYZ Promotions has supplied products for a number of other accounts of the public relations firm. However, this is the first time that the public relations firm has used XYZ Promotions for a bank project. The public relations firm does not know that your wife owns XYZ Promotions. You have not suggested the use of XYZ Promotions.

The public relations firm has made its recommendations to you, including using XYZ Promotions as the vendor for the quality service recognition programme. The bottom line is that if somebody is contracted to do a job — so they do not have any connections from which they could benefit again (like above — you are working for the bank, and it is your job to select an advertising company and if you select XYZ you benefit again!) Essentially this is a conflict of interest because you would benefit from this if XYZ was given the job.

Would you like to learn more about our internal investigation and conflict of interest services? Get in touch and let us know how we can help!

What Will a Financial Regulatory Check Show?

These checks entail a search of individuals who have been disqualified from holding prudentially significant roles primarily within the Banking, Finance, Securities and Investment sector (BFSI), e.g. Individuals who have been disqualified from involvement in the management of a corporation, banned from being securities or futures representatives, banned or disqualified from practising in the financial services industry and individuals who have had Enforceable Undertakings accepted.

A Financial Regulatory Check may also cover whether a person or organisation holds a license where this license is a requirement of their role within the BFSI environment, e.g. Auditors, Liquidators, Authorised Representatives, Financial Planners etc. Availability and access to these checks vary per country.

Would you like to learn more about our Financial Investigations services? Get in touch and let us know how we can help! Or visit us here!

What is a Bankruptcy Check?

Confirms if an individual (including aliases and associated parties) has been declared bankrupt and recorded with the relevant body. This information is relevant to individuals holding positions of management responsibility and certain financial roles.

What about Directorships & Significant Shareholdings Search?

This search identifies potential conflicts of interest that can arise from an individual’s current and past directorships and their significant shareholdings. An individual’s performance as a Director can provide critical insight into their skills and experience. This search can highlight whether any of the companies they have been a director of have had an administrator appointed or deregistered.

What Type of Educational Qualifications can You Check?

Specific educational qualifications are required for many positions of responsibility, and salary packages are set accordingly. Failing to verify this information can result in unqualified people in positions in which they cannot perform their responsibilities.

CRI Group™ verifies the institution attended, the date of attendance, the qualification awarded and the graduation dates. CRI Group™ also verifies that the institution is an accredited provider from approved government databases. Suppose the institution does not appear on an accredited database. In that case, CRI Group™ will also check the institution’s name against a comprehensive list of unaccredited institutions to ensure that the institution is not a known degree mill.

What about Professional Qualifications & Membership Checks?

Specific professional qualifications and memberships are key requirements for many roles. CRI Group’s researchers will verify the type of professional qualification and/or membership received, the status of the membership (i.e. Valid or lapsed), attendance dates and graduation dates where applicable.

National Police Check?

CRI Group’s Police Record Check will reveal details of criminal records in line with the relevant legislation.

Can I Have Access to a Criminal Watch List?

Where CRI Group™ cannot conduct a recognised police record check due to either legal restrictions or simply the lack of such a database, we can offer the “next best alternative.” These searches review proprietary databases and criminal watch lists issued by various governments to identify known individuals. We combine this check with an extensive media search which provides a high degree of confidence that the individual has not been involved in high-level criminal activity.

Anti Money Laundering Check?

This check assists in identifying the risks associated with individuals due to specific or general involvement with Money Laundering (AML), Politically Exposed Persons (PEPs), terrorists and wanted criminals. It achieves this by detailing the relationship network between these individuals and various other entities.

The check provides an international due diligence report utilising up-to-the-day investigative information from an extensive range of available public domain information sources. It uses government, intelligence and police sites, global organisations, international and national media and all international sanctions lists. Would you like to learn more? Get in touch and let us know how we can help!

Credit & Civil Litigation Check

Access, availability, and information released vary across nations. In general:

- Civil litigation: Checks and researches public and private legal disputes on civil matters or through the courts. In other words, civil litigation refers to that branch of law dealing with disputes between individuals and/or organisations, in which compensation may be awarded to the victim. For instance, if a car crash victim claims damages against the driver for loss or injury sustained in an accident, this will be a civil litigation case.

- Credit check: Researches credit bureau for adverse financial judgments for debts and negative credit ratings where available, while a local agent will undertake alternative resources as per jurisdiction to ascertain the financial creditworthiness of the subject in question, which will include media checks, reputational and source comments from Central Bank resources where available.

Can you Conduct FACIS (Fraud & Abuse Control Information System) Searches?

