Mark Your Calendars for the PBSA Annual Conference 2024 this September in Boston!

We are thrilled to announce that Corporate Research and Investigations (CRI Group™) will be proudly sponsoring and exh…

Read MoreRisks of Cybercrime and Social Media: NEW PLAYBOOK

The risks of cybercrime claims many victims over many sectors. The PwC Global Economic Crime Survey 2020 found that a company falls victim to six frauds on average. The most common types are customer fraud, asset misappropriation as well as cybercrime. It also proved a roughly even split between frauds committed by internal and external perpetrators, at almost 40% each – with the rest being mostly collusion between the two. Few can deny the enormous technological advancements that are constantly taking place in the modern world. The internet, the computer, and other technological advancements have dramatically changed what it means to socialise, ‘chat’, and even read a book. Both the disadvantages and advantages of such developments are clear, and as technology gains pace, so have the unlawful activities of those who seek to take advantages of such developments.

According to a 2020 cybercrime report from Europol, COVID-19 sparked upward trend in cybercrime. In fact, since the beginning of the pandemic, the FBI has seen a fourfold increase in cybersecurity complaints, whereas the global losses from cybercrime exceeded $1 trillion in 2020.

In other words, as technology evolves, the risks of cybercrime have become complex. The sense that one is safe from crime in the privacy of one’s own home has been lost. In fact, according to World Economic Forum’s “Global Risks Report 2020” the chances of catching and prosecuting a cybercriminal are almost nil (0.05%).

Take the First Steps Towards Developing Measures Against the Risks of Cybercrime!

This playbook critically examines the growth of cybercrime, evaluating the risks it poses in terms of the different forms of cybercrime that exist and the regulations that seek to detect, prevent and punish them.

The extension of an old legislation to include cybercrime is not entirely effective – especially not for crimes committed within the realm of social media and social networking. Therefore the need to develop an ‘anti-cybercrime culture emerges. It has to be implemented on an international scale that safeguards these crimes – the promotion of careful use would therefore be facilitated to hinder such crimes before they can materialise. Our playbook includes:

- What is cybercrime and why is it important?

- Top corporate cybersecurity risks and 10 types of high-tech crimes

- How cybercrime impacts business and your company’s growth

- Cybercrime and regulations in place

- And how your response as a business matters – how to can you protect your business from cybercrime including advice and tips on how to telework safely

Download the full playbook today and learn step-by-step things your company can do to be better protected from cybercrime. Robust cyber-security, data protection, anti-fraud and risk management all come together to mitigate the dangers posed by hackers, phishers and other cybercriminals.

With the playbook in your hands, you’ll learn about the most common cyber attacks. This includes viruses, phishing attacks and website hacks. You’ll also gain a better understanding of the consequences of different types of cybercrime.

To sum it up, the playbook provides best-practices and ways that companies are lessening their risk without spending prohibitive resources to do so. Above all, the right expert advice means that any company can be on the right track to protecting their customers, their assets, and their employees from the risks of cybercrime.

Who is CRI Group™ ?

Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are, we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds B.S. 102000:2013 and B.S. 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI Group launched the Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC™ operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC™ for more on ISO Certification and training.

New European Parliament Corporate Due Diligence and Corporate Accountability

Corporate due diligence and corporate accountability, ending an era of voluntary policing. A new EU mandate places liability on companies unable to assess and mitigate unethical third-party behaviour. New legislation requires companies operating in the EU to ‘identify, address and remedy their impact on human rights and the environment throughout their global value chains.’

Situation Analysis:

- In 2017, nearly 25 million people categorised as victims of forced labour. International Labour Organization, 2017 report

- From 2000-2012, nearly 25% of all tropical deforestation was due to illegal agro-conversion for export markets. 2019 study

Global economies have significantly benefited from an increase in cross-border and international business partnerships, which has led to a substantial expansion of the global value chain. Subsequently, more and more companies are being exposed to potential liability by unscrupulous third-party providers in their supply chain pipeline with little respect for business ethics, human rights or the environment.

There is a growing concern worldwide of the many supply chain businesses linked to severe abuses, including exploitative working conditions, modern slavery and child labour, toxic pollution, rampant destruction of rainforests and a general disregard for corporate governance.

For decades, companies have voluntarily monitored supply chain partners for bad behaviour, but this self-policing has limited. But now, the European Union Parliament has presented mandates for EU businesses – under penalties of law – to carry out due diligence to identify, prevent, mitigate and account for actual or potential human rights violations and negative environmental impacts in their operations and supply chain.

“We live in a world where businesses with the wherewithal can still shift their adverse social and environmental impact to the most vulnerable people and places on the planet.” Lara Ianthe Wolters, Member, European Parliament

The Challenge: You are Liable for the Conduct of Your Partners; Lack of Due Diligence will Get you into Trouble

The legislation requires companies operating in the EU to identify, address and remedy their impact on human rights (including social, trade union and labour rights), the environment (contributing to climate change or deforestation) and good governance (such as corruption and bribery) throughout their value chain.

This is akin to saying that if a company fails to conduct due diligence on a third-party partner that engages in slave labour, pollutes the environment, manipulates the price or violates jurisdictional regulations, that company is essentially complicit in the partnering company’s illegal behaviour. It may be held liable in a court of law.

Aside from legal and monetary penalties, the company further risks a tarnished reputation in the market and a devaluation of its brand.

It’s crucial for businesses utilising global supply chain partners to conduct due diligence and assess the potential risks that a third party may pose to your organisation, particularly when addressing risks associated with environmental damage and human rights violations.

The Solution: Identify Unethical Behaviour and Protect Your Organisation with 3PRM, Corporate Due Diligence and Risk Management

CRI Group™ developed a highly specialised assessment solution for Corporate Due Diligence and Third-Party Risk Management to assist organisations in accurately identifying, preventing, mitigating and addressing actual and potential adverse impacts of affiliating with global partners and complies with all EU mandates.

From enhanced due diligence to identify non-compliance of the regulatory framework and damaging environmental allegations to investigating company (or stakeholder) human rights violations related to labour laws, child labour or human trafficking, CRI Group experts help determine the legal compliance, financial viability, and integrity levels of outside partners and suppliers affiliated with your company’s value chain.

Outcomes

Recent studies have demonstrated a positive correlation between the extent to which companies implement environmental, social and good governance policies, and their overall economic performance, all while contributing to a more stable global marketplace. Such responsible business conduct:

- Enhances protection for workers

- Improves access to justice for victims

- Safeguards the environment

- Ensures fair products for consumers

Further, apart from general compliance with EU mandates, such organisations enjoy a wealth of intangible benefits, including:

- Reduced overall liability risks

- Improved stakeholder protection

- Lower costs resulting from conflicts

- Improved company transparency

- More profound knowledge of the value chain

- Enhanced reputation in the market

- Improved social standards for workers

“The global pandemic has demonstrated that resilient global supply chains that protect both the people and planet will be crucial to companies and economic recovery in the future.” Transparency International EU

CRI Group’s corporate due diligence and accountability solutions can help your organisation comply with a growing list of global regulations and mandates related to human rights and the environment while acting as an integral part of your business decision-making and risk management systems.

Are you prepared to conduct a due diligence assessment on your global partners? Contact CRI Group to learn more about our Corporate Due Diligence and Accountability solutions and stay one step ahead of the pending EU mandates. We look forward to assisting you.

Zafar I. Anjum | MSc, MS, LLM CFE, CIS, MICA, Int. Dip. (Fin. Crime), Int. Dip. (GRC), MBCI, CII Int. Dip. (AML)

Group Chief Executive Officer, Corporate Research and Investigations Limited

e: zanjum@crigroup.com | t:+44 7588 454959

Our enhanced Integrity Due Diligence services will ensure that working with an, i.e. potential trade partner will ultimately achieve your organisation’s strategic and financial goals. To find out more about each level of due diligence, contact CRI Group HERE!

