Pharma and Healthcare Companies can Benefit from ISO 37001

Pharma and Healthcare Companies can Benefit from ISO 37001

When global pharmaceutical giant GlaxoSmithKline found itself in the Chinese government’s crosshairs for an alleged large-scale bribery scandal, there was perhaps little doubt that the consequences would be large-scale, as well. GSK was accused of systematically paying bribes and “gratuities” to doctors and hospitals in return for favourable product use and promotion. Pharma and Healthcare Companies ISO 37001 Benefits

China was in the midst of an emerging anti-graft campaign and imposed tough penalties against GSK and its executives: In the end, various company leaders were arrested and eventually given suspended prison sentences; GSK was fined $490 million; and the corporation published a statement of apology to the Chinese government and its citizens.

GSK’s fraud was arguably symptomatic of a widespread problem among pharmaceutical companies and healthcare providers (also called “life sciences” providers) with bribery and corruption in economies and healthcare markets around the world. Despite increased awareness of the problem and the application of sophisticated anti-fraud mechanisms, individual actors and agencies continue to defraud public and private health systems in the same ways exemplified by GSK in China.

Generally speaking, healthcare and pharma presents a target-rich environment for fraud. Quantitative data indicate that healthcare fraud has already risen starkly in recent years. The World Health Organisation (WHO) estimates that, where losses have been measured and the types of health expenditure have been covered, the average annual cost of fraud totals 7.29 per cent of healthcare budgets (Gee and Button, 2014). With rapidly ageing populations and the increased costs of providing long-term care, placing substantial pressure upon already overburdened health and social care sectors, healthcare spending will continue to increase worldwide. Unfortunately, this will also bring increased fraud schemes, as fraud perpetrators follow the money.

Bribery and corruption will continue to be a part of this upward trend in fraud. Certainly, not all cases are as broad and sweeping as GSK’s – in some cases, corruption occurs simply because the pharma or healthcare entity doesn’t have proper controls in place to uncover red flags. This also raises serious compliance issues in a landscape that has increasingly stringent regulations and enforcement measures to punish organisations that fail to implement proper anti-bribery and anti-corruption management procedures.

CRI Group investigates: Pharma corruption case included CFO

A major pharma company suspected bribery and corruption among some of its senior employees. The client’s corporate security department had received conflict of interest complaints that reportedly involved a range of employees, from sales personnel on up to the chief financial officer (CFO).

An outside investigation firm was called in launch a risk assessment of the company’s third-party relationships, which included several interviews with identified vendors and suppliers to help ascertain the engagement process and associated risks. This process uncovered the fact that the client had no policy or code of conduct concerning ethics, compliance and standards for appointment of vendors, suppliers and local agents. Most troubling was the fact that in most cases, senior management referred business opportunities to friends and family members.

Investigators found that one of the vendors, which was deeply engaged in procurements and the supply of services for the pharma company over the past five years, raised serious red flags. The vendor’s letterhead lacked a physical address, and the only contact information listed was a single cell phone number. It was clear this vendor warranted further investigation.

Investigators used site visits, background checks and interviews to determine that the suspicious vendor was not a company at all – but a single person. Not just any person, however – a public records check with a national database revealed that this individual, who was posing as a major vendor, was none other than the brother-in-law of the client company’s CFO. Worse still was the fact that this blatant fraud was being conducted right under the noses of procurement and finance professionals at this large and well-known pharma company.

The individual’s residence was being used as a warehouse to help facilitate the fraud. A comprehensive litigation records check found that he was previously convicted in federal court and spent three years in prison for the charges of selling counterfeit products, physician samples and expired medicines; further regulatory checks found that his pharmacist license had been cancelled.

A high fraud risk environment was created through the non-compliance of specific procurement rules, and a lack of integrity due diligence and proper risk management. Also, severe conflicts of interest were exposed, connected to high-level executive positions and benefiting those in positions of power.

The pharma company was exposed to highly unethical practices and could face regulatory and other government action. Furthermore, the company was at risk of civil and criminal investigations and liability, damage to its reputation, and loss in shareholder trust, all of which could adversely affect the company’s financial well-being.

A solution through ISO 37001:2016 ABMS

The case study above is not an outlier – such corruption cases are relatively common in such a broad and complex industry. The pharma company could have prevented the scandal altogether, however, had it proactively implemented a proper anti-bribery management system (ABMS). There is a solution that pharma and healthcare companies can implement to help prevent and detect bribery and corruption: the ISO 37001:2016 Anti-Bribery Management System standard. ISO 37001:2016 is designed to help global organisations implement an anti-bribery management system (ABMS), as the standard specifies a series of measures required by the organisation to prevent, detect and address bribery, and provides guidance relative to that implementation.

CRI Group’s ABAC Certification Services is fully accredited to offer independent ISO 37001:2016 certification to ensure that an organisation is in compliance with the standard, which is recognised and practised worldwide. CRI Group’s auditors and analysts work with pharma and healthcare companies to develop measures that integrate with existing management processes and controls, and include:

- Adopting an anti-bribery policy

- Establishing buy-in and leadership from management

- Training personnel in charge of overseeing compliance

- Communicating the policy and program to all personnel and business associates

- Providing bribery and corruption risk assessments

- Conducting due diligence on projects, business associates and other third-party affiliations

- Implementing financial and commercial controls

- Developing reporting and investigation procedures

In the case study outlined above, having such an ABMS in place would have detected the red flags of bribery and corruption before the scandal was able to proliferate and cause so much damage to the company. Risk assessments, in particular, would have uncovered the lack of due diligence procedures and alerted organisation leaders to the trouble areas that were points of opportunities for the CFO and his brother-in-law. Also, having proper due diligence procedures in place to vet and uncover fraudulent third-parties would have detected the problem with this vendor from the outset.

Once certified, an organisation must continue surveillance and undergo a recertification audit over three years to ensure that the organisation still complies with the ISO37001:2016 standard. During this time, any changes to processes and any new relationships with vendors and other third-party partners are carefully reviewed.

Long-lasting benefits of ISO 37001:2016 certification

ISO 37001 provides a strong framework for addressing and isolating risk factors, and the benefits of certification are far-reaching, impacting not just the primary organisation but also influencing contractors, clients, and raising the profile of the company as an ethical entity that is a good trading partner.

By achieving ISO 37001:2016 certification, a pharma or healthcare organisation will ensure that the organisation is implementing a viable anti-bribery management system utilising widely accepted controls and systems. It will also assure management, investors, business associates, personnel and other stakeholders that the organisation is actively pursuing internationally recognised and accepted processes to prevent bribery and corruption. Today, companies cannot afford to be reactive to threats of bribery and corruption. By achieving ISO 37001 Anti-Bribery Management System certification today, an organisation will remain in compliance and better positioned to address risks head-on.

Who is CRI Group?

Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening,

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.

Risk management and its continuous improvement

Risk management requires continuous improvement. Without a company culture strongly aligned with principles of continuous improvement, organisations will struggle to implement, let alone maintain, successful risk management programs. This can be challenging in practice, as cultivating a risk management attitude within a company involves aligning risk initiatives with existing company values, policies and, to put it simply, convincing everyone involved that risk management is worthwhile. However, improving risk culture is possible, and, like many things, it becomes a lot easier when you have a process for it.

Such a process can be separated into three stages:

- Cultural awareness

- Cultural change

- Cultural refinement

Phase one: Building and strengthening cultural awareness

The first stage is building cultural awareness; this will take the form of communications, training, and general education initiatives within the organisation. Here is where companies set risk management expectations and objectives, define roles and responsibilities, and communicate all of these things with their employees. You shouldn’t expect your employees to conform to your ideas about risk management without first taking the time to educate and inform them, whether through formal training or access to knowledge base material or similar.