Yes, we can; we conduct three levels of searches:

- FACIS Level 1 — A current and historical database of sanctions, exclusions, debarments and disciplinary actions for all provider types: federal sanctions

- FACIS Level 2 — A current and historical database of sanctions, exclusions, debarments and disciplinary actions for all provider types: federal and state healthcare entitlement programme sanctions

- FACIS Level 3 — A current and historical database of sanctions, exclusions, debarments and disciplinary actions for all provider types: federal and state sanctions

I AM LOOKING FOR UK SCREENING!

The UK Screening Module covers:

- Identity Check: An independent check to authenticate an individual’s identity using various sources of stated data.

- Regulated Employment History & References: Regulated employment references to confirm previous employment details.

- Academic Qualifications: Confirmation of highest academic qualification, including details of institution and dates attended.

- Professional Qualifications: Confirmation of latest or most relevant Professional or Trade Memberships.

- FSA Register Search against the UK Financial Services Authority Individual Register and Prohibited Persons Register

- UK Credit Check Check to determine the general credit worthiness of the candidate.

- Directorship Search: Search for UK Directorships and any disqualifications.

- Negative Media Search: Search of press and other media focusing on derogatory information only.

- Compliance Database Check: Search for inclusion in governmental sanctions, enforcements, watchlists, blacklists and criminality.

- Criminal Record Checks — Standard Disclosure: A check of all convictions held on the PNC.

More details on the UK Screening Module can be had here.

A business must understand its exposure when hiring and type of insurance coverage and limits – does your policy cover a negligent hiring lawsuit? The checks are critical to any company’s success – hiring qualified, honest, and hard-working employees is an integral part of thriving in the business community.

CRI Group™ Announces Webinars on Key Aspects of Due Diligence Investigations

The CRI Group™ is hosting a series of webinars on Due Diligence Investigations. The insightful webinars will help you go deep into crucial aspects of Due Diligence Investigations with lessons learned by industry leaders in various areas of business and best practices that you should adopt.

Details:

Webinar 1: Web-based or On-site Due Diligence Investigation: When and Why Do You Need it? And Who’s Going to Need it?

- Duration: 1h 15 min (1h sharing followed by 15 min Q&A)

- Date: 15 September 2022, Thu

- Time: 11.00am – 12.15pm UAE

- Speaker: Ashelea + Kevin (TBC)

- Format: Webinar

- Platform: MS Teams

Learning points:

- Web-based or on-site, or both? Which methods provide robust validity and trust to the information being investigated?

- How is a web-based due diligence investigation conducted?

- How is an on-site due diligence investigation conducted?

- How extensive does the due diligence investigation be with the web-based and on-site?

- When is a web-based due diligence investigation adequately required? And who will need it?

- When is on-site due diligence investigation adequately required? And who will need it?

- When are both web-based and on-site due diligence investigations required? And who will need it?

- What are the types of due diligence investigation offered on the current market

- Current Laws and Legislation around the world that are mandating businesses to conduct due diligence investigations

Webinar 2: The A-Z on How the Examiner Conducts Adequate Due Diligence Investigation

- Duration: 1h 15 min (1h sharing followed by 15 min Q&A)

- Date: TBC

- Time: 11.00am – 12.15pm UAE

- Speaker: Ashelea Arzadon

- Format: Webinar

The first webinar will be on “The A-Z on how the examiner conducts due diligence investigation” while the topic for the second webinar/podcast is “Web-based or On-site due diligence investigation. When and why do you need it? And who’s going to need it?”

The webinars will be addressed by CRI Group experts and will be of one-hour duration followed by a 15 minutes Q&A session. The dates for these webinars will be confirmed shortly. It is recommended that you register your interest here so that you are kept updated on the webinars.

Our Speaker

Ashelea is the Investigations Manager, leading the due diligence, C-level background screening, insurance claim and corporate investigations for multinational clients across various key industry sectors: public relations and advertising agencies of global brands, international law firms, aerospace and defence, and nuclear and energy companies. Her work includes multi-jurisdictional investigations in MENA, Europe and the Americas.

Before joining CRI Group™, she leveraged her knowledge of international law and politics as part of diplomatic and consular practices after working with the Department of Foreign Affairs in Manila. She graduated from Lyceum of the Philippines University with a bachelor’s degree in International Relations with a major in Diplomacy – and currently pursuing her master’s in Corruption and Governance at the University of Sussex. She became a Certified Fraud Examiner in 2018.

Due Diligence Investigations: Mitigate Critical Risks

At CRI™, we provide due diligence services where ever you are. Use our DueDiligence360™ reports to help you comply with anti-money laundering, anti-bribery, and anti-corruption regulations ahead of a merger, acquisition, or joint venture. You can also use them for third-party risk assessment, onboarding decision-making, and identifying beneficial ownership structures.

