Stop Gender Based Violence: Incorporate Risk Assessment Into Your Due Diligence Process

Gender Based Violence: Incorporate Risk Assessment Into Your Due Diligence Process

Gender based violence is constantly on the rise – research by the UN Women, “The economic costs of violence against women” suggests that the cost of violence against women is 2% of global GDP, equivalent to US$1.5 trillion – incorporating gender-based violence into risk and mitigation analyses is a must. The company and country-level economic costs of violence include losses in productivity and increases in health and legal costs according to UN Women, “Ending violence against women”

Gender-based violence is known to increase in emergency situations, and the global COVID-19 pandemic has increased the urgency across the globe. During this global pandemic with long-lasting effects, the rising rates of violence are impacting every country and sector. Incorporating an analysis of gender-based violence can help to mitigate the risks of a future that looks very different than it did even three months ago.

UNICEF has launched the 2022 Covid-19 Diligence Tool Criterion. This tool equips investors to understand the risk their investments are exposed to because of gender-based violence and to incorporate that risk assessment into the due diligence process.

Due diligence is a standard process that all investors undertake when deciding whether and how to invest in a company. This tool is designed to align with standard diligence processes for direct private investments. It also offers recommendations and tools that investors can use to mitigate the risks of violence. The risk assessment is also relevant to public investors at the sector and market levels.

Covid-19 Diligence Tool Criterion highlights the areas of focus in due diligence to determine a company’s exposure to risks created by gender-based violence in the company. This tool provides you with company-level due diligence questions that can help you mitigate any risk:

- Is the company leadership, including the board, aware of potential regulatory changes?

- Have any policies been reviewed or changed in response to the pandemic?

- How has the company responded during the crisis? Have disaster mitigations been measured, effective, and gender-balanced?

This tool is one component of a broader global effort to ensure the right to live free of violence and toward greater gender equality. Download the report now.

The mere process of asking questions about gender-based violence creates an impact and could result in improved practices and business.

Staying one step ahead of any critical risk to your organisation is part of being an effective business leader. Contact us today to get started on implementing a robust program that will serve you well for years to come. Get your FREE QUOTE now!

Let’s Talk!

Don’t leave hiring to chance. Take a proactive stance with the highest level of background screening as a part of your essential corporate strategy. Contact us today to learn more about our full range of services to help your organisation stay protected.

Who is CRI Group™?

Based in London, CRI Group™ works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence and other professional Investigative Research solutions provider. We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group™ also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI Group™ launched Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence – an independent certification body that provides education and certification services for individuals and organisations on a wide range of disciplines and ISO standards, including ISO 31000:2018 Risk Management- Guidelines; ISO 37000:2021 Governance of Organisations; ISO 37002:2021 Whistleblowing Management System; ISO 37301:2021 (formerly ISO 19600) Compliance Management system (CMS); Anti-Money Laundering (AML); and ISO 37001:2016 Anti-Bribery Management Systems ABMS. ABAC™ offers a complete suite of solutions designed to help organisations mitigate the internal and external risks associated with operating in multi-jurisdiction and multi-cultural environments while assisting in developing frameworks for strategic compliance programs. Contact ABAC™ for more on ISO Certification and training.

Meet the CEO

Zafar I. Anjum is Group Chief Executive Officer of CRI Group™, a global supplier of investigative, forensic accounting, business due to diligence and employee background screening services for some of the world’s leading business organizations. Headquartered in London (with a significant presence throughout the region) and licensed by the Dubai International Financial Centre-DIFC, the Qatar Financial Center – QFC, and the Abu Dhabi Global Market-ADGM, CRI Group™ safeguard businesses by establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers and customers seeking to affiliate with your business. CRI® Group maintains offices in UAE, Pakistan, Qatar, Singapore, Malaysia, Brazil, China, the USA, and the United Kingdom.

Contact CRI Group™ to learn more about its 3PRM-Certified™ third-party risk management strategy program and discover an effective and proactive approach to mitigating the risks associated with corruption, bribery, financial crimes and other dangerous risks posed by third-party partnerships.

Zafar Anjum, MSc, MS, CFE, CII, MICA, Int. Dip. (Fin. Crime) | CRI Group™ Chief Executive Officer

37th Floor, 1 Canada Square, Canary Wharf, London, E14 5AA United Kingdom

t: +44 207 8681415 | m: +44 7588 454959 | e: zanjum@crigroup.com

Managing HR through COVID-19 in 4 Simple Steps

Managing HR through COVID-19

Managing HR through COVID-19, here are the four simple steps. COVID-19 continues to affect communities on every continent. This global crisis called for fresh due diligence and risk management review of the company’s third-party partnerships; it has disrupted business and entire industries as we know it; a fraud spike in the wake of the COVID-19 pandemic has consequently led to an increase in identity theft cases; for many HR professionals, employee screening during COVID-19 has become complicated, with its many new ways COVID-19 impacted background checks enhancing why critical background Screening has become. This pandemic has made managing HR more difficult than ever.

While we must take vigorous action to control the spread of the coronavirus and save lives, we must also act to protect our livelihoods. The steps you need to take now relate to four categories: Review, Communicate, Update and Travel. These checklists provide chief human resources officers (CHROs) and other HR professionals with practical ideas for keeping employees safe while maintaining productivity and charting recovery paths. And then, the following will form a good starting point.

The four simple steps in managing HR through COVID-19

1. REVIEW

- Review business continuity plans and how these would be maintained if employees suffer from coronavirus absences.

- Review existing sickness policies and procedures, are they disseminated to staff? Do they need amending?

- Review contracts of employment. It may be relevant to establish whether individuals can be asked to undertake different work or at other locations or at various times from the norm.

- Review your emergency procedures, e.g., if there is an infection and the workplace is closed temporarily. If appropriate, carry out a test run of emergency communication to see how robust the process is.

- Ensure contact details for all staff are up to date.

- Undertake risk analysis of high-risk groups of employees and what steps can be taken to try and reduce risks for those groups. These groups may include: 1) those who frequently travel to countries where there is currently or may well be a risk of infection. 2) those with health issues, such as asthma, diabetes, cancer, or those who are pregnant, are more likely to suffer adversely if they become infected with the virus.

- Review procedures in the office for preventing the spread of the virus, e.g., increased cleaning, availability of hand sanitisers and tissues etc.

- Review planning for the possibility of large-scale absenteeism. For example:

- Identify the essential positions within the business, what needs to carry on during an emergency, and what is the minimum number of employees required?

- Identifying employees with transferable skills so that these essential positions can always be temporarily filled.

- Considering flexible work patterns, such as employees working from home.

- Identify employees who have the necessary IT infrastructure to work from home (e.g., remote access to the office computer systems).

2. COMMUNICATE

- Identify an appropriate person as spokesperson/ communicator of updates on policies etc., with appropriate credibility.

- What, if anything, is said about absence from work for reasons other than ill-health, e.g., where an office is closed?

- Assuming the employer has a health and safety committee, have there been any discussions with that committee about COVID-19 and its potential impact? If there is no such committee, the employer may want to consider setting one up.

- Communicate as a matter of urgency with the high-risk groups identified in any risk review to ensure they are aware of their high-risk status and the measures taken to assist.

- Ensure managers are aware of the relevant workplace policies.