Successfully building and strengthening cultural awareness about continuous improvement includes:

- Establishing a common risk management vocabulary

- Making sure communications are consistent with said vocabulary and that everyone in the organisation has clear access to all relevant documents

- Being clear about risk management responsibilities and accountabilities.

- Launching and maintaining training programs, providing training support and guidance where needed and as required by different roles and responsibilities within the organisation

- Making sure onboarding processes adequately cover risk management.

- Making sure recruitment processes adequately cover risk management.

Phase two: Changing the way the organisation operates

Once a firm foundation of cultural awareness regarding continuous improvement has been established, it’s time to start thinking about how to gradually change how the organisation operates to reflect these values. This phase begins by recognising and rewarding employees for paying attention to risk and responding to risk in a way that challenges the previously established (pre-continuous improvement) status quo. These motivational systems, rewarding and penalising behaviour according to the established ideals of continuous improvement outlined in the early planning stages, will result in the gradual but certain shift towards a proliferation of continuous improvement-conscious company culture. Another important element is recognising the talent that conforms with the desired vision of continuous improvement and capitalising on this alignment by placing them accordingly in relevant, optimised positions of responsibility or seniority. It’s getting people in the right place to drive the right results.

Some important considerations for this phase:

- Utilising challenge as a motivator for driving cultural change

- Gamifying and quantifying risk performance metrics and rewarding/penalising behaviour accordingly.

- Considering risk management and continuous improvement culture in talent management approaches.

Phase three: Optimising and refining the cultural ecosystem

The third and final stage of cultural adoption of continuous improvement occurs once the company culture has matured to the point of widespread adoption and desired values are already well-entrenched. At this point, the focus shifts to monitoring performance versus expectations and attempting to tweak and refine the system to further improve cultural adoption. The expectations can and will be influenced by a wide range of stakeholders, not just top management; employees, a board of directors, analysts, customers, investors – they all have a say in the definition of cultural expectations because these expectations should directly reflect the whole entity that is the organisation, made up of all its constituent stakeholder parts.

Steps taken during this phase might include:

- Iterating feedback and observations from risk management into training, education, resources, and communications.

- Making sure stakeholders are held responsible for their actions

- Make sure any risk performance metrics or quantifiers are adjusted to reflect risk strategy, goals, and objectives changes.

- The capacity to redeploy and reassign individuals within an organisation according to desired risk culture goals

- Continually reflecting on and refining risk culture by continually changing business goals, objectives, and strategies.

At CRI® Group, we are committed to spreading the knowledge about the risk, compliance management and negative impact of fraud, bribery, and corruption to global businesses and promote transparent business relations across the world. As part of this effort, we want to present you our in-depth risk management and compliance insights – articles, whitepapers, eBooks, and other publications to help organisations overcome fraud, compliance, bribery, and corruption management challenges and tackle risks more effectively.

Don’t miss the opportunity to step up towards transparency and better protection for your business and your career – CRI® Group’s risk management and compliance insights give you a chance to explore these topics in-depth. If you are interested in our solutions, please click below to a free quote or contact us today.

Background Checks: An Essential Process

There are inherent risks in the hiring process, including deception by individuals seeking to gain an advantage over other candidates. Thorough pre- and post-employment background checks are critical in mitigating these risk factors, helping any organisation stay better protected from fraudulent candidates or unqualified employees.

The advantages of using an expert third-party service to conduct background checks are many. Comprehensive background checks are best performed by industry experts who understand where to find and confirm employee information, from criminal, education and employment history records checks to verification of credentials, training, certifications and other important info claimed by the employee or candidate. An international firm can access resources in geographic regions not serviced or accessible by typical “out-of-the-box” screening services.

Taking this approach puts protection in the hands of agents who are specially trained to use every resource available to provide timely and thorough pre- and post-employment background checks, adding a level of due diligence that allows you to focus on your core business needs. This is why any pre-employment background checks should dig deep enough (within all local laws and regulations) to assess every detail of a job candidate’s claims and credentials, to confirm that the claims match with the facts. An expert team should examine all of the following details of a potential employee:

- Identity: Some job candidates will actually fabricate a new identity, especially if they have something to hide. Proper screening can verify name, addresses, phone numbers, national ID numbers and other identifying information to confirm that they are who they claim to be.

- Credit checks and bankruptcy checks. As permitted by local laws, financial and credit history should be reviewed, as fraud statistics have shown financial distress to be a key red flag for fraudulent behaviour. Has the candidate claimed bankruptcy? Have they dissolved prior companies or are they faced with debtor filings?

- Previous employment verification. Background checks will verify past employers, locations of past employment, dates employed, salary levels, reasons for leaving, position titles, gaps in employment history and pertinent contact information.

- Education and credentials verification. Verification is needed to confirm school grades, degrees and professional qualifications.

- Criminal history. International criminal records searches are critically important, and should include any convictions for the applicant in the requested jurisdictions.

- … and more.

What gets uncovered serve both as cautionary tales and success stories. One client in the medical industry was hiring for a critical management-level position. After finding what appeared to be an exemplary candidate, they engaged thorough pre-employment

The candidate claimed to be a holder of a university degree, which, upon verification, turned out to be ‘fake and forged.’ The applicant also provided a reference letter, which turned out to be fake as well. In short, there was nothing legitimate about the candidate’s educational background. This person would have been a risk on all levels, including patient safety. The client dodged a very real bullet by applying proper background checks, and not hiring someone who was unqualified and untrustworthy.

Don’t take unnecessary risks with your business, assets, investments and reputation. Whenever you are hiring a new employee, conduct a thorough pre-employment background check, best implemented and administered by a third party. After all, a team that specialises in background checks will have a full bank of resources and experienced personal to do the job properly. Hiring new employees should be an occasion marked by excitement, not risk and uncertainty.

Let’s Talk!

If you have any further questions or interest in implementing compliance solutions, please contact us.

CRI Group has safeguarded businesses from any risks, providing investigations (i.e. insurance fraud), employee background screening, investigative due diligence, business intelligence, third-party risk management, forensic accounting, compliance and other professional investigative research services. In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. Contact ABAC® for more on ISO Certification and training.

Hiring Process: the 10 Top Risks

10 Top Risks Faced in the Hiring Process

Hiring new employees is an essential part of operating, and growing, a successful business. It is also a process that presents an inherent risk to any organisation. Company insiders often commit fraud and other criminal acts; the very people trusted to work for the business’s best interests. While most employees might be honest and trustworthy, it only takes one to cause major unforeseen problems that can be hard to predict and even more difficult to undo.

Companies that don’t perform pre-employment background checks, or conduct insufficient background checks, are at a particularly high level of risk. According to popular employment site CareerBuilder.com, “Fifty-eight per cent of hiring managers said they’d caught a lie on a resume; one-third (33 per cent) of these employers have seen an increase in resume embellishments post-recession.” Even more staggering, 50% of workers know someone else has lied on their resume (BestLife, 2018). This shows an uptick in recent years and should alarm any business owner or hiring manager/human resources professional as a wake-up call that there is a serious problem.

So what are the most common areas of resume fraud? The following is a rundown of the top 10 ways candidates might show deception in the hiring process:

1. Stretching Dates of Employment:

Someone who can only stay at each job for a few months at a time is likely to be a concern for a prospective employer. For that reason, they might fudge their employment dates to make it look like they have longer ranges of employment in certain positions.

2. Inflating Past Accomplishments and Skills:

The candidate might claim major successes; for example: “implemented new CRM process company-wide” – when in reality, they only played a small role in this achievement.