Due Diligence helps you Identify key risk issues clearly and concisely using accurate information in a well-structured and transparent report format. Our comprehensive range of reports includes specialised reports that support specific compliance requirements. Protect your reputation and the risk of financial damage and regulator action using our detailed reports. They enhance your knowledge and understanding of the customer, supplier, and third-party risk, helping you avoid those involved with financial crime.

The CRI Group™ invites you to schedule a quick appointment with them to discuss in more detail how conducting due diligence and compliance can help you and your organisation.

Based in London, CRI Group™ works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, TPRM, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider.

We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group™ also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

Employee Background Screening FAQs – PART II: Pre-Employment Check

This three-part series of articles looks at employee background screening FAQs.

How do you know the candidate you just offered a role to is the ideal candidate? Are you 100% sure that everything they’re telling you is the truth? Or are you just 90% certain? They showed you a diploma: How do you know it’s not photoshopped? Did you follow the correct procedures during your background checks process?

Simply investing in sufficient screening systems can save you time, money and heartbreak.

Part One of the series of articles on employee background screening FAQs, “What, Why and Who?” provides an introduction to employee background checks and the necessary screenings that are vital to avoid horror stories and taboo tales that occur within your business. Part Two, “Pre-Employment Checks,” are essentially an investigation into a person’s character – inside and outside their professional lives. Part Three, “Conflict of interest check & FACIS Searches,” checks for any conflict of interests and sanctions, exclusions, debarments and disciplinary actions. To receive the next series subscribe to our monthly newsletter subscribe now!

Taken as a whole, this employee background screening FAQs ebook developed by the CRI Group™ is the perfect primer for HR professionals and companies wanting guidance on background screening, pre-employment screening and post-employment background checks.

WE’VE COMPILED A LIST OF OUR MOST FREQUENTLY ASKED QUESTIONS TO DO WITH BACKGROUND SCREENING. IF YOU CANNOT FIND WHAT YOU ARE LOOKING FOR BELOW, PLEASE FEEL FREE TO GET IN TOUCH WITH THE TEAM!

At CRI® Group, we specialise in employment screening, working as trusted partners to HR and recruiting managers of corporations and institutions worldwide. Our people work with energy, insight and care to ensure we provide a positive experience to everyone involved – clients, reference providers and candidates.

Does a Candidate Have to Give Consent to Process a Background Check?

A job applicant must give written or electronic consent before any screening conducting (whether in-house or by a third party company like CRI Group™) any criminal record search, credit history check or reference interview, etc.

How Long Does it Take to Conduct a Background Check?

Background checks typically take 2 to 3 days to process and receive back from the outside contracted agency. A few exceptions may take up to 2 weeks. A background check may rarely take longer than 3 to 4 weeks. Please allow additional processing time for each background check in the event of a delay. A delay can occur for any of the following reasons:

- The information has been entered incorrectly by the applicant or the requestor into the vendor’s system.

- The county or district listed for a background check in researching whether the applicant has any criminal felony or misdemeanour charges is delayed in responding to the vendor.

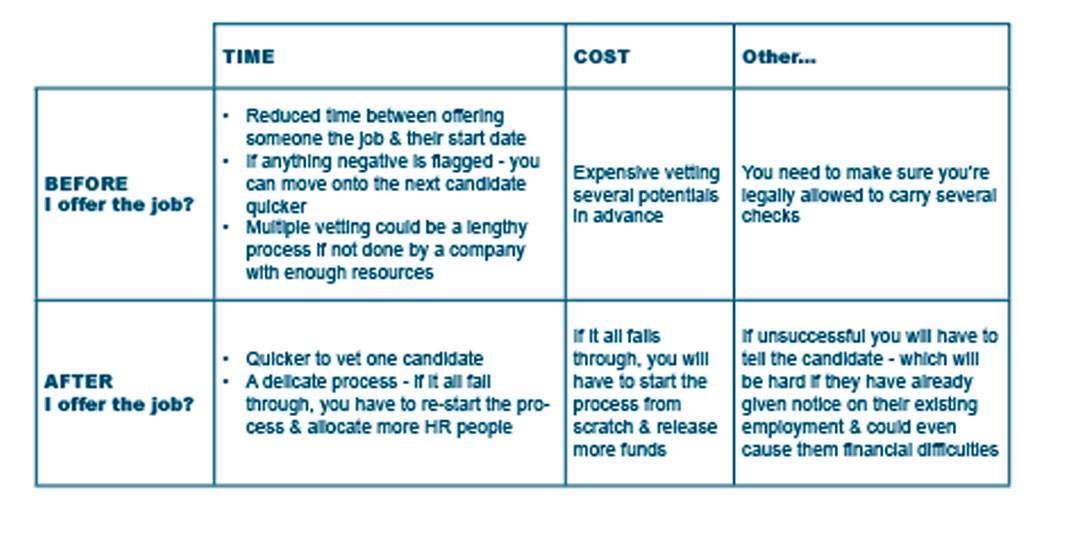

When Should I Conduct Pre-Employment Checks?