- Consider issuing guidance to employees on recognising when a person is infected with the coronavirus. What are the symptoms, and what should one do if one is taken ill at home or work? It is also important to emphasise that individuals may not recognise that they have the virus and may not be exhibiting symptoms. Employees should be informed of the reporting procedure within their employer if they have a potential infection and any official reporting process.

- Provide advice to encourage individuals to take responsibility for their health and safety and slow the virus’s spread. For example, advice on handwashing and sanitiser gels, coupled with a willingness to self-identify where individuals may have encountered individuals with the virus, have become infected themselves or have returned from private travel abroad to an area that turns out to be affected by the virus.

- Make clear that where staff are ill, they must not come to work regardless, i.e. “Struggle through”.

3. TRAVEL

- Log employee travel before it is booked and check against the latest travel protocols.

- Ensure staff know that this applies to personal travel and business travel.

- Encourage staff to tell you if close family members with whom they share a house are travelling to infected areas.

- Replace face-to-face meetings (especially those involving travel) with video conferences, telephone conferences, etc.

- Consult/communicate about whether to encourage varied work patterns to avoid travelling on public transport at rush hour.

4. UPDATE

- Initiate a system to keep up-to-date, especially given the spread of infection.

- Consider establishing a committee on the employer’s side to coordinate responses and engage with any staff consultative forum, with particular responsibility for staying up-to-date with public health updates.

- How will employers communicate regular updates on the coronavirus and its spread to employees? As news develops, it is vital for an employer to be issuing fact-based updates to avoid the possibility of fear being used by worried employees to make decisions about whether or not to come to work, whether to travel abroad, etc.

- Who will have the authority to determine changes to policy and issue any new communications to staff?

Employsmart™: Background Checks During COVID-19 and More

As a background screening provider, CRI Group™ can support you by proactively monitoring the data sources and working with them to understand when and how to carry out verification requests. By working with a background screening partner, we can tailor your screening needs to the challenging times we’re facing. EmploySmart™ is CRI Group’s robust pre-employment background screening service that helps companies of any size and industry avoid negligent hiring liabilities. We know you have lots of questions. We compiled a FAQ ebook, read now or download your FREE ebook.

During the COVID-19 pandemic, it’s imperative to ensure a safe work environment for all of your employees. EmploySmart™ can be tailored to meet the requirements of each specific position within your company. As a leading worldwide provider of specialised local and international employment background screening, CRI Group™’s services are second-to-none in providing risk mitigation and peace of mind in the hiring process.

Learn more about how EmploySmart™ can help your company stay protected during these strange and uncertain times. Contact CRI Group™ today.

Want to Know the Most Crucial Factors in the Hiring Process?

Download our “Top 10 things every organisation should know about background checks” infographic. Get answers to frequently asked questions about background checks/screening cost, guidelines, check references etc. This eBook of compiled list of background screening related questions taken is the perfect primer for any HR professional, business leader and company looking to avoid employee background screening risks. It provides the tools and knowledge needed to make the right decisions.

Who is CRI Group™?

Based in London, CRI Group™ works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider.

We have the largest proprietary network of background screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are, we have the network needed to provide you with all you need, wherever you happen to be. CRI Group™ also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI Group™ launched the Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence – an independent certification body that provides education and certification services for individuals and organisations on a wide range of disciplines and ISO standards, including ISO 31000:2018 Risk Management- Guidelines, ISO 37000:2021 Governance of Organisations, ISO 37002:2021 Whistleblowing Management System, ISO 37301:2021 (formerly ISO 19600) Compliance Management system, Anti-Money Laundering (AML) and ISO 37001:2016 Anti-Bribery Management Systems.

Employee Screening During COVID-19: Doesn’t Have to be Complicated

Employee Screening During COVID-19 Made Simple

Employee Screening During COVID-19. Unsurprisingly, the virus has had a massive impact on businesses, and the recruitment industry is certainly not immune to that. Companies adapted quickly to survive, and the legacy of COVID-19 may forever change the nature of recruitment and the workplace landscape. CRI Group’s survey revealed that 77 per cent of HR professionals accept that there is a risk that employees can initiate fraudulent activity because of the work-from-home arrangement. The rise in recruitment fraud is creating several challenges – last year, it cost £23 Billion just in the UK. The COVID-19 is set to cost even more. And what is particularly worrying for any HR professional is that fraud in recruitment regularly sees genuine businesses used to add legitimacy to illegal behaviour.

Background checks and necessary screenings are vital to avoid horror stories and taboo tales that occur within HR, your business or even your brand – simply investing insufficient screening can save you time, money and heartbreak. COVID-19 is adding even more complexity and new challenges to your job:

- Money mule scammers specialise in hacking employer accounts at job recruitment Websites like Monster.com and other popular employment search services. Armed with the employer accounts, the crooks are free to search through millions of resumes and reach out to people who are in fragile situations due to COVID-19.

- According to jobs site Glassdoor, the virus has sparked new demand for professions related to infectious diseases, which has recorded a more than doubling of job postings with keywords related to coronavirus this month, particularly within the government, healthcare, and biotech and pharmaceuticals.

The recruiters that weather the COVID-19 storm will be those that adapt as the situation unfolds. Outsourcing your background screening is smart and effective. CRI™ Employee Background Checks can reduce the risk of hiring someone who could cause irrevocable damage. Firms spend years, thousands, even millions to brand their products and services and one bad hire can cause loss of capital and reputation to the extent that may bring a business to fail. A robust pre-employment check can help you and your company:

|

|

BS 7858:2019 Standard: A new way to mitigate employee risk during COVID-19

BS 7858:2019 Standard is the revised standard for screening individuals working in secure environments. The far-reaching impact of the COVID-19 outbreak has affected virtually every business and economic sector worldwide. Depending on the global region, the far-reaching implications have hampered (on various levels) the ability to conduct proper and thorough background screening investigations.

In the United Kingdom and the United Arab Emirates, the countrywide lockdowns forced leaders to close sites and send their workforce home. Many must learn how to manage people working from home (WFH) or remotely for the first time. The previous concerns about productivity, privacy and protecting sensitive information only grew more with the practice of WFH.

They highlighted the vital importance of pre-employment background screening and background investigations. BS 7858:2019 Standard for screening individuals working in secure environments offers a complete solution.

Unfortunately, conducting such investigations in a reliable and timely manner has brought its struggles. The closure of public information sources has dramatically impacted accessing public records to verify previous employment, education and criminal charges.

Drug screening tests have been delayed or postponed until such companies are permitted to reopen their doors for business. On the applicant side, it’s been widely reported that individuals are concerned (and rightly so) about participating in face-to-face interviews. Applicants are concerned with leaving their homes to do a drug test and returning to a work environment that may or may not appear healthy, protected and safe.

Want to know the most crucial factors in the hiring process?

Download our “Top 10 things every organisation should know about background checks” infographic. Get answers to frequently asked questions about background checks or screening cost, guidelines, check references etc. This eBook of compiled list of background screening related questions taken is the perfect primer for any HR professional, business leader and company looking to avoid employee background screening risks. It provides the tools and knowledge needed to make the right decisions.

Learn more about how EmploySmart™ can help your company stay protected during these strange and uncertain times. Contact CRI Group™ today.

Who is CRI Group™?

Based in London, CRI Group™ works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider.