3. Enhancing Job Titles and Responsibilities:

Perhaps they were managers, but refer to themselves as a director. Or it might be something subtle, such as calling themselves “senior sales managers” when in fact, they were “assistant sales managers.”

4. Education Exaggeration and Fabricating Degrees:

Claiming a degree that was never earned is one of the most common fabrications. Several executives at large corporations have been exposed to this type of deception.

5. Unexplained Gaps and Periods of “Self-employment:”

A candidate who was simply unemployed (or worse … such as incarcerated, for example) might claim to have been running their own business to explain their employment gap(s) when in fact they were just not working.

6. Omitting Past Employment:

A prospective employee might leave out previous jobs if they were terminated for cause or don’t want that particular employer to be contacted for any other reason.

7. Faking Credentials:

Certifications, assessments, awards – all of these can be fabricated or fraudulently claimed by candidates to make themselves look more qualified for a position than they are.

8. Fabricating Reasons for Leaving the Previous Job:

Being terminated from a job, especially for a serious transgression, is not something most job candidates want to tell a prospective employer. For that reason, they might make up a different scenario, such as “I resigned to pursue better opportunities.”

9. Providing Fraudulent References:

A candidate provides an employment reference who gives a shining recommendation. However, the contact turns out to be a friend of the candidate. This type of deception can hide the true nature and work record of the candidate.

10. Hiding a Criminal Background:

This is one of the most serious omissions. Depending on their history, your business and employees could be at risk from a bad actor who intentionally hides their criminal past.

Several consequences can occur from the above deceptions. Fraud and criminality are possible. Having employees in place who are underqualified to do the job they’ve been hired for is another. This can lead to safety risks and obvious harm to business on every level. That’s why smart business leaders take a proactive approach toward minimising risk with thorough background checks and proper due diligence in the hiring process.

Let’s Talk!

If you have any further questions or interest in implementing compliance solutions, please contact us.

CRI Group™ has safeguarded businesses from any risks, providing investigations (i.e. insurance fraud), employee background screening, investigative due diligence, business intelligence, third-party risk management, forensic accounting, compliance and other professional investigative research services. In 2016, CRI Group™ launched the Anti-Bribery Anti-Corruption (ABAC™) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC™ operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. Contact ABAC™ for more on ISO Certification and training.

Reference checking, 6 keys in the hiring process

Why Reference Checking?

Hiring more people within a company no matter the size can be a lot of effort, waste a lot of time and cost a lot of money so it is important to do it right, which means reference checking. As a large company, it is often the case that there will be an in-house HR team or outsourced company to deal with new employment and reference checking. As a smaller company, it is likely the managing director or office managers handle the process themselves. Companies are at risk of losing a great deal of money from not following the correct employment process. Below are a few recommendations on how you can create and run an effective pre-employment screening process.

1) Understand your risk profile

While lots of businesses have the brand and reputational risk among the leading reasons to conduct background checks, but all organisations have different types of risk. While organisations understandably wish to avoid bad publicity, risk profiles inevitably vary between companies and industry sectors. Other risk-profile considerations include whether the company has regulatory responsibilities to demonstrate due diligence in hirings, such as financial institutions and those working with sensitive or vulnerable people.

2) Implement a strong policy

A background check policy is important because it streamlines the collection, storage and dissemination of employee or applicant background information. When established protocols are in place, incidents of people making mistakes because they had to make a judgment call are reduced.

3) Make It Company-Wide

Create and apply background check policies across the whole company, even for senior management. On average, supervisors spend 17% of their time managing poorly performing employees. In the same survey, 95% of employers said that a poor hiring decision affects the morale of the whole team. Ensuring that the people you hire have the correct qualifications saves time and effort while preserving company spirit.[1]

4) Be Consistent

Pre-employment background screening must be consistent. Most negligence issues start from inconsistency in applying HR policies. Inconsistent enforcement opens the door to discrimination charges, and background screening is no exception.

5) What information can I search for?

Creating pre-defined service packages ensures that your screening policy will be consistently applied. Best practices basic packages includes the following:

• Address Verification

• Identity Verification

• Previous Employment Verification

• Education and Credential Verification

• Reference Check

• Media Check

• Criminal Record Check

6) Understand local and regional screening variance

When building your pre-employment screening program, it is critical to understand that not all countries take the same view of the availability and use of certain types of pre-employment screening information. Creating compliant data and background screening processes is a complex and evolving challenge for all organisations and one that is multiplied by every country involved. As an essential means to ensure the safety and quality of staff, employers need to ensure that their screening programs are right for their organisation and their candidates; transparent, consistent and proportionate by design; and capable of handling an increasingly globalised workforce and disparate regulatory requirements.

References:

Let’s Talk!

If you have any further questions or interest in implementing background screening solutions, please contact us.

CRI Group has safeguarded businesses from any risks, providing investigations (i.e. insurance fraud), employee background screening, investigative due diligence, business intelligence, third-party risk management, forensic accounting, compliance and other professional investigative research services. In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. Contact ABAC® for more on ISO Certification and training.

Demonstrating Adequate Procedures with ISO 37001 ABMS Certification and Training

As the international outcry on bribery and corruption practices continues to tighten its grip around rogue players in the private and public business sectors, global organisations continue to ramp up their efforts to develop effective frameworks to prevent, detect and report bribery and corruption. And by fortifying their anti-bribery management systems, such organisations are further helping their cause as such systems can play a pivotal role in establishing “adequate procedures” as a compliance defense in the event of a bribery accusation.

“Adequate procedures” is a term made popular through the UK Bribery Act of 2010, which poses the potential of a company avoiding liability for failing to prevent bribery if that organization can demonstrate sound and established policies and procedures that deter individuals (inside and outside of the organisation) from partaking in questionable or corrupt conduct. A key challenge, though, is that “adequate procedures” takes on different meanings, depending on what country or jurisdiction one may reside. Further, most enforcement agencies and government authorities offer little guidance that pinpoints what exactly “adequate procedures” means when considered as a possible defense in a legal proceeding.

Consider two international legislative provisions that offer “adequate procedures” as a possible legal defense consideration along with the most recent National Anti-Corruption Plan of the Malaysian Government, and discover how a newly adopted international standard can offer multi-national organisations specific guidelines in developing a globally accepted anti-bribery management system that may support most “adequate procedures” defenses.

UK Bribery Act of 2010

Under the UK Bribery Act, an “adequate procedures” defense would be considered during an investigation into a corporate failure to prevent bribery. The Act provides commercial organisations with a defense to liability when commercial organizations can prove and demonstrate that they had in place proper procedures designed to prevent persons associated with them from undertaking bribery related conduct.

Consequently, corporations that are otherwise liable for violating the corporate failure to prevent bribery provision can escape criminal liability from the provision if they can prove that they had in place “adequate procedures” to prevent the relevant illegal conduct from occurring. This defense is unique in that it contends that corporations are acting in good faith and taking proper precautions throughout the organization in implementing adequate compliance procedures, and subsequently can avoid being held criminally accountable for the failure to prevent bribery. This defense is significant in that there is no such defense under the FCPA (see below) or most other foreign anti-bribery laws.

FCPA (U.S. Dept. of Justice)

While corporate compliance procedures are not considered in the liability phase of the FCPA, they are taken into account during the sentencing phase by the U.S. DOJ relevant to the FCPA. The United States Sentencing Commission outlines through its Federal Sentencing Guideline Manual six factors — four aggravating and two mitigating — that a sentencing court must consider in determining the appropriate penalty on organizations convicted under the FCPA. The existence of an effective compliance program is one of the two mitigating factors. Subsequently, an organization convicted of FCPA violations can use the existence of an effective compliance program to potentially reduce a penalty against it.