John Wood Group to Pay $177 Million to Settle Bribery Charges Inherited Through its Merger

John Wood Group Bribery Probe Trace Back to its Merger with Amec Foster Wheeler Plc.

John Wood Group Plc has agreed to pay $177 million to settle the UK led bribery and corruption probe into a British engineering firm it acquired in 2017. The settlement is part of a so-called deferred prosecution agreement with the Serious Fraud Office and the US Department of Justice concerning Amec Foster Wheeler Plc.

The UK agreement is still subject to court approval. As part of the deal, the company can avoid prosecution for three years if it cooperates in the continuing bribery probe. Wood Group’s payment is one of the largest ever obtained in the UK led bribery and corruption case. The biggest was a $1.2 billion settlement with Airbus SE that also involved the US and French authorities.

In 2017, the SFO opened an investigation into Amec’s use of third parties to gain contracts, just weeks after Shareholders approved wood Group’s proposed acquisition. The DOJ said the probe concerned a scheme to pay bribes to officials in Brazil for a $190 million contract to design a gas-to-chemicals complex.

As part of the deal announced, at least $10.1 million will settle charges brought by the US Securities and Exchange Commission. The DOJ said it would get about $18.4 million to resolve its criminal charges in the Brazil bribery probe. Amounts to be paid to the UK and Brazil are yet to be made public.

Wood Group announced that it was close to a settlement. It originally said it expected a deal for $186 million, with about $60 million paid in the first half of 2021 and the rest over three years. The company also agreed to pay $10 million to Scottish authorities earlier this year to settle the case.

“The investigations brought to light unacceptable, albeit historical, behaviour that I condemn in the strongest terms,” Wood Group Chief Executive Officer Robin Watson said in a statement. “Although we inherited these issues through acquisition, we took full responsibility in addressing them, as any responsible business would.”

The company has “cooperated fully with the authorities” and “taken steps to improve further our ethics and compliance program from an already strong foundation,” Watson said. “I’m pleased that, subject to final court approval in the UK, we have been able to resolve these issues and can now look to the future.”

The agreement comes amid criticism of the SFO and its inability to prosecute individuals after securing settlements with companies. Earlier this year, the SFO dropped its probe into former Airbus directors and was dealt a humiliating setback after its trial against two former Serco Group Plc directors fell apart because it failed to disclose evidence.

In May 2021, the SFO opened one of its biggest investigations into suspected fraud and money laundering concerning GFG Alliance and its financing agreements with Greensill Capital. It was after months of intense pressure from lawmakers to investigate Sanjeev Gupta’s empire.

John Wood Group bribery probe.

Source: Financial Crimes News

Join our mailing list and get exclusive industrial insights for subscriber-only!

The Importance of Due Diligence in Merger and Acquisition to Avoid a Similar Incident Happened like in John Wood Group.

Due diligence is understood as the reasonable steps taken to satisfy legal requirements in the conduct of business relations. That allows you to reduce risks – including risks arising from the FCPA (Foreign Corrupt Practices Act) and the UKBA (UK Bribery Act), to make informed decisions and to pursue takeovers or mergers with more confidence.

Unlike other kinds of control (audits, market analysis, etc.), it must be completely independent and rely as little on information provided by the researched subject. The other important difference lies in the methodology: commercial or financial due diligence analyses available information, investigative type provides reliable and pertinent, but raw, information.

Due diligence on potential business partners when adding a new vendor or hiring a new employee is vital to confirm the legitimacy and reduce the risks associated with such professional relationships. Global integrity due diligence investigations provides your business with the critical information it needs to make sound decisions regarding mergers and acquisitions, strategic partnerships, and the selection of vendors, suppliers, and employees.

It will ensure that working with an, i.e. potential trade partner will ultimately achieve your organisation’s strategic and financial goals. CRI Group investigators employ a proven, multi-faceted research approach that involves a global array of databases, courts and public record searches, local contacts, industry and media resources, and in-depth web-based research. Our resources include:

-

International business verification

-

Individual business interest search

-

Personal profile on individual subjects

-

Company profile on corporate entities

-

Historical ownership analysis

-

Identification of subsidiaries & connected parties

-

Global/national criminality & regulatory records checks

-

Politically Exposed Person database

-

International digital media research

-

Company background analysis

-

Industry reputational assessment

-

FCPA, UK Anti-Bribery & corruption risk databases

-

Global terrorism checks

-

Global financial regulatory authorities checks

-

Money laundering risk database

-

Financial reports

-

Asset tracing

-

Country-specific databases that include litigation checks, law enforcement agencies & capital market regulators

DueDiligence360™ from CRI Group™

WHAT DO YOU ACTUALLY KNOW ABOUT THE INTEGRITY OF THE PARTY & THEIR WAY OF DOING BUSINESS? DOES OR DID THIS PARTY ADHERE TO (INTER)NATIONAL REGULATIONS ON ANTI-CORRUPTION & ANTI-BRIBERY? IS IT POSSIBLE THAT THERE IS A LIABILITY RISK?

At CRI Group™, we specialise in Integrity Due Diligence, working as trusted partners to businesses and institutions across the world. Our people work with energy, insight and care to ensure we provide a positive experience to everyone involved – clients, reference providers and candidates.

CRI’s unique identity and vision evolved from our fundamental desire to support our clients and their candidates. Safeguard your business and its integrity with DueDiligence360™.

Our DueDiligence360™ expose vulnerabilities and threats that can cause serious damage to your organisation and can significantly reduce business. CRI Group is trusted by the world’s largest corporations and consultancies – outsource your due diligence to an experienced provider and you will only ever have to look forward, never back. Clients who partner with us benefit from our:

Expertise

CRI Group™ has one of the largest, most experienced and best-trained integrity due diligence teams in the world.

Global scope

Our multi-lingual teams have conducted assignments on thousands of subjects in over 80 countries, and we’re committed to maintaining and constantly evolving our global network.

Flexibility

Our DueDiligence360TM service is flexible and can apply different levels of scrutiny to the subjects of our assignments, according to client needs and the nature of the project.

DueDiligence360™ from CRI Group™

WHAT DO YOU ACTUALLY KNOW ABOUT THE INTEGRITY OF THE PARTY & THEIR WAY OF DOING BUSINESS? DOES OR DID THIS PARTY ADHERE TO (INTER)NATIONAL REGULATIONS ON ANTI-CORRUPTION & ANTI-BRIBERY? IS IT POSSIBLE THAT THERE IS A LIABILITY RISK?

At CRI Group™, we specialise in Integrity Due Diligence, working as trusted partners to businesses and institutions across the world. Our people work with energy, insight and care to ensure we provide a positive experience to everyone involved – clients, reference providers and candidates.

CRI’s unique identity and vision evolved from our fundamental desire to support our clients and their candidates. Safeguard your business and its integrity with DueDiligence360™.

Our DueDiligence360™ expose vulnerabilities and threats that can cause serious damage to your organisation and can significantly reduce business. CRI Group is trusted by the world’s largest corporations and consultancies – outsource your due diligence to an experienced provider and you will only ever have to look forward, never back. Clients who partner with us benefit from our:

Expertise

CRI Group™ has one of the largest, most experienced and best-trained integrity due diligence teams in the world.

Global scope

Our multi-lingual teams have conducted assignments on thousands of subjects in over 80 countries, and we’re committed to maintaining and constantly evolving our global network.