We have the largest proprietary network of background screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are, we have the network needed to provide you with all you need, wherever you happen to be. CRI Group™ also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI Group™ launched the Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence – an independent certification body that provides education and certification services for individuals and organisations on a wide range of disciplines and ISO standards, including ISO 31000:2018 Risk Management- Guidelines, ISO 37000:2021 Governance of Organisations, ISO 37002:2021 Whistleblowing Management System, ISO 37301:2021 (formerly ISO 19600) Compliance Management system, Anti-Money Laundering (AML) and ISO 37001:2016 Anti-Bribery Management Systems.

How is COVID-19 Radically Transforming the New-Hire Experience

The COVID-19 pandemic has been a challenging time for industries, organizations and their teams on every level. HR leaders had to adapt to a new normal quickly. Along with coping with the closing of workplaces and adjusting to working from home, many organizations had significant recruitment, vetting and onboarding activities. With two-thirds of employers reporting increased productivity for remote workers than in-office workers, businesses also discovered the benefits of a remote and flexible workforce. With the human element of HR almost vanishing overnight, HR leaders had to learn how to leverage the “digital” aspect of their jobs, ramp it up and implement it across their processes to deliver a new-hire experience and an overall good employee experience. And these changes are very likely to stay for the long haul.

This article explores how COVID-19 radically transformed the new-hire experience from recruitment to background screening, onboarding, and retention. We also explore some of the advantages of these changes and how you can leverage the new normal into your employee experience and increase retention.

The New Normal

When COVID-19 struck, companies were faced with the difficult task of hiring quickly and economically, continuing effective onboarding processes, and changing the overall new-hire experience whilst managing the day-to-day risks and ever-changing challenges. COVID posed a lot of challenges when it comes to recruitment, such as:

- Navigating the new realm of virtual recruitment.

- High demand for recruitment in specific sectors (e.g., pharmaceuticals, retail supermarkets, delivery companies, transportation, retail banks, healthcare).

- The need to hire employees with a specific skill set (e.g., digital marketing, IT teams, customer service).

- Accommodating for existing staff working from home.

- Considering the long-term and short-term economic impact of hiring during the uncertainty of the pandemic.

There was also the onboarding process. Before the pandemic, some would say the process of onboarding an employee begins when the candidate is offered the position and continues until the new employee is considered productive – which could be anytime from the end of a probation period, for example, to a full year and the first appraisal. However, according to a recent survey by CareerBuilder, 25% of employers reported that their onboarding process took a day or less. In comparison, 26% spent a week, 21% over a month, and 11% said their onboarding process extends over three months or longer.

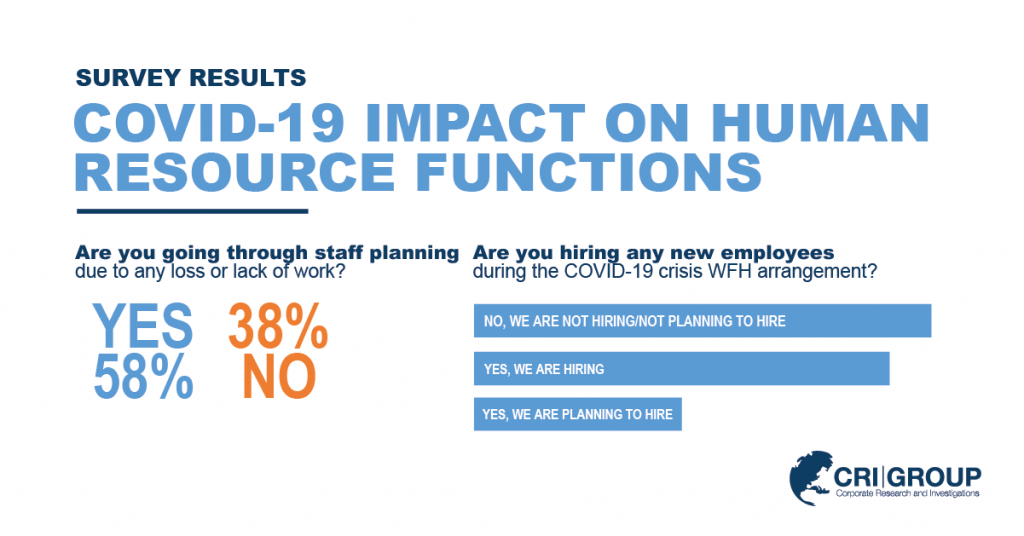

Furthermore, during the pandemic, the number of cases of employee fraud and misconduct grew substantially. In a survey conducted last year by CRI Group, an overwhelming number of respondents said the COVID-19 pandemic is affecting human resources at their company. There are also concerns about fraud, and the protection of confidential information, as much of the workforce has gone virtual in work-from-home (WFH) arrangements. CRI Group’s survey measures the pulse of human resources during a challenging time in business worldwide. The largest number (38%) of survey participants were human resources professionals, but respondents also included managers (19%); executives, directors and administrators (27%); and other roles.

Being digital in a COVID world, where face-to-face interaction is no longer possible, is mostly about optimising the end-to-end employee experience and leveraging data to deliver a somewhat personal employee onboarding experience. Outlined below are ten fundamental tips that support it:

1. Integrate Employee Information from Screening to Onboarding and Deployment

Managing data is a challenge, but it is essential to ensure that the monitoring and engagement of the new hire remain consistent throughout the onboarding lifecycle. Integrate a system that includes Applicant Tracking System (ATS), recruitment, background screening, onboarding, and performance management, and learning/development systems.

2. There are no Shortcuts in Recruitment; Background Screening is More Critical than Ever

Many companies are hiring at an accelerated rate – especially in the medical profession and industries dealing with infectious diseases, medical supply, pharmaceutical companies and research facilities. A need for quick and effective pre-employment screening has arisen, but that is precisely why proper background screening is critical during COVID. Take the revised BS7858:2019 standard: When establishing policies and practices around the standard and vetting new hires against the standard, organisations can show that they place a high value on hiring individuals who possess integrity. Organisations can then task their new hires with responsibilities designed to keep their co-workers, customers and information safe from the negative forces that have become more prevalent in today’s ever-changing COVID-19 world.

3. Reduce Insider Fraud or Misconduct Risk and Increase Employee Integration Success Rate from the Get-Go

Unfortunately, during the COVID-19 crisis, employee fraud has increased. According to a 2020 report from the Association of Certified Fraud Examiners, 5% of all revenue generated by organisations – some three and a half trillion pounds globally – is lost every year through fraud committed by employees. Effective background screening for candidates and employees is an essential and effective countermeasure.

4. Leverage HR Technology, Social Media and Remote Working to Elevate the Employee Experience

Remote working is very much a given in this era, so you must leverage technology to not only facilitate your new hire now but their job as a future permanent employee. It will also reduce the need for face-to-face support while at the same time encouraging pro-activity and self-service. In today’s reality, employee experience is not just about boosting employee engagement but more about employee support effectiveness as a whole – while reducing dependencies on HR at the same time.

5. Engage New-Hire from the Get-Go

Employee onboarding starts not just when the employee joins the organization. Your very first email is the first experience the candidate has with your organization. In the fast world of recruitment, too many sure candidates drop your process or reject your offers for a better one. It is essential to keep the candidate engaged while at the same time initiating a slow process of integrating her/him into the organization asap — by doing so, you will improve the offer-to-join ratio.