Malaysian National Anti-Corruption Plan 2019-2023

Under Section 17A (3) of the Malaysian Anti-Corruption Commission act, if the commercial organisation is found liable under the corporate liability provisions, a person who is the director, controller, officer or partner of the organization, or a person who is concerned with the organization’s management affairs at the time of commission of an offense, is deemed to have committed that offense unless such person can prove that the corrupt act was committed without his consent or connivance and that he exercised due diligence to prevent that commission of the offense as he ought to have exercised with regard to the nature of his function in that capacity and the circumstances.

Hence, there is a need for the company to put in place “adequate procedures” as a defense in case there is proven corruption by the associated individual. The Malaysian Anti-Corruption Commission MACC has issued guidelines which constitute “adequate procedures.” In the National Anti-Corruption Plan, Tun Dr. Mahathir bin Mohamad, Prime Minister of Malaysia on 29th January 2019 developed initiative number 2.1.3 which seeks “To introduce Anti-Bribery Management System (ABMS)MS ISO 37001 certification in all Government agencies” within two years (Jan 2019-Dec 2020). The guidelines further state in initiative 6.2.4 “To propose Anti-Bribery Management System (ABMS) MSISO 37001 certification as a requirement for State-Owned Enterprises (SOEs), Company Limited By Guarantee (CLBG) and the private sector to bid for Government contracts”.

In complying with these guidelines and to prove “adequate procedures”, public and private sector organizations should implement the ISO 37001 certification process which would provide proper assurance that the organization has succeeded in establishing, implementing, maintaining, reviewing and improving its Anti-Bribery Management System.

Demonstrating “Adequate Procedures” through ISO 37001 Certification

ISO 37001 Anti-Bribery Management System is an internationally accepted standard that specifies the procedures by which an organization should implement in preventing bribery while detecting and reporting any bribery incident that occurs.

The standard requires organizations to implement these procedures on a reasonable and proportionate basis according to the type and size of the organization, and the nature and extent of bribery risks faced. It applies to small, medium and large organizations in the public and private sector and can be implemented in any country. Though it will not provide absolute assurance that bribery will completely cease, the standard can help establish that the organization has in place reasonable, proportionate and adequate anti-bribery procedures.

® Center of Excellence Limited is fully accredited as a Conformity Assessment Body (Certification Body) to assist your organization in attaining ISO 37001 certification through a thorough bribery risk assessment and audit covering the entire scope of the standard The audit methodology is evidence-based, meaning any issues raised will be confirmed through adequate evidence that the ABAC Certification team has discovered during the audit.

Auditing techniques take a risk-based approach to examining your organization’s Anti-Bribery Management System (ABMS), and the ABAC Certification team will increase the scale of the investigation if they determine that a specific process presents on a higher risk side. Factors such as Impact, Negligence, Minor, Major, and Critical are taken into consideration during the audit.

A separate audit method is a process-based approach where the ABAC Certification examines the organization’s processes while considering the interaction between those processes. Finally, there is a sampling-based audit approach where ABAC Certification incorporates an appropriate sampling plan utilizing samples from different ABMS processes to conclude and support the audit findings and results.

The audit is extremely thorough in its approach, which results in an accredited certification for the scope of the ISO 37001 Anti-Bribery Management System. Because of the standard’s international acceptance and the thoroughness of the audit process, such certification can provide a valuable safeguard in demonstrating an “adequate procedures” compliance defense in cases posing a liability for a company’s failure to prevent bribery.

Indeed, from an FCPA perspective, certification may provide tangible evidence that a compliance program was in place at the time of the alleged bribery actions. And from a UK Bribery Act perspective, the certification could provide the company with tangible prima facie evidence presented by an accredited certification body attesting to the establishment and effectiveness of the organization’s compliance program. Notably, per Section 17A of the Malaysian Anti-Corruption Commission act, the Prime Minister’s National Anti-Corruption Plan 2019-2023 has declared ISO 37001 certification a requirement for companies operating in Malaysia.

There is a strong likelihood that ISO 37001 Anti-Bribery Management System will continue to set the pace for a globally recognized “adequate procedures” standard for corporations embroiled in corruption litigation proceedings. But for now, the most powerful “insurance” tool that public and private sector organizations can use in their defense strategy is ISO 37001 ABMS certification.

ABAC Certification is an accredited conformity assessment body in issuing ISO 37001:2016 certification, and an independent component of CRI® Group’s Anti-Bribery Anti-Corruption Center of Excellence, which was created to educate, equip and support the world’s leading business organizations with the latest in best-practice processes and procedures, providing world-class anti-bribery and anti-corruption solutions to organizations seeking to validate or expand their existing compliance frameworks to maintain a competitive edge in the world marketplace.

Zafar Anjum, MSc, MS, LLM, CFE, CIS, MICA, Int. Dip.(Fin. Crime), CII, MIPI, MABI | CRI® Group & ABAC® CEO

t: +44 207 8681415 | m: +44 7588 454959 | e: zanjum@CRIGroup.com

Let’s Talk!

If you have any further questions or interest in implementing compliance solutions, please contact us.

CRI® Group has safeguarded businesses from any risks, providing investigations (i.e. insurance fraud), employee background screening, investigative due diligence, business intelligence, third-party risk management, forensic accounting, compliance and other professional investigative research services. In 2016, CRI® Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. Contact ABAC® for more on ISO Certification and training.

Human Capital can make (or break) your business – mitigating employee risk!

Most organisations manage some of their risks via an insurance policy and risk retention. However, this is a reactive strategy when it comes to risk. If you are one of these organisations, then you are missing the riskiest part of the equation: people risk.

People risk IS…

- having the wrong people in the right positions;

- the failure to understand brand;

- having a weak tone at the top that sets a little precedent;

- a leadership failure that trickles down;

- the uncontrollable side of what people do.

At CRI Group we see people risk as a hidden, budget-busting risk. We know that people and culture can influence (very negatively) your strategy. In other words, human capital can make — or break — your organisation. This risk directly affects your culture, brand, operational efficiency, and ultimately your profitability. In our view, effective leaders of people risk squash organisational inconsistency by living the brand.

Employee investigative analysis findings expose employee risk

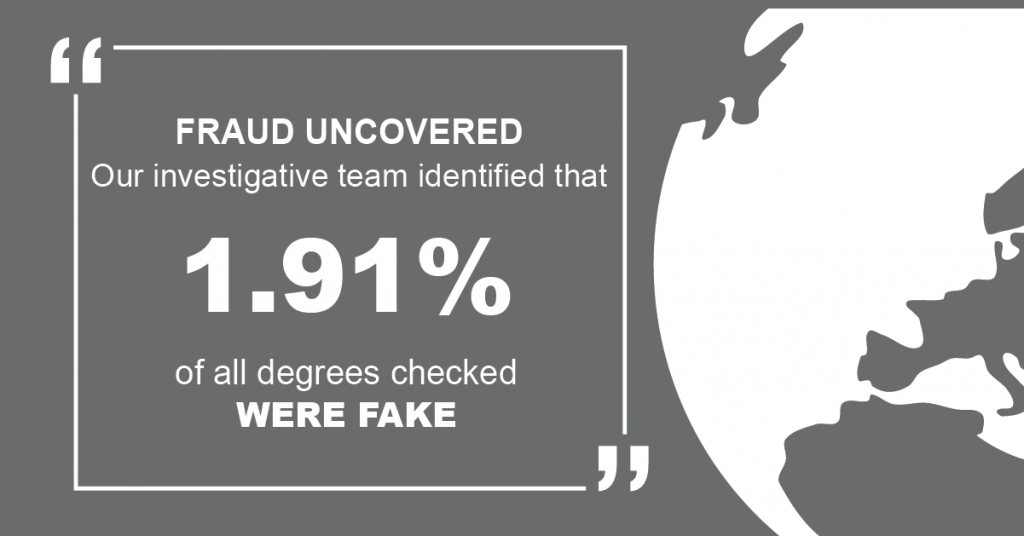

Between February and March 2019, CRI Groups’ investigative analysis team found 3.6% of all requested degree checks to be fake. This is followed by the statistics from January-June 2020, indicating that claiming a fake degree occurred in nearly 2% of cases. Our investigative operations team also found this year that providing incorrect education degree details resulted in 2.33% of all checks. Overall, providing incorrect employment details is the most common red flag, as it was uncovered in about 4.5% of background screenings. Learn more statistics in our article, titled “Background Screening Red flags: Numbers Don’t Lie“.

