5/ March

The Removal of the UAE from the FATF's grey list in February 2024

The UAE's Victory – A New Dawn in Regulatory Compliance and Investment Opportunities In a landmark achievement for the United Arab Emirates (UAE), the Financial Action Task Force (FATF), the global watchdog for anti-money laundering and counter-terrorist financing, has officially removed the UAE from its "grey list" as of February 23, 2024. This decision is a testament to the UAE's steadfast commitment and rigorous efforts in implementing robust financial crime prevention measures. The move underscores the UAE's enhanced regulatory framework and reaffirms its status as a reputable and secure global financial hub. The Journey to Compliance The UAE's journey... READ MORE

Significance of Due Diligence in Economic Crime & Corporate Transparency Act Compliance

The Importance of Due Diligence in Demonstrating Compliance... READ MORE

Kuwait’s Degree Crackdown: A Wake-Up Call for Employee Screening

Kuwait's Degree Crackdown: A Wake-Up Call for Employee... READ MORE

The Future of Business: 2024 Corporate Strategy and Trend Analysis

In 2024, businesses across the UK, EU, and... READ MOREOUR SOLUTIONS

Employee Background Checks

Pre-employment and post-employment background checks are critical to any company’s success because hiring qualified, honest and hard-working employees is an integral part of thriving in the business community. Are you ready to EmploySmart™?

FIND OUT MORE

Due Diligence 360

Due diligence on potential business partners is vital to confirm legitimacy and reduce the risks associated with such professional relationships. This level of due diligence will ensure that working with potential outside party will ultimately achieve your organisation’s strategic and financial goals.

FIND OUT MORE

Third-Party Risk Management (3PRM™)

CRI Group™’s own exclusive, expert-developed 3PRM™ services help you proactively mitigate risks from third-party affiliations, protecting your organisation from liability, brand damage, and harm to the business.

FIND OUT MORE

IP Infringement Investigations

Intellectual property can be a business’s most valuable asset. So when outside parties threaten to steal your ideas, copy your products or disrupt your marketing channels, corrective action on your part can become tedious, time-consuming and expensive.

FIND OUT MORE

AML Advisory Services

Meet stakeholder expectations and safeguard your corporate reputation & competitive positioning. An effective AML framework is a testament to your organisation’s position against financial crime.

FIND OUT MORE

Fraud Risk Investigations

Fraud is one of the biggest and most damaging risks businesses face. The headlines are full of organisations both in the private and public sectors affected by fraud, irregularity or other wrongdoing – either as victims or accused.

FIND OUT MORE

Insurance Fraud Investigations

Insurance fraud is something that no company can afford. CRI Group™’s investigations cover the full range of insurance fraud cases, from healthcare fraud to disability and even fake death claims. Our experts are trained to look for the tell-tale signs of fraud.

FIND OUT MORE

Investigative Solutions

CRI Group™’s team of experts can help safeguard your business from unseen threats such as employee fraud, compliance issues, third-party risk factors and other concerns that can quickly — and severely — impact any organisation in any part of the world.

FIND OUT MORE

Business Intelligence

Business Intelligence is most effective when it combines data derived from the market in which your business operates in (external) with data from within such as financial and operations data (internal).

FIND OUT MOREPUBLICATIONS

eBook | Background Screening FAQs: Hiring new employees

We’ve compiled a list of our most frequently asked questions on background screening. If you cannot find what you are...

Download

RISKS OF CYBERCRIME AND SOCIAL MEDIA: NEW PLAYBOOK

Complete Guide on How to Protect Your Organisation and Team! Take the first steps towards developing measures against cybercrime! This...

Download

Resources | EU Directive Corporate due diligence and corporate accountability

Download the study on Corporate due diligence and corporate accountability by EPRS (European Parliamentary Research Service)

Download

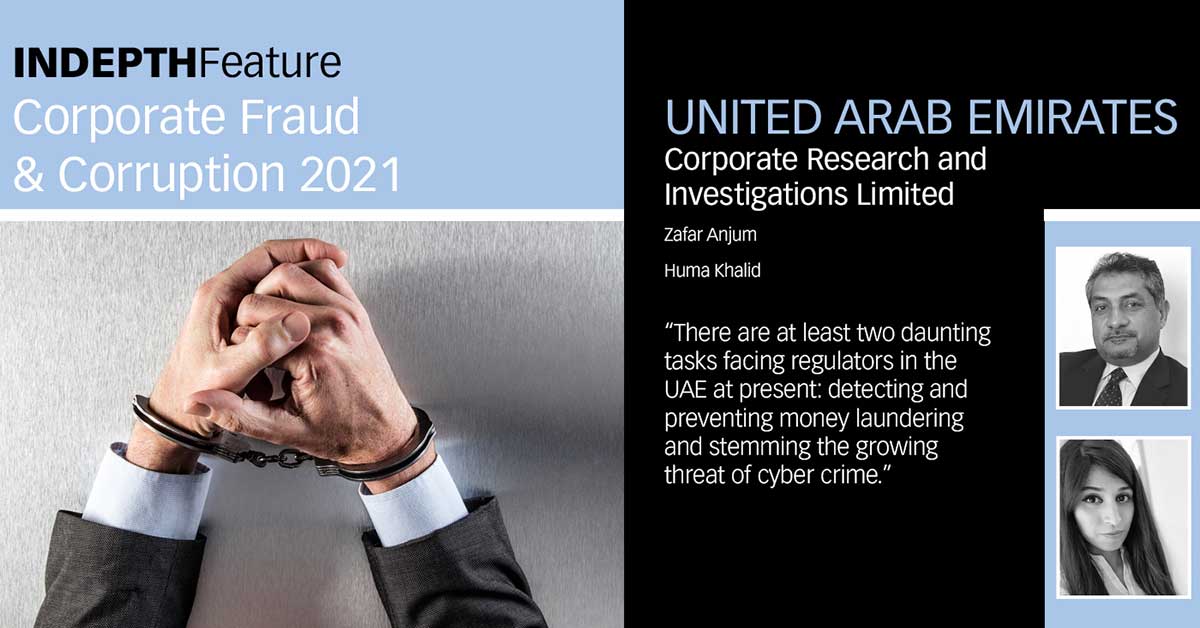

Indepth Feature on Anti-Money Laundering (AML) in the UK & UAE 2021 with our CEO and Scheme Manager

CRI Group™ and its ABAC™ Center of Excellence were featured in Financier Worldwide's In-depth Feature: Corporate fraud and corruption 2021....

Download

Q&A: Anti-Money Laundering in UAE 2021

CRI Group™ and its ABAC™ were featured in Financier Worldwide's InDepth Feature: Anti-Money Laundering 2021. In this edition, CRI Group™'s...

Download