6. Accelerate the Time-to-Competency for New Hires by Reducing the Learning Curve

It is important to establish expectations, set clear goals for the new hire, and monitor them consistently. Investing in employees’ professional development has always been an attractive “benefit” of any luring organization. With COVID and the inability to learn on the job, this is more important. Why? Employees at all levels worldwide have been flung into a different and new way of working, which requires a very different skill set. According to Gallup, organizations that invest in employee development report 11% greater profitability. Every individual has his/ her learning style and ways of retaining information, so leverage all the digital tools available such as on-demand videos, live chats, virtual assistants, and other forms of interactive self-paced learning options.

7. Up-skilling Your People by Providing Learning and Knowledge Retention Tools on Demand

Learning is key to making an employee productive. Training new and current employees to cope with the ongoing changes from the COVID-19 pandemic will help them remain productive. Employee retention like this is invaluable, especially as recruitment has become that bit trickier in a remote world. Do not lose top talent, knowledge and experience, for lacking that extra level of support.

8. Mental Health is Critical; It is Time to Acknowledge and Practice it

The turbulence of today’s dual health and economic crises is unprecedented and is affecting employees. PwC’s 2020 Global Consumer Insights survey shows a shift in the consumer’s priority, with 69% saying they are caring more about their mental health and physical fitness, and 63% saying they want to eat healthier as a direct result of the COVID-19 pandemic. A study from Tilburg University in the Netherlands (commissioned by the IOSH – Institution of Occupational Safety and Health) estimated around 12.8 billion working days are lost due to anxiety and depression. The study concluded that organizations could help prevent mental health problems from becoming more severe and achieve a more sustainable workplace by paying attention to each individual’s situation and conditions. Employers must emphasize meeting individual needs and finding a more tailored approach where the new reality can safely “cohabit” with a desired new future. Leveraging social media to provide a robust peer support system is equally helpful – these will aid the onboarding process.

9. The Employee Continuously Due Diligence

Conduct a periodic review of existing employees. Investing in due diligence is vital to mitigate the risks and identify fraud. Periodically screening and vetting existing employees can protect and enhance the overall security of your organization.

10. Cut Costs Drastically

Leveraging these new changes and integrating them into your onboarding cycle can help reduce expenses drastically across your business. It eliminates the cost that comes when placing the wrong candidate.

EmploySmart – Take the First Step Towards Transforming Your Employee Background Screening!

Businesses have to adapt quickly to survive, which can mean cutting steps in their hiring process, and no one knows how this will play out. Using a vendor to conduct your background screening effectively will invaluably make your onboarding process more scalable. It will allow you to focus on delivering consistently superior services to new hires across the board and, more importantly, focus on the fun stuff like supporting the new hire on their continued improvement.

We understand how important it is to monitor all stages from recruitment to onboarding and from onboarding to learning and development; that’s why our employee screening reports are easy to “transcribe” to whatever HR ecosystem you use. Our reports will essentially complement the effectiveness of any employee onboarding process and, therefore, your HR department.

Mitigate the employee risk impact! Learn how with this FREE eBook. Taken as a whole, this eBook is the perfect primer for any HR professional, business leader and company looking to avoid employee background screening risks. It provides the tools and knowledge needed to stay ahead of COVID-19 effectively. DOWNLOAD now!

EmploySmart | Most Robust Employee Background Check Service

How do you know the candidate you just offered a role to is the ideal candidate? Are you 100% sure you know that everything they’re telling you is the truth? 90%? They showed you a diploma, how do you know it’s not photoshopped? Did you follow the correct laws during your background checks process? Employee background checks and necessary screenings are vital to avoid horror stories and taboo tales that occur within HR, your business, or even your brand – simply investing in a sufficient screening can save you time, money and heartbreak.

CRI® Group has developed EmploySmart™, a robust new pre-employment background screening service, certified for BS7858, to avoid negligent hiring liabilities. Ensure a safe work environment for all – EmploySmart™ can be tailored into specific screening packages to meet the requirements of each specific position within your company. We are a leading worldwide provider, specialized in local and international employee background checks, including pre-employment and post-employment background checks.

EmploySmart | Most Robust Employee Background Check Service

How do you know the candidate you just offered a role to is the ideal candidate? Are you 100% sure you know that everything they’re telling you is the truth? 90%? They showed you a diploma, how do you know it’s not photoshopped? Did you follow the correct laws during your background checks process? Employee background checks and necessary screenings are vital to avoid horror stories and taboo tales that occur within HR, your business, or even your brand – simply investing in a sufficient screening can save you time, money and heartbreak.

CRI® Group has developed EmploySmart™, a robust new pre-employment background screening service, certified for BS7858, to avoid negligent hiring liabilities. Ensure a safe work environment for all – EmploySmart™ can be tailored into specific screening packages to meet the requirements of each specific position within your company. We are a leading worldwide provider, specialized in local and international employee background checks, including pre-employment and post-employment background checks.

BS 7858:2019 | The New Way to Mitigate Employee Risk During COVID-19

BS 7858:2019 Standard: A New Way to Mitigate Employee Risk During COVID-19

BS 7858:2019 Standard is the revised standard for screening individuals working in secure environments. The far-reaching impact of the COVID-19 outbreak has affected virtually every business and economic sector worldwide. Depending on the global region, the far-reaching implications have hampered (on various levels) the ability to conduct proper and thorough background screening investigations.

In the United Kingdom and the United Arab Emirates, the countrywide lockdowns forced leaders to close sites and send their workforce home. Many have to learn how to manged people working from home (WFH) or remotely for the first time. The previous concerns about productivity, privacy and protecting sensitive information only grew more with the practice of WFH.

They highlighted the vital importance of pre-employment background screening and background investigations. BS 7858:2019 Standard for screening individuals working in secure environments offers a complete solution.

Unfortunately, conducting such investigations in a reliable and timely manner has brought its struggles. The closure of public information sources has dramatically impacted accessing public records to verify previous employment, education and criminal charges.

Drug screening tests have been delayed or postponed until such companies are permitted to reopen their doors for business. On the applicant side, it’s been widely reported that individuals are concerned (and rightly so) about participating in face-to-face interviews. Applicants are concerned with leaving their homes to do a drug test and, ultimately, returning to a work environment that may or may not appear healthy, protected and safe.

Recruitment Fraud and How BS 7858:2019 Standard Provide the Solutions

Investigators themselves have hesitations about venturing into the field to complete their assignments, which may require a high degree of boots-on-the-ground research and in-person interaction in many countries. Fortunately, the background screening industry is resilient.

It is steadily working around these obstacles to ensure that workplaces are safeguarded, workers, customers and property are protected, and sensitive information doesn’t fall into rogue hands. This is particularly important in those sectors that rely heavily on vetting personnel working in secure environments responsible for people, property, data and critical systems.

It’s important for the mere fact that a trending increase in recruitment fraud is creating additional challenges for already over-burdened employers. Last year recruitment fraud cost £23 billion in the UK alone.

The BS7858:2019 Standard

The recent update of the BS7858:2019 standard, “Screening of Individuals Working in a Secure Environment – Code of Practice,” emphasizes the risk assessment of secure environment workers. The code focuses on the need for tighter controls over the pre-employment screening – and periodic re-screening – of individuals, who in their positions, could potentially benefit from illicit personal gain, become compromised, or take advantage of other opportunities for creating breaches of confidentiality, trust or safety.