With degree fraud becoming more common and sophisticated in style globally, comes an increased necessity for pre-employment degree checks to deter potential candidates from fabricating their level of experience and qualification, and to prevent the harmful consequences that employing such applicant’s can have on the company. With job seeking becoming more competitive, many employers are looking for degree level candidates to fill their positions and this means that for some candidates, falsely claiming the existence of their degree is an attractive idea[1]. This can come in the form of referencing to their bogus degree in their CV, or potentially even buying a false certificate from a fake or real university under a site which creates these certificates later down the line if the candidate’s fraudulent activity is not initially flagged up.

Of course, using these websites with the purpose to deceive employers, rather than for “novelty use” which the websites so often claim is the purpose of their product, is a criminal offence and can result in 10 years in prison within the UK, under the Fraud Act of 2006[2]. However, this seemingly hasn’t deterred the thousands of UK nationals who have purchased fake degree certificates with one person spending nearly £500,000 on the certificate[3]. According to a study conducted in 2014, one in three employers do not verify the candidate’s degree qualification upon their hiring, meaning that people are hired into positions they are neither qualified nor educated in, so also pushing those who are degree standard out of the chance of reaching the position[4].

One fake degree holder in a sensitive position can ruin the organisation due to significant irreparable reputational damage. Our pre-employment background checks capability thus acts as an effective employee risk mitigation strategy, so protecting your company from the “human factor”.

Mitigating Employee Risk

Where there are people, there are risks. There are factors in employee-related risk management that are out of a company’s control. But just because you can’t prevent them from occurring doesn’t mean you can’t be prepared for them when they do occur. CRI Group has developed this playbook to help you understand how to mitigate employee risk. This playbook defines the risks, explains and identifies each and their impact. “Where there are people, there are risks: mitigating employee risk” provides actionable advice on how to take control within your organisation including information on background screening (pre-employment screening and post-employment background checks).

You secure their future. We secure their past.

How do you know the candidate you just offered a role to is the ideal candidate? Are you 100% sure you know that everything they’re telling you is the truth? 90%? They showed you a diploma, how do you know it’s not photoshopped? Did you follow the correct laws during your background checks process?

Mitigating employee risk is vital to avoid horror stories and taboo tales that occur within HR, your business or even your brand – simply investing in sufficient screening can save you time, money and heartbreak. CRI Group’s EmploySmart service provides in-depth background screening services of employees and candidates at all levels, from senior executives t

o shop-floor employees. Outsource your employee background screening to one of our experienced providers, trusted by the world’s largest corporations, and you will only ever have to look forward, never back.

[accordion_father][accordion_son title=”About CRI Group” clr=”#ffffff” bgclr=”#1e73be”]Based in London, CRI Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening,

In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organisations. Contact ABAC® for more on ISO Certification and training.[/accordion_son][accordion_son title=”Sources & Credits” clr=”#ffffff” bgclr=”#1e73be”][1] https://www.theguardian.com/education/2002/apr/06/students.schools1

[2] https://luminate.prospects.ac.uk/7-ways-to-spot-a-fake-degree-certificate

[3] https://www.bbc.co.uk/news/uk-42579634

[4] https://www.agencycentral.co.uk/articles/2017-04/why-fake-degrees-are-destroying-recruitment.htm

How to handle the “Human Factor”: Top 3 risks when hiring

Talent acquisition in the hiring process requires a great deal of investment in both time and effort for the hiring manager and would involve even greater repercussions if the chosen candidate turns out to be a bad hire. Due to the ever-growing competitive nature of job seeking, it is becoming increasingly likely that a prospective employee may embellish their CV, making themselves appear more attractive to the employer. When hiring new employees, the company becomes vulnerable to human capital risk, which is often thought as the most damaging threat to an organisation yet is also the least well-managed. Hence, performing the appropriate background screening before confirming the hire can save the company from unnecessary costs later down the line.

Top 3 risks when hiring new talent

1. False Credentials

It is thought that generally, around 40% of all job applications contain some fraudulent information, and such a high percentage hence displays the necessity for thorough background checks in the hiring process[1]. One of the most common lies tend to be extending dates of employment to hide a suspicious employment gap which the candidate wants to cover up. Similarly, claims of fraudulent degrees found are on the rise which is a great indicator that the candidate is in fact not qualified for the role. Other false credentials may include exaggerating daily activities in job roles or improving the job title. Other times you may expect to find fraudulent references, or at least references that are not suitable[2].

2. Breach of Trust

In addition to the risks that a hire with false credentials may impose on the company in terms of being unqualified for the role, the candidate’s willingness to lie on their résumé can be a strong indicator of an untrustworthy candidate. If they are willing to lie to reach their desired position, then what else may they lie about within the company?

With access to sensitive company information and documents, and company reputation on the line, hiring a person that can be trusted to perform their role is critical. For example, theft within a company is estimated at roughly 5% of revenues each year[3]. Hence, pre-employment background checks can also act as a judgment of character of the prospective employee for the hiring manager.

3. Negligent hiring and employer liability

As well as having a background screening process in place having the power to discourage untrustworthy candidates, pre-employment background screening conveys that the employer has exercised the necessary due diligence as a preventative measure to protect the company from legal harm. Pre-employment background checks can also check for criminal checks, social media checks and right to work checks; all areas in which an employer can become liable if the correct due diligence process hasn’t been conducted. An employer who hires a candidate without the right to work “can now be subject to a maximum civil fine of £20,000 per individual and/or a criminal sanction of an unlimited fine or imprisonment of up to 6 months”, Ben Mason- employment law associate at Aaron & Partners LLP[4]. Hence, background checks can reduce the likelihood of encountering risk later on.

A cost-effective risk-management tool?

According to the US Department of Labor, a bad hire can cost the company at minimum 30% of that employees first-year salary[5], whilst Fast Company says that one quarter of companies surveyed estimated that a bad hire cost them at least $50,000 in the past year[6]. Hence, pre-employment background screening is a cost-effective risk-management tool to help deter fraudulent candidates, mitigate risk to the company and protect the company from liability in the future. This keeps the company safe and acts as an effective risk management tool in providing integrity and confidence in hiring new talent.

Let’s Talk!

If you have any further questions or interest in implementing background screening solutions, please contact us.

CRI Group has safeguarded businesses from any risks, providing investigations (i.e. insurance fraud), employee background screening, investigative due diligence, business intelligence, third-party risk management, forensic accounting, compliance and other professional investigative research services. In 2016, CRI Group launched Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. Contact ABAC® for more on ISO Certification and training.