Flexibility

Our DueDiligence360TM service is flexible and can apply different levels of scrutiny to the subjects of our assignments, according to client needs and the nature of the project.

Tackling Corporate Fraud in the Middle East

Tackling corporate fraud in the middle east has become even more challenging during the pandemic. ICAEW Insights sat down with our founder and chief executive, Zafar Anjum, to discuss the rising levels of corporate fraud in the middle east during the pandemic.

Find out how CR™ is using AI to investigate wrongdoing; from fake degrees and doctored CVs to false insurance claims and bogus bills, our corporate fraud investigators in the Middle East have seen it all. Zafar told ICAEW his firm was busier than ever as the pandemic triggered a rise in white-collar crime cases across the region.

From its base in London, CRI™ has been helping firms in middle east regions like Qatar, Dubai, Abu Dhabi and Saudi Arabia. Regions where anti-fraud frameworks are still being built out inside the embryonic corporate regulatory regimes that govern the Middle East.

“We’ve seen a lot of insurance fraud claim investigations, fake bills, fake debts and fraudulent certificates designed to cheat insurance companies,” Zafar said. “Covid allowed internal controls to be relaxed; people are working from home, so the usual check and balances are missing.”

Nascent Regulatory Regime

Last year, PwC research found corporate fraud was on the rise across the region, with nearly half of all local companies reporting at least one occurrence in 12 months. Zafar said the lack of counter-corruption model legislation such as the UK Bribery Act 2010 often meant policing the business areas such as the Dubai International Finance Centre (DIFC) fell to private companies as the regulator doesn’t have the resources to cover the scale of the problem.

“In the Middle East, the issues relating to fraud and corruption are of concern because there isn’t the legislation when compared to developed countries. The definition of fraud and fraudulent activities are different across the Middle East,” he said.

The DIFC was established in 2004 to create a safe and constant upward regulatory environment for companies to do business. One of its aims was to attract investment from London and Wall Street firms and other corporates from both continents. A regulator was created to monitor the market, and the set-up was replicated for the Abu Dhabi and Qatar financial business districts.

The economic “free zones” have relied on firms themselves to help shape the regulatory framework, Zafar said, which has created a mixture of frameworks as standards are broadly aligned with the UK or US markets.

“It’s not national-level legislation, which carries its own problems. There have been scandals, and a lot of that centres on fraudulent financial statements, investment scams,” Zafar said. “A prevalent problem is vendor/third-party screening and false claims, especially during the bidding process. Some firms exaggerate their capabilities and are not able to deliver.”

Investor Scams on the Rise

A big part of CRI Group’s work is analysing financial statements, checking backgrounds, and working with compliance teams to root out bad actors. Zafar said investors scams were also on the rise across the UAE; because the country is ripe for development, some fraudsters had found it easy to prey on foreign victims who are drawn to the opportunities but unwilling to carry out proper due diligence.

The UAE’s family offices are a driving force of industry, and the name carries significant weight regarding deals. “It’s very risky to invest without carrying out the proper checks, and unfortunately, a lot of people come in blind,” Zafar said.

“Fake property claims are rife. It can be individuals who are targeted or small groups of foreign investors. One case involved a handful of US investors who wanted to invest in some economic and humanitarian projects. They wanted to create jobs, other activities, but fell in with people who weren’t with the families they claim to be a part of.”

Family names are often taken by scammers and used to convince investors to part with their cash fairly frequently, Zafar said. Because many people don’t care about due diligence, it can end up costing millions of dollars,” he said. “It’s so hard to recover the money, to catch the fraudster. If the victims don’t have local consultants or experts, it can be hard to trace back and recover the damages.”

An investor group puts its trust — and its funds — in the hands of an outside business partner without considering a due diligence check on the individual.

Eighteen months into the partnership, the individual has succeeded in fleecing the group of more than $6 million and is still at large. Investigators such as CRI™ are increasingly turning to artificial intelligence and machine learning tools to help with screening. Zafar said great strides had been made in tackling corruption and bribery.

Public and Private Investigation Partnerships

Databases of politically exposed individuals, or persons with links to crime, on watchlists or have criminal activity linked to their name or accounts are rapidly being populated for use by regulators and private investigators.

“We’re trying to prove that there is a role for AI in detecting crime and that it can be a part of the investigative process. Machines will scan publicly available databases, criminal cases and the like, and we can check if firms have been blacklisted by authorities such as the Asian Development Bank, IMF or World Bank, which is really helpful.”

In the past, these checks would have to be carried out by hand, one by one. “It’s hard, almost impossible! Name matches are probably the largest problem in the Middle East.

You cannot find a person with the first name Mohammad or last name Khan; you’ll get billions of matches, so we need to develop a database that builds on this with other information. There isn’t a nationwide electoral database in any Middle East region, so you can see how much work still has to be done.”

Credit history, employment checks and previous addresses are a handful of ways the files can be built out, Zafar said, and his team is working on ways to streamline that process. There was no concept of background screening in 2008 when Zafar’s team started, and despite having come a long way, he said they still encounter fraud on a massive scale. However, they still encounter fraud on a huge scale, he said.

Alarming Numbers

“Sometimes applicants try to falsely fill the gap in their CV, which is dangerous because we don’t know if they’ve spent time in jail,” he said. “More common red flags are fake degrees and fake previous employment references. We found one in 20 applications for a job had fake degrees, experience letters, or fake references in some regions. It’s a huge number, and some of the universities were prestigious too, which makes it quite alarming.”

Another big area of focus is auditing gifts and donations passed through a company concerning projects carried out. His team works with companies to ensure their anti-bribery controls are as robust as possible, given the tough penalties on offer.

“It’s a criminal liability for a company, and the directors will be liable if they don’t have the proper anti-bribery procedures in place,” Zadar said. “Accounts and financial teams are critical to making sure firms have proper internal controls.”

CRI™ is also on a mission to stamp out “box-ticking” compliance, which has traditionally been a problem across the Middle East due to the nascent regulatory framework. “If you’re conducting audits, nothing will happen if this is the way; you’ll never spot the problem,” he said. “The role of accountants, whether internal or external, to shape the controls and make sure they are implemented effectively.”

He said bribery through sales commissions, waste for public service, sexual extortion or sextortion as a form of corruption could be rife in some sectors. It was up to companies to ensure money wasn’t being paid outside official channels to staff.

“We understand it’s a process for some firms who are not used to doing it this way, but we’re here to help,” he said. “Companies need to establish their compliance documentation and make sure it’s up to the standard. The most important areas are due diligence and anti-bribery policies. This should not be a paper-based box-ticking exercise, it has to be implemented, and every employee must know the company believes in zero-tolerance of corruption.”

Visit ICAEW’s Fraud hub for related articles and case studies, or to see the original article, click here.

The Story of Our CEO and Company

The Story of CRI Group™

By Zafar I. Anjum, Group CEO

THE BEGINNING: EVENT THAT CHANGED ME

Shortly after leaving the Pakistani Rangers in 1994 (five years after my graduation), I took over my father’s private investigation organisation – called, at the time, the Metropolitan Detective Agency. During this period, I was involved in investigating a case of suspected insurance fraud. The case involved a grandfather attempting to lay claim to his daughter’s life insurance settlement following her death under the pretext that he was responsible for the guardianship of her four orphaned children. After investigation, it was revealed that this was not the case and that the grandfather was attempting to defraud his late daughter’s insurance company.

Much like my feeling towards the case, the situation’s outcome could be characterised in two ways – one positive and one negative. I remember the overwhelming pride I felt in our success on the positive side. However, this was somewhat overshadowed by a sense of what is perhaps best articulated as injustice – I saw first-hand how fraud is damaging. And although fraud was having (and continues to have) a detrimental effect on the people, the lack of an effective solution to the problem meant that, frustratingly, such crimes were able to continue.