Written by the British Standards Institute, which is recognized as the UK’s national standards body, BS7858:2019 lays out the scope of “obtaining personal background information to enable organizations to make an informed decision, based on risk, on employing an individual in a secure environment.”

Those workers include business owners, directors, partners, silent partners and shareholders holding more than 10% of the business; managers, area managers, department managers, screening managers and staff; installers and service crew; security personnel; and office supervisors and staff with access to customer and system records.

The amended guidelines of the standard put the onus on the organization’s top management to demonstrate that they are focused on the aspects of the business where the most risk lies and the particular personnel roles involved within those risks areas.

This is particularly important because, as the standard states, the “organization retains ultimate responsibility for an outsourced screening process and is required to review the completed screening file.” Risks assessment includes examining certain roles that involve financial tasks, data security, goods management, property risks or any number of “people risks” such as roles with direct access to vulnerable adults and children.

To that end, management ensures that the organization has proper and adequate resources and infrastructure to manage the adequate vetting of high-risk personnel. Management is tasked with the response and that there is a firm commitment at the top level to manage and support the coordination required to execute the screening process.

Finally, management is tasked with ensuring that such responsibilities are appropriately assigned and communicated throughout the organization. The guideline also eliminates its original text in 2012, a requirement to produce character references as part of the screening process. This decision was based on the supposition that such references are now deemed potentially weak and difficult to verify.

Price of a Bad Hire

The price of a bad hire has far-reaching consequences for any business, including productivity loss, decreased employee morale, risks to employee safety, increased exposure to costly negligent hiring claims, and potentially devastating litigation. The premise behind the standard is to safeguard employers from harmful or fraudulent hires. Cases of organizations that forego conducting due diligence on a new hire – especially a hire with high-risk exposure – often end badly for those organizations.

The revised BS7858:2019 standard enables organizations to demonstrate a commitment to safeguarding their businesses, employees, customers and information utilizing widely accepted methods that focus on risk assessment and top-down management involvement in the company’s employment policies and practices. In establishing standards and practices, organizations can show that they place a high value on hiring individuals who possess integrity. Organizations can then task them with responsibilities designed to keep their co-workers, customers and information safe from the negative forces that have become more prevalent in today’s ever-changing COVID-19 world.

Playbook | Everything About BS 7858:2019 Standard

The price of a bad hire has far-reaching consequences for any business, including productivity loss, decreased employee morale, risks to employee safety, increased exposure to costly negligent hiring claims, and potentially devastating litigation. The premise behind the standard is to safeguard employers from bad or fraudulent hires. Cases of organizations that forego conducting due diligence on a new hire – especially a hire with high-risk exposure – often end badly for those organizations.

At CRI® Group, we know how important is your background screening to your company’s success and to give you an idea of what is new, we have produced this playbook detailing the differences between the BS7858:2012 standard and the new BS7858:2019 standard.

Managing People through COVID-19

The COVID-19 pandemic is undeniable, affecting the world. And the situation is changing at an hourly rate as we go into a second global lockdown. Businesses have to adapt quickly to survive, i.e. cutting steps in their hiring process, and no one knows how this will play out. However, there are ways you can mitigate the impact, learn how from this free ebook.

Taken as a whole, this ebook is the perfect primer for any HR professional, business leader and company looking to avoid employee background screening risks. It provides the tools and knowledge needed to stay ahead of COVID-19 effectively. Read the answers to the following questions:

- Does a candidate have to give consent to process a background check/screening?

- How long does it take to conduct a background check?

- When should I conduct pre-employment checks?

- How often should I screen employees?

- How to collect references, and what to ask?

- How much does it cost to conduct background checks?

- What is the difference between employment history verification and employment reference?

FAQ E-Book | All About Background Checks

The price of a bad hire has far-reaching consequences for any business, including productivity loss, Get answers to frequently asked questions about background checks/screening cost, guidelines, check references etc.

Taken as a whole, it is the perfect primer for any HR professional, business leader and company looking to avoid employee background screening risks. It provides the tools and knowledge needed to make the right decisions. This eBook is a compilation of all of the background screening related questions you ever needed answers to:

- Does a candidate have to give consent to process a background check/screening?

- How long does it take to conduct a background check?

- When should I conduct pre-employment checks?

- How often should I screen employees?

- How to collect references, and what to ask?

- How much does it cost to conduct background checks?

- What is the difference between employment history verification and employment reference?

- How do I check on entitlement to work?

- How to conduct identity checks?

- What will a financial regulatory check show?

- Is it possible to identify conflict of interest during checks?

- What is a bankruptcy check?

- What about directorships and shareholding search?

- Can I have access to a criminal watch list?

- Anti-money laundering check?

- Can we conduct FACIS (fraud and abuse control information system) searches?

CRI Group™ | BS7984:2008 Accredited Company

Based in London, CRI Group™ works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are, we have the network needed to provide you with all you need, wherever you happen to be. CRI Group™ also holds BS102000:2013 and BS7858:2019 Certifications is an HRO certified provider and partner with Oracle.

Unemployment Insurance Fraud During COVID-19

The Financial Crimes Enforcement Network (FinCEN), a bureau of the United States Department of the Treasury that collects and analyses information about financial transactions in order to combat domestic and international money laundering, terrorist financing, and other financial crimes launched an Advisory on Unemployment Insurance Fraud During the Coronavirus Disease 2019 (COVID-19) Pandemic.

This advisory is aimed “to alert financial institutions to unemployment insurance (UI) fraud observed during the COVID-19 pandemic. Many illicit actors are engaged in fraudulent schemes that exploit vulnerabilities created by the pandemic. This advisory contains descriptions of COVID19-related UI fraud, associated financial red flag indicators, and information on reporting suspicious activity”.

We published recently that COVID-19 continues to affect businesses in a myriad of ways. Organisations are having to adapt quickly to the fast-changing climate of the pandemic, and unfortunately, we’ve recently noticed some business practices of cutting steps in a few internal processes, such as hiring, or lack of risk management controls. It’s a vulnerable time for organisations – earlier we wrote that a crisis can bring out the worst in some people. Fraudsters who prey on people’s fear and confusion tend to waste no time when a global pandemic strikes. COVID-19 is relatively new, yet fraud schemes are multiplied much like the virus itself as criminals look for vulnerabilities among a fearful population. This pandemic also creates risks for employee fraud – CRI Group’s survey revealed that nearly 77 percent of HR professionals accept that there is a risk that employees can initiate fraudulent activity because of the work-from-home arrangement.

But employee fraud might not be the only risk the organisations face today. Earlier this year, we published that some organisations commit fraud themselves and abuse the Coronavirus Job Retention Scheme by engaging in furlough fraud. They do this by accepting taxpayer money designed to help them pay salaries for furloughed workers, who are essentially “deactivated” due to loss of business and quarantine – yet they pressure them to work (or they accept furlough benefits without the employees’ knowledge).

