Webinar Video | Protecting Your Company from the Global Corruption Pandemic

Organizations now, more than ever, become vulnerable and have to take actions now to protect themselves, reputation, employees and other stakeholders from bribery and corruption associated risks; particularly against the Global Corruption Pandemic.

The recently celebrated International Anti-Corruption Day drew attention to these sometimes hidden risks worldwide, and many organization joined for this day to raise awareness of how to stop corruption inside and outside their organizations. That’s great news. But we at CRI® Group and ABAC® believe that “saying NO TO CORRUPTION” is not enough and draw attention all-year-round on how organisations can take actions now to secure themselves and contribute towards businesses’ fight against bribery and corruption risks.

Even with the world under partial lockdown during the COVID-19 pandemic, there’s been no shortage of bribery and corruption cases. Did you know that £100 billion of dirty money passes through the UK systems and services every year? Or that £1.27 billion is lost annually to fraud, bribery and corruption in the NHS? Recently, the Airbus was fined £3.6 billion in February 2020 by courts in the UK, US and France for slush funds, “success payments” and lavish hospitality. Are you 100% sure what’s happening in your organization or even department?

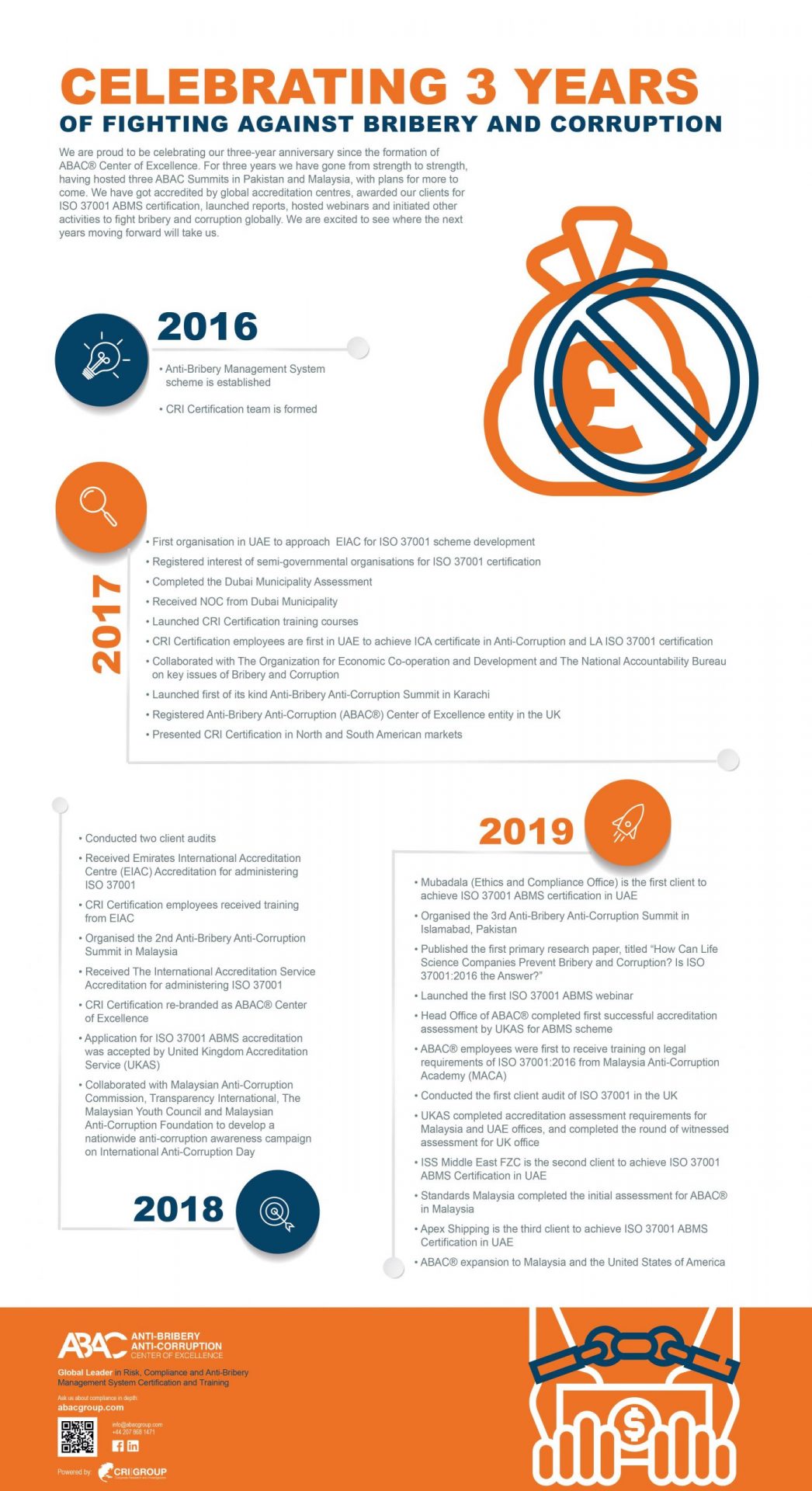

Such risks could affect you any time and not only in healthcare or aviation industries – no industry, organization or even country is immune to that. The above mentioned shocking figures indicate the need for organizations in public and private sectors and different industries to take more stringent actions to stop bribery and corruption. Learn more bribery and corruption-related facts by reading our ABAC®’s infographic here.

ANTI-CORRUPTION WEBINAR

As part of our continuous effort to educating businesses across the world of risk management, anti-bribery and anti-corruption solutions, we publish the library of insights and resources aimed to help you find the tools you and expand the knowledge.

This February, together with ABAC®, CRI® Group presents the anti-corruption webinar, focused on helping businesses to stay protected from the global pandemic of corruption. This FREE “Protecting your company form the global pandemic of corruption” webinar (date TBA) will provide you with the knowledge to identify how to protect your organization from global corruption and to critically assess the applicability of several recent legislative guidelines to the proactive mitigation of corruption and bribery in corporate administration across the world.

Based on recent Airbus and Rolls-Royce cases of multinational, multi-party bribery, the webinar will dive into the consequences of systemic inadequacy, confirming a paradigm shift in corporate oversight and network risk management.

- Discuss how to ensure compliance, compare and analyze the spectrum of regulatory instruments and corporate compliance standards and legislation in order to establish a comparative basis for Anti-Corruption policies and practices

- Assess the Airbus and Rolls-Royce cases studies to outline rules-based violations and identify compliance instruments for mitigating future replication

- Identify a combination of institutional solution for managing and monitoring corporate compliance to prevent bribery and corruption in a modern enterprise

- Get the copy of webinar content supporting and complimentary eBook

- Engage in a live Q&A session

CONTACT US

Headquarter: +44 7588 454959

Local: +971 800 274552

Email: info@crigroup.com

Headquarter: 454959 7588 44

Local: 274552 800 971

Email: info@crigroup.com

NEWSLETTER SUBSCRIPTION