UNCOVERED MY FIRST FRAUD; WHAT’S NEXT?

Whilst I had managed to deal with one case of fraud and thus prevented the successful committing of a crime, this was just a single instance of fraud – I had done nothing to move towards an overall reduction of the problem. In other words, I concluded that I had managed to treat a mere symptom rather than the underlying illness.

DEDICATION TO INVESTIGATING FRAUD

Although the case itself was not particularly unusual, at least as far as fraud cases go, one particular aspect of the affair struck me – that, in contrast, most crimes are dealt with by the justice system, and fraud is peculiar. It often mandates investigation by an external agency or organisation that specialises in fraud detection. I noticed that such organisations were sorely lacking in Pakistan at the time – and that there was a distinct lack of counter fraud education in the general population, which aided those committing fraud greatly. Furthermore, even where individuals were aware that they were being defrauded, they lacked knowledge of effectively resolving disputes between themselves and the defrauder.

With this analysis in mind, I concluded that there needed to be significant growth in the counter-fraud industry within Pakistan. This is where the privatised nature of fraud investigation could make a significant positive impact.

Although the police might not have had the resources to deal with fraud in its entirety, there was certainly an incentive for private companies to increase their spending in this area. In other words, there was a clear market opportunity for the expansion of the anti-fraud industry, and one that I knew how to fill with my experience and knowledge. Although I am market-minded as a matter of business necessity, it has become apparent to me over recent years that I am at my most motivated not when I am seeking organisational growth but when I am seeking professional development.

Corporate Research and Investigations Ltd (CRI Group’s First Logo)

FUTURE PLANS: CRI GROUP™ EXPANSION

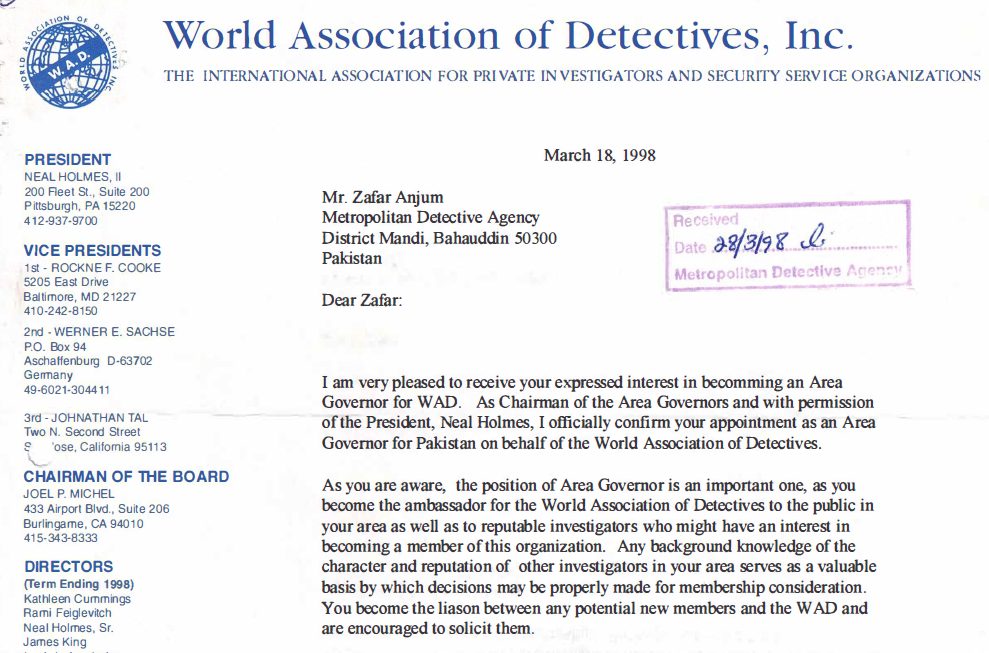

With this conclusion in mind, I continued with the operation and expansion of Corporate Research and Investigations Limited “CRI® Group”. As well as expanding the CRI® Group, I began to take more and more of an interest in the professional aspects of fraud investigation. For this reason, in 1995, I became the first member of the Association of Certified Fraud Examiners from Pakistan, and in 1998 I was appointed the Area Governor for Pakistan and the Middle East by the World Association of Detectives.

The Area Governor appointment letter, issued to Zafar Anjum by

World Association of Detectives, 1998

If I were to summarise the one lesson that I learned due to my early experiences in Pakistan, it would be important to expand counter-fraud and counter-corruption to where it is needed. The ramifications of this lesson did not end when I left Pakistan either. My awareness of areas into which fraud prevention might be further expanded has continued. For this reason, I have taken a particular interest in the emerging area of corporate corruption and fraud.

CRITICAL REFLECTIONS ON MY PERSONAL DEVELOPMENT

Being a business owner, it is only natural that my personal development has been attached to the development of my organisation. As noted above, I have sought to have my organisation grow in line with my field – where there has been a need to combat corporate corruption and fraud, I have sought to conquer the resulting market. Similarly to how I have sought to expand my business, I have also found it necessary to seek out personal development opportunities whenever they become available. To this end, I have consistently been seeking out academic development since 2009. I have since completed an ICA International Diploma in Financial Crime Prevention, ICA International Diploma Governance, Risk and Compliance, ICA International Diploma in Anti-Money laundering, and MSc in Counter Fraud and Counter Corruption Studies. I completed another Master in Fraud and Financial Crime with Distinction and a Master of Laws (Legal Practice Intellectual Property). It is only natural that I am currently seeking to learn academically and contribute something to academia in the form of my PhD thesis.

In terms of personal development, I can therefore consider myself lucky to bring my career experience to doctorate-level study. Still, I will be able to take what I have learned at the doctorate level and apply it in a professional setting. Although I am market-minded as a matter of business necessity, it has become apparent to me over recent years that I am at my most motivated not when I am seeking organisational growth but when I am seeking professional development.

Hard work and dedication are two values ingrained into our core and are found in all facets of our operation. We believe that true value comes from fostering trust with our colleagues and clients at an equal level. We take great care in keeping integrity at the forefront of our Anti-Corruption, Compliance and Risk Management services. We wish to build long-term relationships in which we can be counted on to provide efficient and cost-effective services.

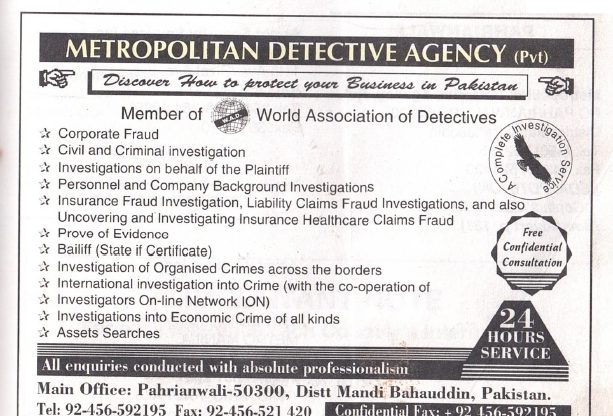

CRI Group’s very first international directory advertising in the UK during 1998

Looking Forward…

I believe it is important to constantly look for ways of improvement, especially in this rapidly changing industry. Each new technological development is an opportunity for us to advance our capabilities and competencies. Making use of the finest equipment and the most advanced technologies is one of the many ways that we set ourselves apart from the competition. I take great pleasure in implementing the most innovative ways to provide for our colleagues and team.