As we can see, a fraudulent activity might happen in a myriad of ways. Let’s dive in what are the red flag indicators of unemployment insurance (UI) fraud as unemployment claims across the globe have surged due to the COVID-19 pandemic.[/vc_column_text][vc_hoverbox image=”8095″ primary_title=”> The Unseen Enemy: Explore Insurance Fraud in-depth with our eBook!” hover_title=”GET YOUR FREE COPY”]DOWNLOAD NOW[/vc_hoverbox]

What are the Red Flags of Unemployment Insurance Fraud?

In the advisory, FinCEN lists the financial red flag indicators to alert financial institutions to fraud schemes targeting UI programs, and to assist them in detecting, preventing, and reporting suspicious transactions related to such fraud. The illicit activity might include employer-employee fraud-related activities, such as creating a fake company with fictitious employees and providing fabricated details such as wages, or conspiracy between the two parties when an employee receives UI payments while the employer continues to pay reduced and/or officially undisclosed salaries. The fraud scheme might also be happening under the ‘misrepresentation of income fraud’ when the applicant fails to provide the correct income/wage details, or even submits an application with stolen or fake identity information.

A similar case happened when the COVID-19 was in a full swing last year: one for-sale ad was published in the black-market specialising in selling stolen accounts and data – it was for access of the stolen UI claim in California that had been approved and offered benefits worth $17,550. This is just one example of the fraudulent activities – “in California, fraud was so pervasive that officials have suspended processing jobless claims for two weeks to put new controls in place and reduce a bulging backlog”. It also resulted in The U.S. Labor Department making fraud detection a priority and allocating $100 million to combat the issue. To support this fight against illicit activities, FinCEN identifies the following red-flag indicators:

- Account(s) held at the financial institution receive(s):

- UI payments from a state other than the state in which the customer reportedly resides or has previously worked;

- Multiple state UI payments within the same disbursement timeframe;

- UI payments in the name of a person other than the accountholder, or in the names of multiple unemployment payments recipients;

- UI payments and regular work-related earnings, via direct deposit or paper checks;

- Numerous deposits or electronic funds transfers (EFTs) that indicate they are UI payments from one or more states to persons other than the accountholder(s);

- A higher amount of UI payments in the same timeframe than similarly situated customers received.

- The customer withdraws the disbursed UI funds in a lump sum by cashier’s checks, by purchasing a prepaid debit card, or by transferring the funds to out-of-state accounts.

- The customer’s UI payments are quickly diverted via wire transfer to foreign accounts, particularly to accounts in countries with weak anti-money laundering controls.

- The customer receives or sends UI payments to a peer-to-peer (P2P) application or app. The funds are then wired to an overseas account, or withdrawn using a debit card, in a manner that is inconsistent with the spending patterns of similarly situated customers.

- Individuals quickly withdraw disbursed UI funds via online bill payments addressed to an individual(s), as opposed to businesses, as payee(s), with some individual payees receiving multiple online bill paychecks over a short time period.

- The IP address associated with logins for an account conducting suspected UI-fraud activities does not map to the general location of stated address in identity documentation for the customer or where the UI payment originated.

- Individuals direct UI-related EFTs, or deposit UI checks into suspected shell/front company accounts, which may be indicative of money mules transferring these funds in and out of the accounts.

- Multiple accounts receiving UI payments at one or more financial institutions are associated with the same free, web-based email account that may appear in more than one UI application.

- A newly opened account, or an account that has been inactive for more than thirty days, starts to receive numerous UI deposits.

- After a financial institution suspects UI fraud and requests additional identification documentation to verify the identity(ies) of the customer(s), queried individuals provide documents that are incorrect or forged, which may be an indicator of an account takeover or identity theft. After a financial institution suspects UI fraud and conducts due diligence, it determines that the customer does not have a history of living at, or being associated with, the address to which the UI check or UI debit card is sent, or within the geographical area in which the registered debit card is being used.

Insurance fraud is something that no company can afford. It is a serious crime that can result in serious consequences for fraudsters who may find their future job prospects impacted, find it harder to obtain insurance and other vital financial services, obtain a criminal conviction and even face the prospect of imprisonment. CRI Group’s insurance fraud investigations cover the full range of insurance fraud cases, from healthcare fraud to disability and even fake death claims. Our experts are trained to look for the tell-tale signs of fraud: they can view claims, medical and hospital records, conduct interviews, examine statements and documents, as well as perform on-site inspections.[/vc_column_text][/vc_column][/vc_row]

Enhanced Risk Management

At CRI Group™, we suggest you consider looking at your overall risk management process, involving not only potential insurance fraud risks during the COVID-19 pandemic, but a broader range of employee, bribery and corruption, compliance risks your organisation might face.

The “Risk Management & ABMS Playbook” provides tools, checklists, case studies, FAQs and other resources to help you lead your organisation into better preparedness and compliance. Our experts share their own plays to help you reduce risk, thereby preventing and detecting more fraud. The first section addresses risk management directly: proper third-party due diligence and critical background screening take centre stage for this game plan. Section two tackles bribery and corruption, with tried-and-true measures you can implement to stay better protected and in compliance with strict laws and regulations.[/vc_column_text][vc_btn title=”GET YOUR FREE COPY NOW” link=”url:https%3A%2F%2Fcrigroup.com%2Fcase-study%2Frisk-management-abms-playbook%2F|target:_blank”][/vc_column][/vc_row]

Speak up – Report illegal and Unethical Behaviour

If you find yourself in an ethical dilemma or suspect inappropriate or illegal conduct, and you feel uncomfortable reporting through normal channels of communication, or wish to raise the issue anonymously, use our Compliance Hotline. This hotline is available to all everyone in a business relationship with CRI Group and ABAC Group. It is an anonymous reporting mechanism that facilitates reporting of possible illegal, unethical, or improper conduct when the normal channels of communication have proven ineffective, or are impractical under the circumstances.[/vc_column_text][vc_btn title=”REPORT NOW” link=”url:https%3A%2F%2Fcrigroup.com%2Fcompliance-ethics-hotlines%2F|target:_blank”][/vc_column][/vc_row][accordion_father][accordion_son title=”Who is CRI Group?” clr=”#1e73be”]Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

ILO Monitor: COVID-19 and the world of work, 2nd update

ILO (International Labour Organization) has updated “ILO Monitor: COVID-19 and the world of work. Second edition”. Since the first edition, the COVID-19 pandemic has further accelerated in terms of intensity and expanded its global reach. According to ILO, full or partial lockdown measures are now affecting almost 2.7 billion workers, representing around 81% of the world’s workforce. Leaders and businesses across a range of economic sectors are facing difficult decisions, as COVID-19 is changing their business. There are many cases where COVID-19 has prompted innovative leadership in an attempt to avoid catastrophic losses, and a potential end to operations and or even solvency.

COVID-19 crisis is leaving millions of workers vulnerable to income loss and layoffs. According to ILO new edition, employment contraction has already begun on a large scale in many countries. Changes in working hours (which reflect both layoffs and other temporary reductions) reflect the new reality of the current labour market situation. As of 1 April 2020, the ILO’s estimates that global working hours will decline by 6.7% in the second quarter of 2020, which is equivalent to 195 million full-time workers.

The ILO estimates that 1.25 billion workers, representing almost 38% of the global workforce, are employed in sectors such as retail trade, accommodation, food services, and manufacturing. Dues to Covid-19 crisis these are sectors that are now facing a severe decline in output and consequently a dramatic impact on the world’s workforce. The workforce in high risk of displacement will experience greater challenges in regaining their livelihoods during the recovery period.