References:

[1] https://www.forbes.com/2006/05/20/resume-lies-work_cx_kdt_06work_0523lies.html#5fd1c99c78b5

[2] https://www.thebalancecareers.com/do-you-know-who-you-re-hiring-1919148

[3] http://www.greenhouse.io/blog/4-risks-your-company-takes-when-background-checks-are-not-a-part-of-your-hiring-process

[4] https://www.personneltoday.com/hr/background-screening-eight-key-checks-employers-must-make/

[5] https://www.forbes.com/sites/falonfatemi/2016/09/28/the-true-cost-of-a-bad-hire-its-more-than-you-think/#652e877b4aa4

[6] http://www.greenhouse.io/blog/4-risks-your-company-takes-when-background-checks-are-not-a-part-of-your-hiring-process

CRI® Group’s 3rd ABAC Summit 2019 Sets the Tone at the Top

CRI® Group’s 3rd ABAC Summit 2019 Sets the Tone at the Top

CRI® Group, a global leader in risk and compliance hosted the “3rd Anti-Bribery Anti-Corruption Summit 2019” in association with ICCI, GPCCI, Bank Al Habib, Transparency International Pakistan, ACFE Corporate Alliance USA, ICA and Fraud Advisory Panel UK. The one-day event was held in Islamabad, Pakistan, marking a return to Pakistan for this annual event that debuted in Karachi in 2017 (last year’s ABAC Summit 2018 was held in Kuala Lumpur, Malaysia).

The Summit embraced the theme of “Setting the Tone at the Top” for sharing invaluable expertise in due diligence, internal controls and compliance issues, along with showcasing the latest resources and solutions to detect and prevent bribery and corruption. The main aim of the event was to provide guidance and training that enables business sectors to fight malpractices and learn about the latest resources and solutions to detect and combat bribery and corruption within the organisation.

A large number of CEOs, CFOs, directors, compliance and legal officers, lawyers, and due diligence and risk management professionals from leading corporate entities who attended the ABAC Summit were there to gain invaluable expertise from distinguished expert speakers and share their knowledge with the participants.

Mr. Zafar I Anjum, CEO of CRI® Group:

CRI® Group founder and CEO Mr. Anjum provided the introductory welcome. During his speech, Mr. Anjum highlighted that “Systematic corruption continues to be a substantial obstacle in both the public and private sectors nowadays. Corruption is a cultural issue that will only change as future generations are made aware of the detrimental impact of corruption in our society. The most powerful tool an organization can use to demonstrate ‘adequate procedures’ as an effective bribery defense and deterrent is ISO 37001. ABAC® Centre of Excellence works to educate, equip and support the world’s leading business organizations with the latest in best-practice due diligence processes and procedures, not only in Pakistan but around the globe”.

Mr. Drago Kos – Keynote Speaker, Chairman of Working Group on Bribery in International Business Transactions at Organization for Economic Co-operation & Development:

Mr. Drago Kos highlighted that “in 41 percent of cases, management-level employees paid or authorised the bribe, whereas the company CEO bribed in 12 percent of cases.” He also added that “organizations where leadership, management and workforce do not take corruption seriously will never be adequately protected from risk” Mr. Kos urged businesses to apply disciplinary procedures against breaching ethics and compliance programs and anti-corruption measures. CEOs and managers face increased pressure to prevent bribery and corruption and maintain compliance. They also “influence everything by their management style, and are role models for their employees”, therefore, setting an ethical “Tone at the Top” is hugely important.

Dr. KM Loi Vice-Chairman of ISO/PC 278 (ISO 37001:2016), Co-convenor of ISO/TC 309 WG2 (ISO 37001 Handbook)

Dr. KM Loi was part of a Project Committee which was responsible for the design and development of ISO 37001:2016 – Anti-Bribery Management System (ABMS) standard. Dr. Loi spoke in depth about the threat of bribery and corruption, and how a management system like ISO 37001:2016 can help an organisation remain better protected and in compliance. “Bribery is one of the greatest challenges to international development and poverty relief” Dr. Loi said.

“According to OECD, estimates show that the cost of corruption equals more than 5 percent of global GDP”, Dr. Loi said (this equates to US $2.6 trillion, according to the World Economic Forum), “with over US $1 trillion paid in bribes each year”, (according to the World Bank). “It is not only a question of ethics; we simply cannot afford such waste. This is money that could have been spent on improving life for millions if not billions of people”

Mr. Mian Muhammad Ateeq Sheikh – Senator:

Mr. Senator took a part in presenting his thoughts on bribery & corruption at the ABAC summit. He said, “bribery and corruption is eating away Pakistan’s foundation. Our country is unfortunately way down on the ladder on this account. Corporate Research and Investigations (CRI Group) is taking actual encouraging procedures to fight against bribery and corruption. The administration sector should come up with strong compliance and legitimate regulations and take apart in the fight against this white-collar crime”. He also addresses, “NAB plays a very important role in fighting against serious corporate crime. The present government should bring strong control in compliance management system, he also said “We can save the future of our generation by fighting the corrupt practices today”.

Mr. Irfan Naeem Mangi, Director General National Accountability Bureau (NAB):

The speaker presented the national efforts against corruption and an overview of NAB: “Rigorous imprisonment up to 14 years, imposition of fine not less than the illegal gain, immediately cease to hold public office, disqualified for 10 years from holding public office, no financial facility / loan allowed for 10 years” this is how sections 10, 11 and 15 of NAO 1999 deals with punishment of corruption and corrupt practices.”

Mr. Faisal Anwar, Independent Consultant/Adviser & Trainer:

Mr. Faisal Anwar discussed the role of ethics and compliance culture with focus on the banking sector of Pakistan. “A good culture is about more than ensuring good people don’t do bad things – it’s about enabling good people to do better things” (Alison Cottrell, CEO, Banking Standards Board, UK) – the quote illustrated anti-bribery and anti-corruption risk management strategy. “The strategy should consist of policies, risk assessments, remedial actions, training and communication, culture, controls and oversights, business parties and third-party monitoring”, Mr. Anwar suggests.

Mr. Uzair Ahmed Certification Manager at ABAC® Center of Excellence:

Mr Uzair presented the concept of ISO 37001 and the certification process overview. “The organisation can choose to implement this anti-bribery management system as a separate system, or as an integrated part of an overall compliance management system. The organisation can also choose to implement this anti-bribery management system in parallel with, or as part of, its other management systems, such as quality, environmental and information security”, Mr. Uzair explains.

Mr. Shauzab Ali, Commissioner Securities Exchange Commission of Pakistan-SECP (Specialized Companies Division, Securities Market Division, Anti-Money Laundering Department:

Mr. Ali discussed the issued Corporate Governance Frameworks issued by Securities and Exchange Commission of Pakistan. He also highlighted one of the main responsibilities, power and functions of the Board: “the Board shall also develop and implement a policy on “anti-corruption” to minimise actual or perceived corruption in the company. Development of whistle-blowing policy and protection mechanism” – Mr. Ali lists.

Mr. Azhar Zia Ur Rehman, Governance Consultant:

The speaker presented the practical road map for implementing the Anti-bribery Management System. “Set of interrelated or interacting elements of an organisation, establish anti-bribery policies and anti-bribery objectives and processes to achieve those anti-bribery objectives”. The detailed process was discussed which will ensure organisations for the successful ABMS implementation.

Benefits to Attendees

Apart from the speeches of the distinguished experts, the summit included highly informative work sessions, group discussions, Q&A periods and plenary sessions to address the many challenges being faced by the corporate world. A post-event survey of the attendees found that 82 percent face challenges raising awareness amongst employees about anti-bribery and anti-corruption measures. They are doing something to remedy that, however 88 percent said they are looking to implement ABMS certification and/or ABMS training at their organisations within the next six months.