Our goal is to provide principled and reliable Anti-Corruption, Compliance and Risk Management Services for our clients. With the shifting marketplace, we pride ourselves on maintaining our core values as a constant. The message to our client is that your satisfaction is the main driving force behind our business. When you choose our services, you can expect a professional, high-quality experience every time.

Thank you all for your dedication, and congratulations on our 35th anniversary!

With gratitude and wishing for more years to come for the CRI Group™ family,

What’s Law vs Allowed with Pre-employment Screening Around the World:

Pre-employment Screening is a vital yet overlooked function in an organisation. Many organisations scale their businesses globally and into multiple countries simultaneously. The main reason as to why many business may opt to not run prior background screening on their employees is because they are more inclined to believe that the potential employee is telling the truth. Another reason is that businesses mat not be aware of how to run these checks in line with the legal requirements of their country. It is incredibly important to be able stay on top of the different legal requirements of background checks across the globe as it helps to comply with and set standards which can help businesses go further in their career span. So what exactly are the different pre-employment screening measures across the globe? Consider this article a handy set of global guides covering the basics that companies need to know.

Background Screening

How do you know the candidate you just offered a role to is the ideal candidate? Are you 100% sure you know that everything they’re telling you is the truth? 90%? They showed you a diploma, how do you know it’s not photoshopped? Did you follow the correct laws during your background checks process? Employee Background Checks and Pre-employment Screening are vital to avoid horror stories and taboo tales that occur within HR, your business or even your brand – simply investing in sufficient pre-employment screening can save you time, money and heartbreak.

However handling employment law compliance in-house can be challenging. We are a leading worldwide provider, specialised in local and international employment background screening, including pre-employment screening and post-employment background checks. We have used our experience and knowledge to bring you this article, which covers 61 key jurisdictions mandatory background checks vs what it is allowed.

At CRI, our Employee Background Checks as well as Pre-employment Screening can help to reduce the risk of hiring an employee who could cause irrevocable damage to the firm, reversing the impact of the time and money invested into the company to brand their products and services. A singular bad hire can cause your organisation a loss of revenue and reputation – all factors which can lead to the failure of a business. Pre-employment Screening checks aid in avoiding such a situation as well as helps businesses gain a competitive edge through hiring competent and qualified people.

Pre-employment Screening in Oceania

To summarise, Oceania audits its companies frequently thus allowing for different measures to be taken to ensure compliance in line with legal requirements. The process also relies on the provision of consent from the potential hires. See the breakdown below.

NEW ZEALAND

- Law: 1) Required in some industries, e.g. childcare; 2) Immigration compliance.

- Allowed: Criminal, reference and credit reference checks are permissible but are subject to the candidate’s consent.

AUSTRALIA

- Law: Immigration compliance.

- Allowed: Permitted with the candidate’s consent and subject to relevant discrimination laws. Offers of employment may be subject to pre-employment screening checks including criminal record checks or medical examination if necessary to determine fitness for a particular job.

Pre-employment Screening in The Middle East and North Africa (MENA)

Immigration compliance is prevalent in the laws across MENA regarding employee background checks however, in respect to what is allowed in line with the legal guidance varies from country to country. This may be due to the differing laws either covering a broader or slimmer spectrum on the scale for employee background checks. See the breakdown below.

TUNISIA

- Law: Every company must require its employees to undergo a medical examination and, in particular, a medical examination relating to the employment. The results of the medical examinations belong to Occupational Medicine. It is obligatory for any company governed by the Labour Code to have an Occupational Medicine service in place, whatever its number of employees.

- Allowed: Employers may ask employees to provide information relating to criminal records, subject to the employee’s prior consent. There are no legal requirements or restrictions on pre-employment screening measures such as education checks or reference checks. In principle, the CV contains the necessary education and work-related information, and the employer can request a copy of any diplomas or certificates of work or internship.

UNITED ARAB EMIRATES

- Law: Foreign employees must receive prior approval from the Ministry of Human Resources and Emiratization (MOHRE – formerly, the Ministry of Labour), or relevant free zone authority, and the immigration authorities before they can be hired on local employment contracts. The UAE authorities’ background checking and screening level vary according to an individual’s nationality. As part of this approval process, since January 2016, employers registered with MOHRE are now required to submit a completed offer letter, signed by both parties, using MOHRE’s standard form offer letter. The terms of the employee’s employment contract cannot then differ from the terms of the offer letter.

- Allowed: Employers are not able to obtain the same level of information from background checks as they can in other jurisdictions, and in most cases, the employees themselves will be required to provide this information.

BAHRAIN

- Law: Foreign employees must receive prior approval from the LMRA and Ministry of Interior before hiring on local employment contracts. The level of background checking and screening carried out by Bahrain authorities varies according to the nationality and proposed position of an individual.

- Allowed: Generally, employers cannot obtain the same level of information from background checks and pre-employment screening as they can work in other jurisdictions and, in most cases, the employees themselves are required to provide this information. A Certificate of Good Conduct from the Criminal Investigation Directorate is the most commonly requested document.

SAUDI ARABIA

- Law: Immigration compliance for all non-GCC employees.

- Allowed: Criminal and credit reference checks are only permissible for specific roles (e.g., certain finance positions) and are subject to proportionality requirements. Reference and education checks are standard and acceptable with applicant consent.

MOROCCO

- Law: Immigration compliance. A criminal record check required for certain limited occupations (e.g., solicitors and chartered accountants).

- Allowed: Identity and personal information checks. Education checks. Prior employment checks.

OMAN

- Law: Foreign employees must receive prior approval from the Ministry of Manpower and immigration authorities before hiring on local employment contracts. The level of background screening and screening carried out by the authorities varies according to the individual’s nationality.

- Allowed: Employers may not obtain the same level of information from background checks as they can in other jurisdictions. In most cases, the employees themselves will be required to provide this information.

QATAR

- Law: Foreign employees must receive prior approval from the Ministry of Labour and Ministry of Interior before hiring on local employment contracts. The Qatar authorities’ level of background screening varies on several factors, including the individuals’ nationality and whether the individual is a local hire or recruited from abroad. Insofar as we are aware, local nationals are not subject to the same level of checks as foreign nationals recruited by a Qatari entity from abroad. In some cases (depending on the nature of the role), as part of the work permit/residence visa process, employees will be required to provide an attested copy of their degree/high school certificates to the Ministry of Labour.

- Allowed: Generally, you cannot obtain the same level of information from background checks and pre-employment Screening as you can in other jurisdictions – employees themselves will be required to provide this information. For example, Criminal record: the individual can only obtain police checks or Certificates of Good Conduct from the Criminal Evidences and Information Department (CEID). To obtain the Good Conduct Certificate, the individual, if a foreign national, may also be required to obtain police clearance from his home country and provide an attested copy of this policy clearance to the CEID. Employment: There is a provision in the Labour Law for employers to provide all employees with a certificate of service if requested, so candidates should be asked to verify their employment history.

KUWAIT

- Law: The Kuwait authorities’ level of background checking and pre-employment Screening varies according to the individual’s nationality. However, foreign employees must receive prior approval from the Public Authority for Manpower (PAM) and immigration authorities before hired.

- Allowed: Employers can not obtain the same level of information from background checks as they can in other jurisdictions – employees will be required to provide this information themselves.

Pre-employment Screening in Asia

The legislation regarding background checks across Asia are incredibly diverse with some of the ‘allowed’ measures requiring candidates consent in some countries and not in others. There are different protection acts that are in place in each individual country which contributes to its diverse laws and measures. See the breakdown below.

CHINA

- Law: Immigration compliance.

- Allowed: Reference and education checks are standard, even without the applicant’s consent. There is no restriction on criminal record checks.