>Read the full report here!

ILO discusses how policy responses are critical now in order to provide immediate relief to workers and enterprises and protect livelihoods and economically viable businesses. According to the ILO report, the final tally of annual job losses will depend on how much longer will COVID-19 continue to impact the world and whatever measures taken to mitigate its impact. Stay updated, subscribe for more insights like these!

Managing your people through COVID-19

The COVID-19 pandemic is undeniable affecting the world. And the situation is changing at an hourly rate as we go into a second global lockdown. Businesses are having to adapt quickly to survive, i.e. cutting steps in their hiring process, and no-one knows how this will play out. However, there are ways you can mitigate the impact, learn how with this FREE ebook. Taken as a whole, this ebook is the perfect primer for any HR professional, business leader and companies looking to avoid employee background screening risks. It provides the tools and knowledge needed to stay ahead of COVID-19 effectively. Read the answers to the following questions:

- How to turn the tide’ on coronavirus crisis?;

- COVID-19 Action point checklist;

- Background Screening: Essential Checks;

- Six steps for good practice in connection with COVID-19;

- 11 Steps to Reduce Personnel Costs;

- COVID-19 General advice;

- How to remove any danger to your business during COVID-19;

- … and more!

> Download your “Employee Screening during COVID-19: everything you need to know and more!“ FREE ebook here![/vc_column_text][accordion_father][accordion_son title=”Who is ILO?” clr=”#ffffff” bgclr=”#1e73be”]The ILO was founded in 1919, in the wake of a destructive war, to pursue a vision based on the premise that universal, lasting peace can be established only if it is based on social justice. The ILO became the first specialized agency of the UN in 1946.[/accordion_son][accordion_son title=”About CRI Group” clr=”#ffffff” bgclr=”#1e73be”]Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.[/accordion_son][/accordion_father]

Have you read…

[/vc_column_text][vc_basic_grid post_type=”case-study” max_items=”6″ style=”pagination” items_per_page=”3″ item=”234″ grid_id=”vc_gid:1605683277613-8a07ec62-1f1d-4″][/vc_column][/vc_row]

BS7858:2019 – everything you need to know and more!

The recent update of the BS7858 standard, “Screening of Individuals Working in a Secure Environment – Code of Practice,” places emphasis on the risk assessment of secure environment workers. The code focuses on the need for tighter controls over the pre-employment screening – and periodic re-screening – of individuals, who in their positions could potentially benefit from illicit personal gain, become compromised, or take advantage of other opportunities for creating breaches of confidentiality, trust or safety.

What is BS7858?

BS7858 stands for “Screening of Individuals Working in a Secure Environment – Code of Practice,” The BS7858 is a code of practice released by BSI (British Standards Institution), a business standards company which supports companies in achieving excellence within their field, and continuously boosting performance. Introduced in 2013, the standard was updated in September 2019 and is now considered to be the industry standard for all screening in employment, despite its original intention for use in security environments only. This code was meant to provide a critical security standard that guided employers on the screening process for security staff before offering full employment. However, the new update has widened the scope of this code.

This British Standard helps employers to screen personnel before they employ them. It gives best-practice recommendations, sets the standard for the screening of staff in an environment where the safety of people, goods or property is essential. This includes data security, sensitive and service contracts and confidential records. It can also be applied to situations where security screening is in the public’s interest. It sets out all the requirements to conduct a screening process. It covers ancillary staff, acquisitions and transfers, and the security conditions of contractors and subcontractors. It also looks at information relating to the Rehabilitation of Offenders and Data Protection Acts. CRI Group is the first and only investigative research company in the Middle East to receive the certifications BS7858:2019 and BS102000:2013, Code of Practice for the Provision of Investigative Services from internationally recognised training and certification body BSI.

Change of scope

The change of scope is possibly the biggest change of the standard. In the old document, the standard concerned the security sector only. However, the scope has been amended to allow organisations in all environments to adopt the standard when employee screening. And due to the current pandemic, this update is more significant than ever. There is a specific section of the standard that relates to risk management which states: “An integral part of risk management is to provide a structured process for organisations to identify how objectives might be affected. It is used to analyse the risk in terms of consequences and their probabilities before the organisation decides what further action is required”.

BS 7858:2019 lays out the scope of “obtaining personal background information to enable organisations to make an informed decision, based on risk, on employing an individual in a secure environment.” Those workers include business owners, directors, partners, silent partners and shareholders holding more than 10% of the business; managers, area managers, department managers, screening managers and staff; installers and service crew; security personnel; and office supervisors and staff with access to customer and system records.

The amended guidelines of the standard put the onus on the organisation’s top management to demonstrate that they are focused on the aspects of the business where the most risk lies, and the particular personnel roles that are involved within those risks areas. This is particularly important because, as the standard states, the “organisation retains ultimate responsibility for an outsourced screening process and is required to review the completed screening file.” Risks assessment includes examining specific roles that involve financial tasks, data security, management of goods, property risks or any number of “people risks” such as roles with direct access to vulnerable adults and children.

To that end, management is charged with ensuring that the organisation has proper and adequate resources and infrastructure in place to manage the adequate vetting of high-risk personnel. Management is tasked with the response and that there is a firm commitment at the top level to manage and support the coordination required to execute the screening process. Finally, management is tasked with ensuring that such responsibilities are correctly assigned and communicated throughout the organisation. The guideline also eliminates from its original text in 2012, a requirement to produce character references as part of the screening process. This decision was based on the supposition that such references are now deemed as potentially weak and difficult to verify. Managing risk effectively is essential to ensure businesses succeed and thrive in an environment of constant uncertainty. ISO 31000 aims to simplify risk management into a set of clearly understandable and actionable guidelines, that should be straightforward to implement, regardless of the size, nature, or location of a business.

BS7858:2019, a new way to mitigate employee risk during COVID-19

The far-reaching impact of the COVID-19 outbreak has affected virtually every business and economic sector worldwide, and depending on the global region, has hampered (on various levels) the ability to conduct proper and thorough background screening investigations. In the United Kingdom and the United Arab Emirates, the countrywide lockdowns forced leaders to close sites and send their workforce home. Many are having to learn how to manged people working from home (WFH) or remotely for the first time. The previous concerns about productivity, privacy and protecting sensitive information only grew more with the practice of WFH. They highlighted the vital importance of pre-employment background screening and background investigations. BS 7858:2019: the revised Standard for screening individuals working in secure environments offers a complete solution.

The revised BS7858 standard enables organisations to demonstrate a commitment to safeguarding their businesses, employees, customers and information utilising widely accepted methods that focus on risk assessment and top-down management involvement in the company’s employment policies and practices. In establishing policies and procedures around the standard, organisations can show that they place a high value on hiring individuals who possess integrity. Organisations can then task them with responsibilities designed to keep their co-workers, customers and information safe from the opposing forces that have become more prevalent in today’s ever-changing COVID-19 world. Find out more on how you can mitigate employee risk during this pandemic with BS7858:2019.

Playbook BS7858:2019, everything you need to know and more!

| The price of a bad hire has far-reaching consequences for any business, including productivity loss, decreased employee morale, risks to employee safety and increased exposure to costly negligent hiring claims and potentially devastating litigation. The premise behind the standard is to safeguard employers from harmful or fraudulent hires.