Mr. Zafar Anjum thanked the government officials, speakers and participants of the event for taking corruption and bribery as a serious issue and joining hands with CRI® Group to share knowledge and expertise. Mr. Anjum has dedicated over 30 years to the areas of fraud prevention, protective integrity, security and compliance. His expertise helps create secure networks across challenging global markets. Attendees noted their overwhelming satisfaction with the event in the survey results, and CRI® Group is already looking forward to hosting another successful ABAC Summit in 2020.

CRI® Group is pleased to announce the upcoming Anti-Bribery 2018 Summit in Kuala Lumpur, Malaysia, 25 September 2018. This is the second year for the ABAC Summit, providing invaluable expertise in due diligence, internal controls and compliance issues, along with showcasing the latest resources and solutions to detect and combat bribery and corruption within organisations.

The one-day summit is a must-attend event for anyone working in anti-bribery and anti-corruption, due diligence, risk management, and anti-fraud such as CEOs, CFOs, Chief Legal Officers, Chief Compliance Officers, In-house Counsels, Compliance Managers, Lawyers and Auditors, Heads of Procurement and Other officers responsible for Compliance and Anti-Corruption.

Last year’s Anti-Bribery Summit was a great success, with critical topics presented by leading experts in anti-bribery and anti-corruption compliance. This year aims to be even better, with an agenda that includes the following highlights:

- A welcome introduction by Zafar Anjum MSc, CFE, Intl. Dip. (Fin. Crime). As founder and CEO of CRI Group, Zafar Anjum has dedicated 28 years to the areas of fraud prevention, protective integrity, security and compliance. His expertise helps create secure networks across challenging global markets.

- Mohd Nur Lokman Bin Samingan, Assistant Commissioner at Malaysian Anti-Corruption Commission (MACC), will present “MACC (Amendment) Act 2018: Section 17A, ‘Offence by Commercial Organization’”. Mohd Nur Lokman Bin Samingan has vast experience as an investigator and a prosecuting officer, and is currently attached to the Community Education Division of MACC as the head of Private Sector Branch. He engages business entities, corporations and private companies in cultivating anti-corruption awareness.

- Dr KM Loi, Vice-Chairman of ISO/PC 278 (ISO 37001:2016), Co-convenor of ISO/TC 309 WG2 (ISO 37001 Handbook), will present “ISO 37001:2016 – Management Tool to Address Corporate Liability Provision”. Dr KM Loi is an anti-bribery expert with 20 years of management skills in quality consulting, training and auditing with wide exposure to various industries in the context of ISO 9001, ISO 14001, ISO 13485, IATF 16949, ISO 26000, ISO 37001, SA8000 & OHSAS 18001.

- Drago Kos, Chairman of Organization for Economic Co-Operation & Development, will present “Corporate Integrity Guarantees Prosperity”. Drago Kos is the Chairman of the OECD Working Group on Bribery in International Business Transactions, Co-Chair of the Defence Corruption Monitoring Committee in Ukraine and adviser to the Kosovo Anti-Corruption Agency.

- Cristian Nicoara, Independent Expert Consultant; Justice, Anti-Corruption, and Security Sector Reform Adviser, will present “Anti-Corruption Agencies are Fighting an Imbalanced Battle. Where to Find the Allies?” Cristian Nicoara is a former Romanian investigative prosecutor with 15 years specialisation in major crimes, anti-corruption and financial investigations.

- Md Alimuddin Rahim, Group Integrity Officer at Petra Energy Berhad, will present “Role of Malaysian Anti-Corruption Foundation (NGO) in assisting Malaysian Anti-Corruption Commission (MACC)”. Md Alimuddin Rahim has more than 20 years’ experience in his industry – he is the Secretary General at Malaysian Anti-Corruption Foundation and also works as Group Integrity Officer at Petra Energy Berhad.

- Presenter Cynthia Gabriel, Executive Director at The Center to Combat Corruption and Cronyism (C4 Center), human rights advocate and anti-corruption leader in Malaysia will present “New Lessons from 1MDB: The evolving actors in modern money laundering”. Cynthia Gabriel has experience advancing and promoting human rights, good governance and democratic freedoms. She founded the Centre to Combat Corruption and Cronyism (C4), a NED grantee, which works to promote good governance and conducts a multifaceted project designed to encourage public participation in efforts to combat corruption.

- A special panel discussion and Q&A session will feature all of the keynote speakers.

- An hour at the conclusion for additional networking among attendees, with refreshments provided.

CRI® Group founder and CEO Zafar Anjum said that after the success of last year’s inaugural event in Pakistan, he is excited about the second Anti-Bribery Anti-Corruption Summit in Kuala Lumpur, Malaysia. “This year’s agenda was developed to provide you with invaluable information and foresight into the forces that guide and dictate our everyday work life: the ongoing quest for solutions, balance, and insight into the oftentimes chaotic world of anti-bribery and corporate corruption compliance”, Anjum wrote. This is a critical time for world markets and economies. The latest Corruption Perceptions Index shows that “most countries around the world are making little or no progress in ending corruption” (Transparency international, titled “Corruption perception index 2017”, 2018).

That’s why the expertise, best practises and resources shared by the leading industry experts at the ABAC Summit are more important than ever. In the Asia Pacific region alone, the majority of countries are in the lower half of this year’s Corruption Perceptions Index. This is because bribery is still a key problem, made worse by unaccountable governments, lack of oversight, instability and insecurity. There are positive signs as well. Officials in Malaysia, the host country of this year’s ABAC Summit, have made strides in the fight against bribery and corruption. According to MACC, 879 offenders – from top management to lower level staff, in both the public and private sectors – were arrested last year. This demonstrates Malaysia’s commitment to bringing offenders to justice.

Time is running out to make your plans to attend ABAC 2018 and get an edge on the latest best practises, laws, regulations and compliance, presented by the foremost experts in the field. Meet the colleagues you networked with at last year’s event; or make new connections with CEOs, CFOs, other executives, directors, lawyers, auditors, legal officers, compliance officers and others who face the same anti-fraud and anti-corruption challenges as you.

The first ABAC Summit Pakistan

On Thursday, 26 October, the region’s leading anti-fraud professionals gathered in Karachi, Pakistan, for CRI® Group’s Anti-Bribery Summit 2017. CRI® Group took the initiative to organize the first Anti-Bribery Summit in Pakistan with the goal to redefine the anti-bribery culture within organisations in the country.

The Anti-Bribery Summit couldn’t have come at a more critical time, or have been held in a more relevant location – Pakistan is on the front lines of a struggle between those who willfully engage in bribery and corruption, and those who endeavor to put a stop to it. But the problem of corruption is worldwide, affecting government, military and public sector organisations. The Anti-Bribery Summit 2017 included sessions on compliance for the most significant international laws and regulations, including a Q&A session with an expert on the Foreign Corrupt Practices Act.

Attendees also learned about compliance pitfalls, and how to engage in proper third party due diligence to keep their organisations safe from unethical partners that could hurt the organisation’s reputation and bottom line. “It was good to see international speakers from UN and OECD on the practices being used and available standards for comparing our policies and procedures,” said Riaz Nazarali Chunara, Director, State Bank Of Pakistan.

The Anti-Bribery Summit brought together some of the greatest minds in the fight against corruption, with a lineup of expert speakers that shared their experiences, knowledge and best practices with an attentive audience.

Keynote speakers included Drago Kos, Chair of the OECD Working Group on Bribery in International Business Transactions and Co-Chair of the Defence Corruption Monitoring Committee in Ukraine and advisor to the Kosovo Anti-Corruption Agency (see an exclusive video interview with Drago Kos about the Summit); Jouhaida Hanano, Criminal Justice Advisor – Sub-Programme II, UNODC Pakistan; Shehzad Yousuf, Chief Internal Auditor at PTCL; Tariq Hussain, Former Director / HOD Securities & Exchange Commission of Pakistan (SECP) – Supervision and Enforcement and Company Law Division; Ali Anwer Adil, Head of Internal Audit, Fraud Management and Revenue Assurance at Zong; and Ghulam Farooq, Director at The National Accountability Bureau.