TAIWAN, REPUBLIC OF CHINA

- Law: Work permit and residency compliance.

- Allowed: Non-criminal record certificates, reference and education checks are permissible with applicant consent, although some restrictions apply.

JAPAN

- Law: Generally not required.

- Allowed: Criminal background checks are not prohibited but are discouraged by the labour authorities. You need a strong justification for such checks. In addition, conducting a criminal background check in Japan is difficult because records are not publicly available. Reference and education checks may be completed with consent, but third parties who receive such requests do not always cooperate. Some employers require a health check at hiring, but employers should not conduct HIV testing and gene diagnosis unless there is employee consent and a solid and legitimate reason.

VIETNAM

- Law: Before hiring foreign employees to work, as an employer you must obtain written approval from the provincial People’s Committee through the Department of Labour, Invalids and Social Affairs (DOLISA). Possessing a valid work permit issued by the provincial labour authorities is a compulsory condition for foreign citizens to work in Vietnam, except where an exemption applies. Legal sanctions for the employer of a foreign citizen without a work permit include fines, and the authorities may even suspend a business’ operations. A foreign citizen working in Vietnam without a work permit risks deportation.

- Allowed: Employers may request that their employees provide information relating to the execution of an employment contract, such as full name, age, gender, residence address, education level, occupational skills, and health conditions. There are no regulations on obligatory pre-hire checks, including pre-hire reference checks, pre-hire criminal checks or pre-hire credit checks, in the Labour Code 2012. However, specific regulations exist in more heavily regulated fields, such as aviation, security and medicines. Questions about an applicant’s past, health and criminal record are generally permissible in Vietnam.

INDIA

- Law: There is no statutory requirement on an employer to carry out pre-hire background checks, except for employment in specific sectors such as mining, where medical checks are mandatory before employment. In the case of foreign citizens, the visa stamp or sticker in the employee’s passport will include the name of the employer, and the employer will be required to provide an undertaking to the Foreigners Regional Registration Office (FRRO) on behalf of the employee to register the employee with the FRRO. Therefore, the employer should undertake a basic immigration check at a minimum. In addition, considering that termination of employment is not straightforward in India, it is common for employers to verify the professional and educational qualifications of the candidate.

- Allowed: Background checks for applicants may be conducted as long as they comply with the fundamental right to privacy, which means that applicant/employee consent should be obtained. Establishments usually have a pre-hire background check policy in place for new hires. Background screening is generally done for education qualification verification, previous employment status, address verification, criminal background verification, reference verification and applicable database verification.

MALAYSIA

- Law: Immigration compliance for foreign nationals.

- Allowed: Pre-employment background screening is not regulated, and the practice varies from one industry to other. Employers should obtain the individual’s consent if the pre-hire checks require accessing, collecting or processing the individual’s personal data to ensure compliance with the Personal Data Protection Act 2010.

THAILAND

- Law: Visa and work permit compliance. Age of the employee (the employee must not be younger than 15).

- Allowed: The use, publication or distribution of any information obtained requires consent from the candidate who has given such information. Suppose the information is regarded as personal data under the Personal Data Protection Act BE 2562 (2019) (“PDPA”). In that case, the employer who collects uses and/or discloses such information must notify the purposes of such collection, use and/or disclosure before receiving consent from the data subject-employee. An applicant can be asked to have a medical examination. However it can only be done once a conditional offer of employment has been made. And the candidate’s consent should be obtained. before any criminal or education checks are carried out or employer references are sought, the candidate’s consent should be obtained.

PHILIPPINES

- Law: There are no regulatory requirements for pre-hire, subject to compliance with immigration laws for the employment of foreign expatriates.

- Allowed: the labour law leaves it to the management prerogative of employers to provide for pre-hire checks, including but not limited to a National Statistics Office (NSO)-issued birth certificate, a National Bureau of Investigation (NBI) clearance, a transcript of records for education verification and previous employer references.

SINGAPORE

- Law: Immigration checks to ensure that the relevant work pass required is obtained for the prospective candidate.

- Allowed: 1) Offers of employment are often made subject to; a) the prospective candidate having obtained the relevant work pass; and b) the company satisfying the advertising requirements under the Tripartite Fair Consideration Framework and independently determining that the candidate is the best candidate out of all the applicants; 2) Where necessary, the obtaining of satisfactory references and When appropriate, background and criminal record checks; 3) Employers may also require the prospective candidate to undergo a medical examination and produce evidence of qualifications. 4) Pre-hiring checks must comply with Singapore’s Personal Data Protection Act 2012 (No. 26 of 2012) (PDPA). Generally, employers are required to notify applicants of the purposes for which their personal data is being used in connection with the management and termination of employment and obtain their consent where collecting, using or disclosing their personal data. However, relevant exceptions to the PDPA notification and consent requirements include where the information is publicly available and where the data collected is for evaluative purposes (e.g., to evaluate employee suitability for the role) or for investigative purposes. In particular, there is no requirement under the law to ask for personal identification (NRIC) numbers for job applications. However, the employer would be required to know if an employee is holding an NRIC to determine if a work pass is required.

SOUTH KOREA

- Law: Immigration checks are generally required.

- Allowed: Under the Personal Information Protection Act (PIPA), to conduct background checks beyond the scope generally required to enter into an employment agreement, consent must be obtained from the applicant. Separate consent must be obtained if sensitive information such as an employee’s health information or criminal records is checked.

MYANMAR

- Law: None.

- Allowed: Employers may request their employees to provide information relating to the execution of an employment contract, such as full name, age, gender, residence address, educational level, occupational skills, and health conditions. Employers may also request a recommendation letter from a local administration office or a previous employer and may request a criminal background check from the relevant township police station when an employee submits an employment application.

Pre-employment Screening in The Americas

Although verification is a recommended procedure across the majority of The America’s, the vast majority of the countries do not require it by law and leading countries such as Turkey and the USA do not have any written legislations in place for these procedures. See the breakdown below.

TURKEY

- Law: None.

- Allowed: 1) Pre-hire checks (e.g., criminal and credit reference or reference and education checks) are only permissible with the applicant’s consent. 2) Depending on the position of the employee, pre-hire checks are standard.

VENEZUELA

- Law: None. However, foreign employees must have a labour (TR-L) visa to work in Venezuela. Therefore, an immigration check is recommended.

- Allowed: Employers are entitled to use any information about an applicant that is in the public domain, including information available on social media, for verification purposes. Employers may also conduct background checks covering a candidate’s education, family and other information at any stage of the hiring process. This includes asking candidates directly for references or contacting previous employers to check references. Information collected must be relevant to the position being applied for. Employers should avoid the collection of information that may be considered offensive or discriminatory. Protected characteristics from discrimination include sex, race, religion, marital status, pregnancy, political beliefs, sexual preferences, social class, union affiliation, physical disability or criminal background. Specifically, requiring criminal records or a criminal background certificate from candidates and requiring female applicants to undergo medical tests to determine pregnancy are prohibited. HIV testing is permissible when the position applied for involves matters of public health.

USA

- Law: None, except in certain regulated industries, which may require fingerprinting, background checks, motor vehicle histories, and/or drug/alcohol screening.

- Allowed: Laws vary from state to state. Reference and education checks are common. Criminal background and credit checks generally may be performed in accordance with applicable federal, state, and local law, with an increasing number of state and local jurisdictions limiting criminal history questions on applications and permitting such checks only following a conditional job offer. Medical examinations and drug and alcohol screening are generally permissible if conducted post-offer and in accordance with applicable law.

BRAZIL

- Law: Immigration compliance, a valid ID and a pre-hire medical examination are required.