Cases of organisations that forego conducting due diligence on a new hire – especially a hire with high-risk exposure – often end badly for those organisations. At CRI Group we know how important is your background screening to your company’s success and to give you an idea of what is new we have produced this playbook detailing the differences between BS7858:2012 standard and the new BS7858:2019 standard. |

|

Managing your people through COVID-19

The COVID-19 pandemic is undeniable affecting the world. And the situation is changing at an hourly rate as we go into a second global lockdown. Businesses are having to adapt quickly to survive, i.e. cutting steps in their hiring process, and no-one knows how this will play out. However, there are ways you can mitigate the impact, learn how with this FREE ebook.

Taken as a whole, this ebook is the perfect primer for any HR professional, business leader and companies looking to avoid employee background screening risks. It provides the tools and knowledge needed to stay ahead of COVID-19 effectively. Read the answers to the following questions:

|

|

Frequently asked questions about background checks

Get answers to frequently asked questions about background checks / screening cost, guidelines, check references etc.

This eBook is a compilation of all of the background screening related questions you ever needed answers to:

|

Taken as a whole, is the perfect primer for any HR professional, business leader and companies looking to avoid employee background screening risks. It provides the tools and knowledge needed to make the right decisions. |

Let’s Talk!

BS7984:2008 accredited companies (such CRI Group) highlight to their clients that their security personnel are staff that can be trusted and relied upon to complete a high-quality job as the screening process highlights the level of conduct that they have presented in the past. This reassures the safety of the people, goods and property that they have been hired to protect. If you have any further questions or interest in implementing compliance solutions, please contact us.

About the Author

Zafar I. Anjum, is Group Chief Executive Officer of Corporate Research and Investigations Limited “CRI Group” (www.crigroup.com), a global supplier of investigative, forensic accounting, integrity due diligence and employee background screening services for some of the world’s leading business organizations. Headquartered in London (with a significant presence throughout the region) and licensed by the Dubai International Financial Centre-DIFC, the Qatar Financial Center-QFC, and the Abu Dhabi Global Market-ADGM, CRI Group safeguards businesses by establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers and customers seeking to affiliate with your business. CRI Group maintains offices in UAE, Pakistan, Qatar, Singapore, Malaysia, Brazil, China, USA, and the United Kingdom.

Zafar Anjum, MSc, MS, LLM, CFE, CII, MABI, MICA, Int. Dip. (Fin. Crime), Int. Dip. (GRC)

CRI Group Chief Executive Officer

37th Floor, 1 Canada Square, Canary Wharf, London, E14 5AA, United Kingdom

t: +44 207 8681415 | m: +44 7588 454959 | e: zanjum@crigroup.com

Who is CRI Group?

Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening, Business Intelligence, Due Diligence, Compliance Solutions and other professional Investigative Research solutions provider. We have the largest proprietary network of background-screening analysts and investigators across the Middle East and Asia. Our global presence ensures that no matter how international your operations are we have the network needed to provide you with all you need, wherever you happen to be. CRI Group also holds BS 102000:2013 and BS 7858:2012 Certifications, is an HRO certified provider and partner with Oracle.

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

Fraud in a wake of COVID-19 pandemic

COVID-19 continues to affect businesses in a myriad of ways. Organisations are having to adapt quickly to the fast-changing climate of the pandemic, and unfortunately, we’ve recently noticed some business practices of cutting steps in a few internal processes, such as hiring, or lack of risk management controls. It’s the vulnerable time for organisations – earlier we wrote that a crisis can bring out the worst in some people. Fraudsters who prey on people’s fear and confusion tend to waste no time when a global disaster strikes. COVID-19 is relatively new and still spreading, yet fraud schemes are multiplying much like the virus itself as criminals look for vulnerabilities among a fearful population. This pandemic also creates risks for employee fraud – CRI® Group’s survey revealed that nearly 77 per cent of HR professionals accept that there is a risk that employees can initiate fraudulent activity because of the work-from-home arrangement.

But employee fraud is not the only risk the business world faces today. Earlier this year, we published that some organisations commit fraud themselves and abuse the Coronavirus Job Retention Scheme by engaging in furlough fraud. They do this by accepting taxpayer money designed to help them pay salaries for furloughed workers, who are essentially “deactivated” to due to loss of business and quarantine – yet they pressure them to work (or they accept furlough benefits without the employees’ knowledge).

Supporting the fight against fraud

But there’s some good news. Proactive organisations are taking steps to fight fraud and highlight the consequences of committing fraud during these times. The International Fraud Awareness Week this November provides a spotlight on fraud and encourages businesses to introduce and/or improve internal and external anti-fraud activities to help promote transparency and honesty among their employees and company’s business relations. More and more companies every year join Fraud Week as official supporters and implement fraud-preventing initiatives. Learn more about what can you do too.

A few months ago, Fraud Advisory Panel has set up a COVID-19 fraud watch group – a cross-sector and a cross-industry coalition of trusted partners (including the Cabinet Office and the City of London Police) who meet weekly to share information on emerging fraud threats and trends affecting business. The panel aims to act as a conduit to warn the public, private and third sectors about COVID-19 fraud risks.

ACFE, a leading Association of Certified Fraud Examiners, is also actively contributing to anti-fraud society during these unprecedented times: “To illuminate the global pandemic’s impact on the fight against fraud, the ACFE is undertaking a series of benchmarking surveys exploring how fraud risks and anti-fraud programs are changing in the current environment. The September 2020 edition of the Fraud in the Wake of COVID-19: Benchmarking Report summarizes the results of the second of these surveys, which was conducted from late-July to mid-August 2020″.

Recently, the second edition of this study was launched, which indicates that the level of fraud has increased since May 2020 and is expected to continue rising. The following points were uncovered by ACFE:

-

77% of survey participants have seen an increase in the overall level of fraud as of August, compared to 68% who had observed an increase in May.

-

92% expect the overall level of fraud to continue increasing over the next 12 months (48% expect this increase to be significant).

-

The top fraud risks, based on both current observations and expected increases, are 1) cyberfraud, 2) unemployment fraud, 3) payment fraud, and 4) fraud by vendors and sellers.

-

38% expect an increase in their overall anti-fraud budgets over the next year, while 14% expect a decrease.

-

A notable majority (68%–76%) say that preventing, detecting and investigating fraud are more difficult now than before COVID-19.

-

An inability to travel is still the most significant challenge in combating fraud right now., but more people are citing conducting remote interviews as a current top challenge for them, moving this up to the No. 2 spot.

These findings indicate that the fraud risk is rising during these times and it’s the best time for organisations to embrace the risk and strengthen their risk management processes and procedures. If you don’t know how, contact us – our experts are skilled at fraud risk management solutions and investigations. CRI® Group’s global team of Certified Fraud Examiners (CFEs) are highly trained in uncovering fraud. From cases including money laundering, embezzlement, cash theft, asset misappropriation, bribery and corruption, contract and procurement fraud, our investigators have seen it all – and they have helped organisations around the world get to the bottom of suspected cases of fraud. Get in touch and let us know how we can help!

GET A FREE QUOTE FOR FRAUD RISK MANAGEMENT SOLUTIONS

Speak up – report any illegal, unethical, or improper behaviour!