Pre-employment screening services can help you avoid adding potential fraudsters and other bad actors to your staff. These checks can be implemented before or after a job offer (with each having its pros and cons).

How Often Should I Screen Employees?

Employees should be screened regularly to reveal any new information relevant to the business. That’s why our background investigations services also include:

- Employee monitoring & risk management

- Data protection compliance

- Employee testing & confidentiality

- Employee risk management

- Post-employment background checks

How to Collect References and What to Ask?

Because it is impossible to know how your candidate will work daily from just one interview, you will need references. References are a great way to find out whether your candidates are suitable for the role or will fit with your company culture. A primary reference check asks for:

- Employment dates

- Employment main responsibilities

- Attendance record

- Any disciplinary actions against them

- Any reasons why they shouldn’t be employed

These references will help you back up their CV – however, many candidates tend to exaggerate or misrepresent themselves. Third-party vendors such as CRI® Group can go beyond to get a fuller picture for you:

- Greatest strengths?

- Are they suitable for the role they’ve applied for?

- Would they rehire the candidate?

- Suitable management style?

- Do they have any leadership skills?

- Situations in which they have excelled at?

Note: Some companies have policies not giving references and just providing necessary employment details, while others direct you towards HR.

How Much Does it Cost to Conduct a Background Check?

That will depend on the scope. Please contact the team for a free consultation.

What are Employment References?

CRI Group’s comprehensive and detailed reference checks have been carefully designed for senior-level positions. Our highly skilled researchers probe extensively across a range of performance and behavioural attributes that have been specifically targeted to meet the information and management requirements of hiring senior-level executives.

We also verify any restrictive covenants, disciplinary actions or warnings; attendance or reliability issues; claims by or their former employer; acts of dishonesty, and eligibility for rehire in a comparable role. We provide a valuable perspective of an individual’s past performance and behaviours by conducting professional, impartial references.

What is the Difference Between Employment History Verification & Employment Reference?

CRI Group™ verifies who the individual reported to and their dates of employment, positions held, remuneration, responsibilities and reason for leaving. This is different to an Employment Reference as it verifies quantitative information such as employment dates, salary packages etc.

Media Search

An individual’s media profile can encompass both professional and personal activities. This check can provide the client with a unique insight into an individual’s public activities and reputation. Our broad-based press search encompasses electronically available national newspapers and regional media sources from states where an individual has worked, helping to ensure that there are no hidden surprises. The search can be conducted by country, region or globally, where it can be of immense value in the uncovering of omissions made by the candidate (note: additional charges apply).

How do I Check on Entitlement to Work?

It is an employer’s responsibility to ensure that every individual they hire is legally eligible to work in certain Jurisdictions. CRI Group™ uses copies of the candidate’s passport or birth certificate to verify entitlement to work in the respective Jurisdiction. Where the candidate is not a local citizen, we have an online verification process set up with the Department of Immigration and Citizenship, as the case may be, to confirm eligibility to work. We will confirm whether or not the candidate is entitled to work in Australia and provide details of any limitations attached to a work visa. This search verifies and appropriately documents the individual’s entitlement to work in accordance with DIMIA requirements.

How do You Conduct Identity Checks?

The availability of identity checks varies from nation to nation, depending on centralised databases and legislation. In essence, these checks are designed to ensure the person is who they claim to be. Where there is a recognised legislated identity card system, CRI Group™ will collect this card, ensure the details are reflected on the background check form submitted and upload the identity card to the candidate file to allow for the requestor to sight.

Identity theft is on the rise, and validating an individual’s identity is essential to making an informed hiring decision. CRI® Group verifies an individual’s identity details via a comparison with details held in the electoral roll, online telephone directory and the National database registration authorities.

Passport Check

This passport verification solution enables the client to verify a person’s identity and whether their passport is forged. Passport Check verifies the authenticity of machine-readable passports and identity documents by simply entering the passport/ID data.

CV Comparison Check

Curricula Vitae (CV) are increasingly being used as a sales tool rather than a factual account of a person’s work history. This check will compare information supplied by the candidate to CRI Group™ with details supplied to an organisation in a candidate’s CV. This check aims to provide a thorough review of the candidate’s background and reveal any misrepresentations that may exist through a candidate omitting or overstating information on their CV.

CONTACT US

Headquarter: +44 7588 454959

Local: +971 800 274552

Email: info@crigroup.com

Headquarter: 454959 7588 44

Local: 274552 800 971

Email: info@crigroup.com

NEWSLETTER SUBSCRIPTION