- Allowed: Education, prior employment and basic personal information (proof of identity; and residential address) are accepted in certain circumstances. Criminal checks are limited to particular circumstances.

COLOMBIA

- Law: Immigration compliance.

- Allowed: 1) Pre-employment background checks are permitted, and it is common to use specialised companies for these services. All background screening checks can include educational history and professional qualifications, employment history, civil litigation, consumer credit checks, criminal and fiscal records, OFAC/Global Sanctions Lists, a driver’s license check and passport/ID validation, among others; 3) On the initiation of the recruitment process, the applicant must grant express written consent to conduct background checks; 4) Under Colombian law, there are few restrictions on an employer’s right to request substantiating documents and to confirm the information provided by the applicant (e.g., regarding health conditions, pregnancy, drug use, family situations and political tendency).

CHILE

- Law: None. However, an immigration check recommended ensuring the employee has the right to work legally in Chile.

- Allowed: In general, employers are permitted to check education and prior employment records. Employers can check financial history, health, drug/alcohol usage, and criminal records in very limited circumstances when such information is directly relevant to the position for which the candidate is considered. No background checks can be based on any status protected by the Chilean anti-discrimination statute, including checks based on union membership or political affiliation.

CANADA

- Law: 1) All employers should verify that individual employees are legally entitled to work in Canada by obtaining the employee’s Social Insurance Number (SIN), but only after a conditional offer of employment is made. Certain employers may also require criminal records checks through a Canadian Police Information Check (CPIC). In some industries, a more comprehensive check may be required by law (e.g., for persons who work with vulnerable individuals such as children); 2) Criminal records checks should not be done without the prospective employee’s consent and, in any event, it is recommended that a conditional offer of employment be made before a criminal record check is performed; 3) Where the employer requires a criminal record check, the prospective employee may have grounds to claim discrimination if a decision not to hire is based on:

- A conviction of a provincial offence revealed by check.

- A criminal offence for which a pardon has been granted or

- A criminal conviction is unrelated to the individual’s employment.

- Allowed: Verifying references, past employment, and education is common and permissible, provided that:

- The applicant has consented and;

- The employer conducts the verification in a consistent and non-discriminatory manner.

- Caution must be exercised in undertaking more detailed background checks to ensure that the scope of the detailed background check is not excessive and that proper consent has been obtained in accordance with applicable privacy laws.

- Credit checks are generally permissible when the candidate’s credit history is relevant to the position (e.g., positions involving handling money or involving financial decision making). Credit checks must be conducted in accordance with applicable consumer protection legislation, which requires that:

- Consent is obtained from the individual and

- A proper process is followed when the credit check is undertaken.

- It is recommended that a conditional offer of employment is made before a credit check is performed.

ARGENTINA

- Law: 1) Pre-hire medical checks are required pursuant to resolutions issued by the Occupational Risk Superintendence. If an employee does not complete a pre-hire medical check, the employee will be deemed to have begun work in optimal health; therefore, any injuries or diseases that may arise in the future will be deemed to have happened during the employment relationship; 2) Criminal record checks are required for foreign employees to obtain a work visa.

- Allowed: Where criminal checks are not required for work visa purposes, they are only permissible – and are common in practice – for specific roles (e.g., high-level managerial positions). Reference and educational checks are common and permissible, provided applicant consent was previously obtained.

MEXICO

- Law: Immigration compliance.

- Allowed: 1) Under Mexican law, there are few restrictions on an employer’s right to request substantiating documents and confirm the information provided by the applicant regarding their education, health condition, finances, drug use, family situation and criminal background. Employers have broad flexibility regarding the questions that may be asked during the application process; 2) Criminal background checks are permissible; however, only the employees in question themselves can request such information from the corresponding authority. Credit checks are not common in Mexico as there is no specific procedure established by law for employers to obtain credit information. Pre-employment Screening measures such as reference and education checks are common and permissible with applicant consent.

CZECH REPUBLIC

- Law: Immigration compliance. Entry health check. Where required by law, criminal record check or pregnancy information (e.g., where a pregnant employee cannot perform certain work).

- Allowed: 1) Reference and education checks are common and permissible. Criminal records and credit reference checks may be requested if justified by the specific nature of the work performed and subject to the proportionality principle; 2) Subject to the same conditions, the employer may also request information concerning pregnancy, financial and family affairs of the applicant.

HONG KONG, SAR

- Law: Immigration compliance.

- Allowed: Any data collected as a result of pre-employment screening must comply with the Personal Data (Privacy) Ordinance (PDPO), candidates must be expressly informed of collecting, using, and disclosing any personal data related to them by their employer or prospective employer. Asking a candidate to sign a Personal Information Collection Statement will assist an employer in complying with these obligations. A candidate may be asked to undergo a medical examination, but only after the employer has made them a conditional offer of employment. If criminal checks are carried out, an employer must be careful not to dismiss, exclude or display prejudice against the candidate based on any spent conviction – that is, where a person was previously convicted of an offence for which they were not sentenced to imprisonment for more than three months or given a fine of more than HKD10,000. The person has not been convicted of any other offence for at least three years.

INDONESIA

- Law: legislation is silent thus, there are no requirements or prohibitions on background checks.

- Allowed: All ethical pre-employment screening measures and background checks.

PERU

- Law: There are no mandatory pre-employment checks however specific companies that perform high-risk activities (e.g., in the mining industry) must perform occupational medical exams on their candidates.

- Allowed: Immigration checks are highly recommended for foreign employees. Employers are permitted to check candidates’ education and prior employment history. Employers may also conduct (i) financial checks for jobs that involve handling money; (ii) drug or alcohol usage checks, but only if the individual has a job where the use of drugs could threaten the safety of others; and (iii) a criminal record affidavit for candidates and criminal records checks after the first interview.

Pre-employment Screening in Africa

This continent allows for criminal records, references and educational background checks to be completed across all countries. The requirement by law focuses heavily on immigration compliance. See the breakdown below.

ANGOLA

- Law: Immigration compliance and pre-hire medical examinations.

- Allowed: Pre-employment screening checks such as reference and education checks are permissible.

MOZAMBIQUE

- Law: Immigration compliance for foreign employees. Foreign employees must have a valid work permit and a residence permit to work in Mozambique. In general, pre-hire checks are not mandatory, but in some areas of activity (e.g., mining, oil and gas), prior medical examinations are required.

- Allowed: Reference and education checks are permissible, and candidates may be requested to provide a certificate of criminal records.

NIGERIA

- Law: 1) Immigration compliance; 2) Medical examination for manual and clerical workers.

- Allowed: Background checks for education, prior employment and basic personal information such as proof of identity and residential address are accepted in Nigeria. In practice, the prospective employee’s consent is sought before such pre-employment screening checks are carried out.

UGANDA

- Law: Immigration compliance for all non-nationals.

- Allowed: Permissible Criminal and credit reference checks are permissible. Reference and education checks and medical examinations are common and permissible.

KENYA

- Law: 1) Education qualification checks and referee follow-up for hires; 2) Criminal record clearance checks; 3) A locally registered entity to support the application. For an entity that already employs foreign expats, whether the ratio of 1:3-7 in favour of Kenyans is loosely observed.

- Allowed: The Department of Immigration Services, in conjunction with both the local and international security agencies, can conduct background checks on all applicants.

Pre-employment Screening in Europe

Candidates’ consent is also a vital factor on what is allowed in European countries – a large selection of the countries only allow these checks to be carried out in regards to specific job roles and data handling. Emphasis is largely placed on Identity verification and criminal checks across Europe. See the full breakdown below.

ITALY

- Law: Immigration compliance.