“(It was) a wonderful conference on anti-bribery held by CRI®,” said Muhammad Nauman Ahmed, Head of Compliance at PEL. Ahmed said the “most amazing part” was that “OECD Anti-Bribery chairman Mr. Drago Kos and Director NAB, Sindh attended the conference.”

“SECP representatives were also present,” Ahmed said, calling it a “great event” for learning about the most current practices to counter bribery in Pakistan.

Featuring keynote addresses, Q&A sessions, trainings and a panel discussion, the Anti-Bribery Summit addressed topics critical to any organization leader or executive in the region including anti-bribery compliance issues, strategies, the FCPA and UK Bribery Act, the corporate culture in Pakistan, conducting proper risk management and due diligence.

“It was a really good event, very well organized and an excellent learning experience,” said Yousuf Ali, Executive Manager, Assurance, EY Ford Rhodes. “My team and I at Ernst & Young thoroughly enjoyed it. Especially the presentation from Mr Shehzad Yousuf.”

“We are looking forward to other such events,” Ali said.

CRI® Group thanks all of the attendees, speakers and everyone involved in making the Anti-Bribery 2017 an unmatched success.

About us…

Based in London, CRI® Group works with companies across the Americas, Europe, Africa, Middle East and Asia-Pacific as a one-stop international Risk Management, Employee Background Screening,

In 2016, CRI® Group launched the Anti-Bribery Anti-Corruption (ABAC®) Center of Excellence – an independent certification body established for ISO 37001:2016 Anti-Bribery Management Systems, ISO 37301 Compliance Management Systems and ISO 31000:2018 Risk Management, providing training and certification. ABAC® operates through its global network of certified ethics and compliance professionals, qualified auditors and other certified professionals. As a result, CRI® Group’s global team of certified fraud examiners work as a discreet white-labelled supplier to some of the world’s largest organizations. Contact ABAC® for more on ISO Certification and training.

MEET THE CEO

Zafar I. Anjum is Group Chief Executive Officer of CRI® Group (www.crigroup.com), a global supplier of investigative, forensic accounting, business due to diligence and employee background screening services for some of the world’s leading business organizations. Headquartered in London (with a significant presence throughout the region) and licensed by the Dubai International Financial Centre-DIFC, the Qatar Financial Center – QFC, and the Abu Dhabi Global Market-ADGM, CRI® Group safeguard businesses by establishing the legal compliance, financial viability, and integrity levels of outside partners, suppliers and customers seeking to affiliate with your business. CRI® Group maintains offices in UAE, Pakistan, Qatar, Singapore, Malaysia, Brazil, China, the USA, and the United Kingdom.

Contact CRI® Group to learn more about its 3PRM-Certified™ third-party risk management strategy program and discover an effective and proactive approach to mitigating the risks associated with corruption, bribery, financial crimes and other dangerous risks posed by third-party partnerships.

CONTACT INFORMATION

Zafar Anjum, MSc, MS, CFE, CII, MICA, Int. Dip. (Fin. Crime) | CRI® Group Chief Executive Officer

37th Floor, 1 Canada Square, Canary Wharf, London, E14 5AA United Kingdom

t: +44 207 8681415 | m: +44 7588 454959 | e: zanjum@crigroup.com

CRI™ Malaysia celebrates Anti-Corruption Day

Anti-bribery and anti-corruption efforts are a huge priority in the South Asia Region, with many governments trying to strengthen laws and enhance enforcement in both their private and public sectors. As recent high-profile corruption cases in the region have demonstrated, today’s regulators are seeing the issue as a societal problem as much as a legal one. That’s why CRI™ Malaysia celebrates Anti-Corruption Day partnered with the Malaysian Anti-Corruption Commission (MACC), Transparency International Malaysia (TI-M), the Malaysian Anti-Corruption Foundation and the Malaysian Youth Council for International Anti Corruption Day to raise awareness throughout Malaysia and beyond of the risks posed by bribery and corruption. Themed “United Against Corruption,” the event, held 9 Dec. in Kuala Lumpur, placed the focus squarely on stepping up the fight against corruption and helping position Malaysia a leader against fraud in the South Asia region.

United Against Corruption received extensive coverage in the press – including articles in the The Borneo Post, The Sun Daily, The Edge Markets and other outlets, and a video posted on MACC’s YouTube channel – helping to fulfil the goal of increasing awareness among the general public. As reported in The Borneo Post (“International Anti-Corruption Day celebrated nationwide,” 10 Dec. 2018), the event was held in conjunction with the Premier Walk-About Program and “celebrated simultaneously throughout the country to raise public awareness on the dangers of corrupt practices”.

Efforts increase following 1MDB scandal

The high-profile push against bribery and corruption comes just a few years after the 1MDB scandal first hit the news cycles in Malaysia and, eventually, across the world. Malaysia’s state-owned investment fund, 1MDB, was created to attract foreign investment, but instead it triggered a scandal that led to criminal and regulatory investigations that continue today. “A Malaysian parliamentary committee identified at least $4.2 billion in irregular transactions related to 1MDB. In May, Najib was ousted from power in a general election as the scandal fuelled a voter backlash that ended his party’s 61 years of rule. As the investigations continue, Najib faces trial on corruption charges and U.S. prosecutors have implicated at least three senior Goldman Sachs Group Inc. bankers in a multiyear criminal enterprise” (Bloomberg, 2018).

After-effects from the 1MDB case spread far beyond Malaysia and the South Asia region. In the U.S., federal prosecutors announced that one of the implicated former Goldman Sachs bankers had pleaded guilty, with bribery and money laundering charges lodged against a second banker as part of the investigation.

With eyes on Malaysia due to the breadth of the 1MDB scandal, the Malaysian Anti-Corruption Commission (Amendment) Act 2018 was passed in April of this year – with a provision on corporate liability. The amended act gives more power to the MACC in fighting corruption in the private sector, with penalties for firms that can now be held liable if their employees commit bribery.

On 25 Sept. 2018, Mohd Nur Lokman bin Samingan, Assistant Commissioner at Malaysian Anti-Corruption Commission, spoke in Kuala Lumpur at CRI Group’s Anti-Bribery Anti-Corruption (ABAC) Summit 2018, where he explained some of the key objectives of the 2018 Amendment Act. Among them, the new provisions are meant “to encourage business and commercial activities being carried out in a corruption-free environment; to encourage all commercial organisations to take adequate measures in order to prevent corruption in their respective organisations; and to promote better corporate governance and legal compliance by requiring corporations to take proactive roles in preventing corruption”. Mr. Mohd Nur Lokman went on to explain that punishment for bribery and other corrupt acts under the amendment can include fines “of not less than 10 times the sum of value of the gratification which is the subject matter of the offence”, or one million ringgit (whichever is higher) – and can also include imprisonment for a term not exceeding 20 years.

What is clear to everyone, however, is that governments cannot fight the war on corruption alone. It is critical for government organisations to work hand-in-hand with private sector corporations, non-governmental organisations (NGOs) and nonprofits to change the culture and tolerance level of bribery and corruption along with the legal framework for prosecuting it. In today’s business landscape, companies have found that it is far better to be proactive in the fight against fraud rather than to try to sweep problems under the rug. The problem in years past was a lack of a consistent framework for organisations to follow in efforts to increase their compliance and decrease risk on their own.