- Allowed: Criminal and credit reference checks are only permissible for specific roles (e.g., certain finance positions) and subject to proportionality requirements. Reference and education checks are common and permissible with applicant consent.

SOUTH AFRICA

- Law: Immigration compliance.

- Allowed: It is permissible to carry out background checks. A criminal record check may only be carried out if the candidate provides a copy of their fingerprints. Furthermore, in terms of the Protection of Personal Information Act, 2013 (POPIA), which came into effect on July 1, 2020, consent is required to conduct a criminal record check. The National Credit Act, 2005 prohibits the release of credit reports “unless directed by the instructions of the consumer.” Furthermore, the purposes for which credit reports may be used are limited. They should only be used for considering a candidate for employment in a position that requires trust and honesty and entails the handling of cash or finances. It also provides that the consumer’s consent should be obtained before requesting the credit report for this purpose. A medical check requires the consent of the individual. While consent is not required to conduct other checks such as a check on qualifications, references and employment history, it is advisable to obtain consent. Furthermore, in terms of POPIA, the applicant should be notified about the background checks that will be carried out.

AUSTRIA

- Law: Immigration compliance.

- Allowed: Criminal and credit reference checks are only permissible for specific roles (e.g., certain finance positions) and subject to proportionality requirements. Reference and education checks are common and permissible with applicant consent.

IRELAND

- Law: Immigration compliance. Criminal record checks only for those who work with children, with vulnerable adults and in security.

- Allowed: Reference and education checks are common and permissible with applicant consent.

HUNGARY

- Law: Immigration compliance is required. Criminal records are also checked concerning certain occupations, such as judges, attorneys, public servants and auditors.

- Allowed: 1) Apart from the above, a check of criminal records is only allowed if it provides important information with respect to the given position or work to be carried out; 2) Further checks (e.g., education and references) are also permitted, but may only be carried out if aiming to obtain important information to enter into the employment.

DENMARK

- Law: Employers are responsible for ensuring that all employees have a valid residence and work permit when employing third-country citizens. For any occupations involving work with children under the age of 15, an employer must ask for a record that specifies whether the employee is fit to work with children. The employee must give consent before collecting the record.

- Allowed: An employer may ask a potential employee to produce a copy of their criminal record if necessary and proportionate to the job. Information on a potential employee’s health may be requested only if this is of significant importance to performing the job in question. Concerning educational background and activities, data from the application may, as a rule, be verified by the employer. It is common in Denmark to issue job references. Applicants may be asked to provide contact data of former employers. Credit checks are allowed for employees in special fiduciary positions and if there is a legitimate purpose for the check.

FINLAND

- Law: Under the Employer Sanction Directive and the Finnish Employment Contract Act, employers must ensure that non-European Economic Area nationals comply with residency and immigration requirements, or the employer may face fines for non-compliance. Criminal records must be checked when working with children.

- Allowed: For tasks other than working with children, credit history and criminal records may be checked only in situations where the law requires and follows the procedure stipulated in the law. Medical checks may be used to check employees’ ability to work. Reference and education checks are common and carried out with the applicant’s consent.

FRANCE

- Law: If the individual to be employed is a foreigner, the employer must check the validity of their work permit. As of January 2017, with some exceptions, employers must set up a preventive and informative medical assessment to take place within three months of the commencement of employment, unless the employee has been subject to such visit during the previous five years.

- Allowed: Pre-hire checks may be permissible to data privacy laws and if the information is related to the job position. Reference checks are permissible, provided the applicant is informed. A criminal record check is permissible for specific job positions only (e.g., those involving the handling of cash)

GERMANY

- Law: Immigration compliance. For certain employment positions (e.g., public services, education sector, medical sector and security services), statement of good standing (Führungszeugnis) from the Federal Central Register (Bundeszentralregister).

- Allowed: Requiring a credit reference check or a statement of good standing is only permissible for roles justifying interest in such information and is subject to proportionality requirements.

PORTUGAL

- Law: Immigration compliance. For certain roles (e.g., security guards and employees who work with children), a criminal record check certificate. Pre-hire medical examinations.

- Allowed: Reference and education checks are permissible. The employer may not request a candidate for employment to provide information related to their private life (including criminal record checks), health condition or pregnancy, unless such information is strictly necessary and relevant to evaluate the person’s aptitude for the performance of the employment or when the nature of the professional activity justifies such request, and the reasons for the request are provided, in writing, to the candidate. Tests and medical examinations (other than the legally required pre-hire medical examinations), including drug tests, may only be requested if aimed at the protection and safety of the employee or third parties or when the nature of the activity so requires. The employer must inform the employee in writing of the grounds for the request. Requesting that an employee or applicant submit to a pregnancy test or medical examination is strictly forbidden

SWITZERLAND

- Law: Immigration compliance. Criminal and credit reference checks for specific roles (e.g., attorneys at law and bank executives).

- Allowed: Criminal and credit reference checks are only permissible if they are relevant to the proposed work and are subject to proportionality requirements. Reference and education checks are common and permissible with the applicant’s consent.

SWEDEN

- Law: No pre-hire checks required in general.

- Allowed: On immigration compliance. References and education checks are common and permissible with applicant consent. Employers may ask for criminal records, and for specific roles (e.g., childcare positions), it is required. Note, however, that criminal records for pre-hire checks normally may not be processed electronically due to data privacy restrictions.

UKRAINE

- Law: For non-Ukrainian citizens, employers must check for compliance with immigration requirements and obtain work permits (unless the employer or employee falls under a special category, as discussed in the Immigration section below). Employees must provide a valid ID and, except for first-time employment, their labour book. On a case-by-case basis, employers can request employees to provide documents confirming education (speciality, qualification), health status, etc., to confirm compliance with requirements established for a specific profession or position or the work performed. For example: to be employed as an officer responsible for labour protection, an individual shall provide the employer with a certificate that proves the employee’s knowledge in the area of labour protection; or if the job description provides that the employee’s duties will include operation of a vehicle, the employer is entitled to require a driving license.

- Allowed: An employer cannot require candidates or employees to provide additional documents/information not specifically required by law as a condition precedent to the employment. The ability to conduct any pre-hire or post-hire checks is limited by labour and personal data protection laws. In most cases, checks not expressly required by law are possible only with written consent.

SPAIN

- Law: Immigration compliance. For certain roles (e.g., security guards), the employee must provide the potential employer with a certificate proving that they do not have a criminal record. These certificates cannot be stored by the employer nor transferred to any other entity.

- Allowed: Reference and education checks are permissible with the applicant’s consent only. Most companies and institutions prefer to deliver the information directly to the applicant to supply it to the potential new employer directly and personally.

POLAND

- Law: Immigration compliance: requirement to obtain a work permit for foreigners originating from non-EU and non-European Economic Area (EEA) countries. A statutory list of so-called regulated activities to be performed only by persons holding specific licenses or possessing certain types of education and professional experience. Initial medical examinations to confirm that no health reasons are barring the person’s employment in a certain position. However, there are certain exceptions – for example, where a medical certificate was issued during previous employment in the same position.

- Allowed: Certain limited types of personal data may be requested from the candidate as specified by the Polish Labour Code and other applicable provisions. These include name and surname, date of birth, contact details, education, professional qualifications and work history. The employer may also request that a candidate provide personal data not listed in the Polish Labour Code; however, additional data processing requires the candidate’s consent. The employer may collect and process sensitive data such as data revealing racial or ethnic origin, political views, religious or ideological beliefs, trade union membership, genetic data, biometric data to uniquely identify a person and data on health, sexuality or sexual orientation only if a candidate provides this at their own initiative. Information on criminal convictions may be requested only if separate statutory provisions require the obligation to provide this information.

SLOVAK REPUBLIC